Top-shelf municipal bonds were slightly weaker on Tuesday around midday, as yields on some maturities were as many as one basis point higher while the long end of the curve is steady, according to traders who said they saw a flurry of activity.

Primary Market

In the negotiated sector, RBC Capital Markets priced the Ohio Water Development Authority's $400 million of state water pollution control loan fund revenue bonds on Tuesday. The bonds were priced to yield from 2.62% with a 5% coupon in 2026 to 3.03% with a 5% coupon in 2031. The deal is rated triple-A by Moody's Investors Service and S&P Global Ratings.

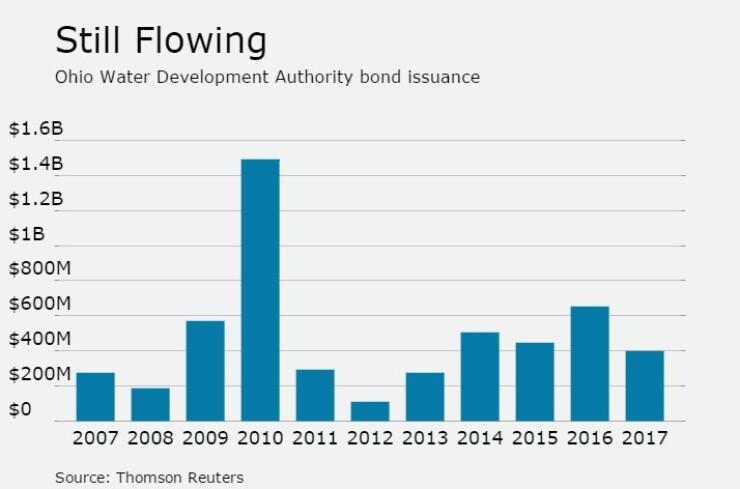

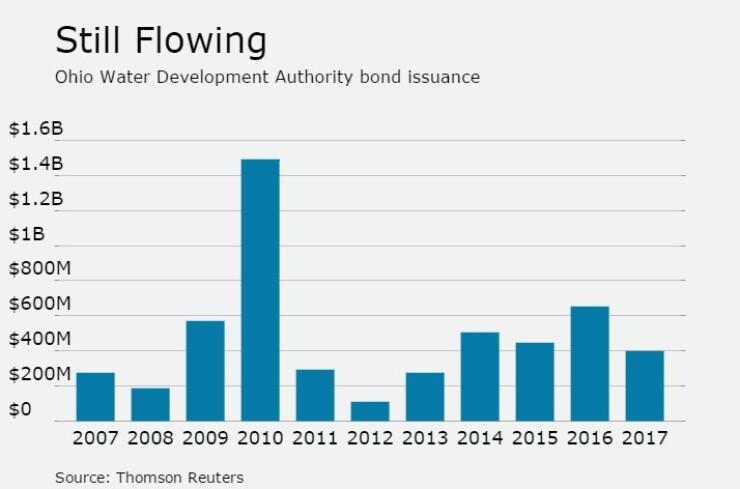

Since 2007, the OWDA has sold about $5.22 billion of bonds, with the largest issuance coming in 2010 when it offered $1.49 billion, the only time in that period when it issued more than $1 billion. OWDA issued less than $300 million in five of those years.

Bank of America Merrill Lynch priced the county of Hamilton, Ohio's $307.01 million of hospital facilities revenue bonds for Trihealth Inc. Obligated Group Project, slightly higher than the originally scheduled $296 million. The bonds were priced to yield from 1.12% with a 3% coupon in 2018 to 4.30% with a 4.125% coupon in 2038. A term bond was priced as 5s to yield 4.06%. A term bond in 2047 was priced in a split maturity to yield 4.11% with a 5% coupon and 4.39% with a 4.25% coupon. The deal is rated A-plus by S&P and Fitch Ratings.

BAML also priced the city of Chesapeake, Va.'s $101.84 million of GO improvement and refunding bonds on Tuesday, although it was original scheduled to for $201 million.

The $75.97 million of GO public improvement and refunding bonds were priced to yield from 0.80% with a 4% coupon in 2017 to 2.86% with a 5% coupon in 2030. The bonds were also priced to yield from 3.02% with a 5% coupon in 2032 to 3.51% with a 4% coupon in 2036.

The $5.86 million of GO bonds for South Norfolk Tax Increment Financing were priced to yield from 0.80% with a 3% coupon in 2017 to 3.66% with a 3.50% coupon in 2036.

The $20.005 million of GO water and sewer refunding bonds were priced to yield from 1.68% with a 4% coupon in 2021 to 2.46% with a 5% coupon in 2025. The deal is rated Aa1 by Moody's and triple-A by S&P and Fitch.

On Monday five competitive sales planned for the Empire State Development Corp. Tuesday were delayed until Thursday.

Secondary Market

The 10-year benchmark muni general obligation yield was as many as one basis point higher from 2.49% on Monday, while the yield on the 30-year GO was steady at 3.25%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mostly stronger Tuesday around midday. The yield on the two-year Treasury was flat at 1.37% from Monday, while the 10-year Treasury yield was lower to 2.59% from 2.61%, and the yield on the 30-year Treasury bond decreased to 3.18% from 3.19%.

On Monday, the 10-year muni to Treasury ratio was calculated at 95.4%, compared with 95.7% on Friday, while the 30-year muni to Treasury ratio stood at 101.8%, versus 102.3%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 38,888 trades on Monday on volume of $7.869 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $220.8 million to $11.03 billion on Tuesday. The total is comprised of $5.29 billion of competitive sales and $5.74 billion of negotiated deals.