Municipal bond volume will drop by nearly $3 billion from last week, with one California issuer responsible for a third of the new issuance.

Ipreo estimates volume will drop to $6.36 billion, from the revised total of $9.02 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $4.85 billion of negotiated deals and $1.51 billion in competitive sales.

One thing that has stood out to Bill Black, CFA, managing director and senior portfolio manager at City National Rochdale, is how bifurcated the market is right now.

“The overall market is weaker and weaker, but high yield bonds are trading up and investment grade bonds are flat or trading down,” he said. “Even with recent inflows (both overall and in high-yield) there is still a surprising weakness with the market, stemming from banks and insurance companies selling due to new tax legislation. This is weighing heavily on the investment-grade side.”

Black added that on the high-yield side, deals have been very well oversubscribed. He said scarcity is a factor in the demand for those types of deals, which are few and far between.

“Not only is there not enough new supply, but the existing high-yield paper seems to be shrinking, as issuers are refunding what became high-yield debt and replacing with investment grade paper,” he said.

There are only 14 deals scheduled $100 million or larger, with only a lone representative on the competitive side.

“The demand should keep on rolling as issuance will be decent, deals are shifted towards the beginning of the week for a reason,” Black said. “Things should get all cleaned up before people start heading out for the long weekend.”

The Regents of the University of California is scheduled to bring a total of $2.06 billion, listed as four separate deals on the Dalcomp calendar. Bank of America Merrill Lynch will run the books on the $946 million of general revenue bonds on Tuesday after a retail order period on Monday, as well as a $283 million taxable portion of the general rev. bonds. The deals are rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

There is also a $739 million deal of limited project revenue bonds scheduled to price on Wednesday after a ROP on Tuesday and a $95 million taxable portion of the same bonds. The deals is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

West Virginia is set to sell a total of $800 million in two deals. On Monday, BAML is slated to price $312 million of general obligation state road bonds. On Wednesday, the Mountain State will sell $488.205 million of the same bonds via competitive sale. The deals are rated Aa2 by Moody’s, AA-minus by S&P and AA by Fitch.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended May 18 were from Puerto Rico and Texas issuers, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 64 times. In the revenue bond sector, the Grand Parkway Transportation Corp. in Texas 5s of 2048 traded 45 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp. 6.05s of 2036 traded 22 times.

Week's actively quoted issues

Puerto Rico, New York and California names were among the most actively quoted bonds in the week ended May 18, according to Markit.

On the bid side, the Puerto Rico COFINA taxable 6.05s of 2036 were quoted by 61 unique dealers. On the ask side, the DASNY revenue 5s of 2029 were quoted by 140 dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 22 dealers.

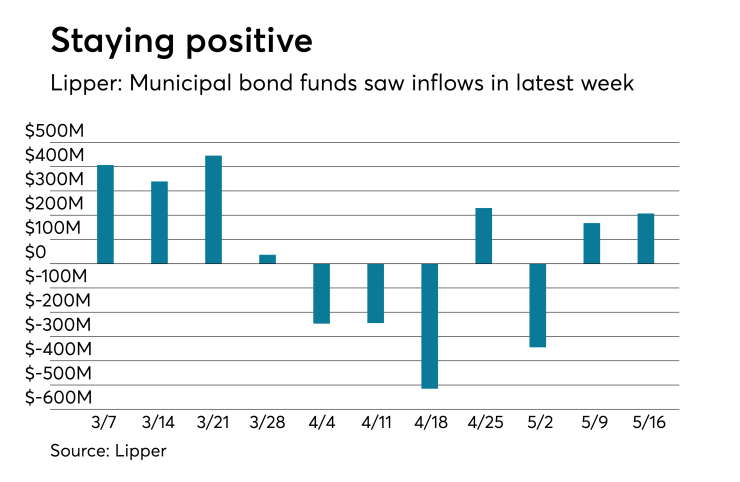

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds again showed confidence and put cash into the funds in the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $206.948 million of inflows in the week ended May 16, after inflows of $167.323 million in the previous week.

Exchange traded funds reported outflows of $110.620 million, after inflows of $24.407 million in the previous week. Ex-ETFs, muni funds saw $317.568 million of inflows, after inflows of $142.915 million in the previous week.

The four-week moving average turned positive at $64.760 million, after being in the red at -$115.765 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $264.239 million in the latest week after inflows of $252.252 million in the previous week. Intermediate-term funds had inflows of $10.742 million after inflows of $68.529 million in the prior week.

National funds had inflows of $240.367 million after inflows of $200.965 million in the previous week. High-yield muni funds reported inflows of $415.493 million in the latest week, after inflows of $220.975 million the previous week.

ICI: Long-term muni funds see $352M outflow

Long-term municipal bond funds saw an outflow of $352 million in the week ended May 9, the Investment Company Institute reported on Thursday.

This followed an outflow of $163 million out of the tax-exempt mutual funds in the week ended May 2 and outflows of $96 million, $830 million, $696 million and $110 million in the four prior weeks.

Taxable bond funds saw an estimated inflow of $2.38 billion in the latest reporting week, after seeing an inflow of $3.64 billion in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $4.22 billion for the week ended May 9 after inflows of $45 million in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.