Want unlimited access to top ideas and insights?

Representatives of minority- and women-owned small banks from around the country are teaming up to expand business opportunities in New York City. Politicians and firm representatives said they hope to show other cities and states how they can incorporate a more diverse business model into their investments.

Thursday's

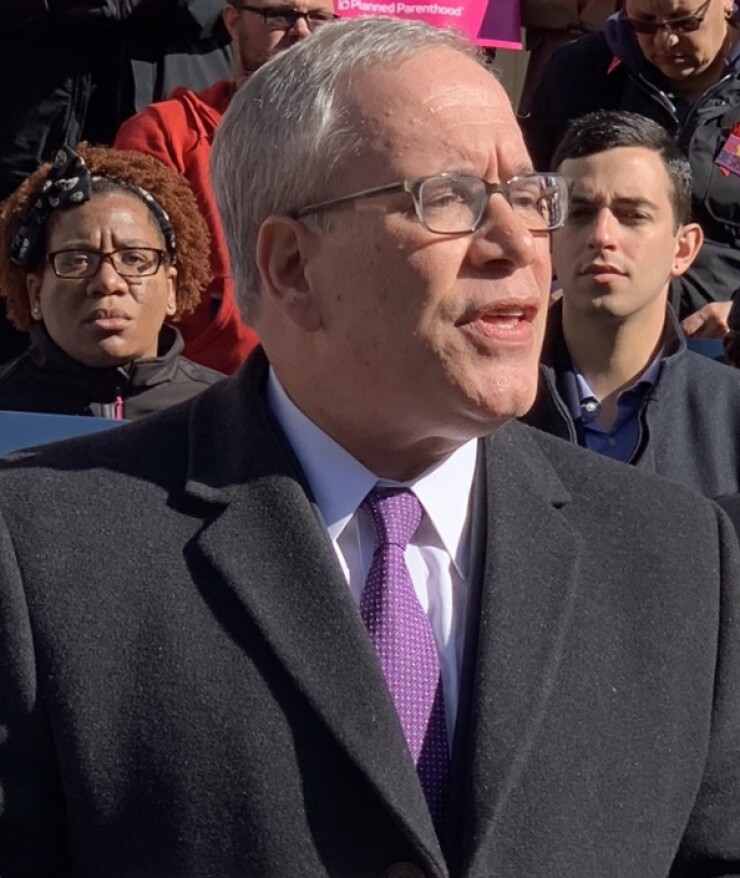

MWBE University is a program developed by New York City Comptroller Scott Stringer to aid businesses owned and operated by women and people of color.

"We believe that minority banks can and should play a pivotal role in the economic success in the neighborhoods of our city,” Stringer said at the gathering, held at the comptroller’s office at the David M. Dinkins Municipal Building in Manhattan. “But right now there’s a big barrier between minority banks that could do business with the city and the ones that are doing business with the city.”

Of the 26 depository banks in New York City approved by the city banking commission, only two are run by leaders and board members who are people of color: East West Bank and Popular Community Bank.

“Only two. That’s why we’re here today,” Stringer said. “This disparity is not just in banking; we see this pattern across all industries. And I believe fundamentally that when you invest with companies that have diverse corporate boards, you’re investing in stronger companies. When you invest with minority- and women-owned businesses, you are equally creating wealth that lifts up cities and neighborhoods across the country.”

He added that “when you invest in minority- and women-owned banks, you’re also investing in neighborhoods as well.”

In the United States, there are 149 minority depository institutions with assets totaling $233.9 billion. There are 73 Asian institutions, 35 Hispanic, 23 African American and 18 Native American with average assets of about $1.6 billion, according to

In New York City, there are 11 minority depository institutions with assets totaling $14.4 billion. There are eight Asian institutions, two Hispanic and one African American, with average assets of about $1.3 billion, according to FDIC data. There were eight banks based in Manhattan, two in Queens and one in the Bronx.

The comptroller said his office is looking at ways to create a larger pool of banks that are eligible to receive city money and wants to work with MWBE banks to make this happen.

“That is something I think could set a precedent for cities around the country,” Stringer said.

The city is one of the largest issuers of municipal debt in the United States. As of March 31, the city had about $37.68 billion of general obligation (Aa1/A/A) debt outstanding. That's not counting the various authorities that issue debt.

The NYC Transitional Finance Authority has $37.02 billion of debt outstanding while the NYC Municipal Water Finance Authority has $29.81 billion of debt outstanding. The TFA’s debt consists of future tax secured senior bonds (Aaa/AAA/AAA), future tax secured subordinate bonds (Aa1/AAA/AAA) and building aid revenue bonds (Aa2/AA/AA). The MWFA’s debt consists of general resolution bonds (A1/AAA/AA+) and second general resolution bonds (Aa1/AA+/AA+).

“In fiscal year 2018, the city spent about $19.3 billion in contracts,” said Wendy Garcia, chief diversity officer in the comptroller’s office. “But only about $1 billion, or 5.5%, were awarded to MWBEs.”

She said that about 20% of certified MWBEs received city payments in the 2018 fiscal year, a slight decrease from 22% in the 2017 fiscal year.

The banking commission approves institutions as city-designated Banks, which means they are the only banks that can hold city deposits, said Brian Cook, assistant comptroller for economic development.

Designated banks are also able to respond to city solicitations for banking services, such as holding NYC funds, lockboxes, accepting taxes and related depository services. Banks must apply for the designation every two years.

The commission is made up of the mayor, the comptroller and the commissioner of finance.

The commission also administers the city’s Banking Development District, which is a program of the New York State Department of Financial Services. The program helps banks open branches in underserved neighborhoods.

Among those attending Thursday’s session were representatives from Texas National Bank in Edinburg; the First National Bank of Gordon in Nebraska; Embassy National Bank in Georgia; Central Bank in Florida; InterAmerican Bank in Florida; Pacific Global Bank in Chicago; KEB Hana Bank USA NA in New Jersey and New York; Leader Bank in Massachusetts; NewBank in New York City; Califia Pacific Bank in San Francisco; Amerasia Bank in New York; Chinatown Federal Savings Bank in New York; Popular Bank in New York; Mission National Bank in San Francisco; Shinhan Bank America in New York; Sunstate Bank in New York; Ponce Bank in New York; and Bank of Cherokee County in Oklahoma.

Also in attendance were representatives from the New York City Division of Finance and the Federal Reserve Bank of New York.

Representatives of the banks will now work closely with the comptroller’s office to become qualified to receive city business.

The next MWBE university class, “Doing Business with the Comptroller’s Office,” will be held Aug. 2 at the Dinkins Building.

On June 7, New York State will be holding an