Municipals sold off double-digit basis points Tuesday following

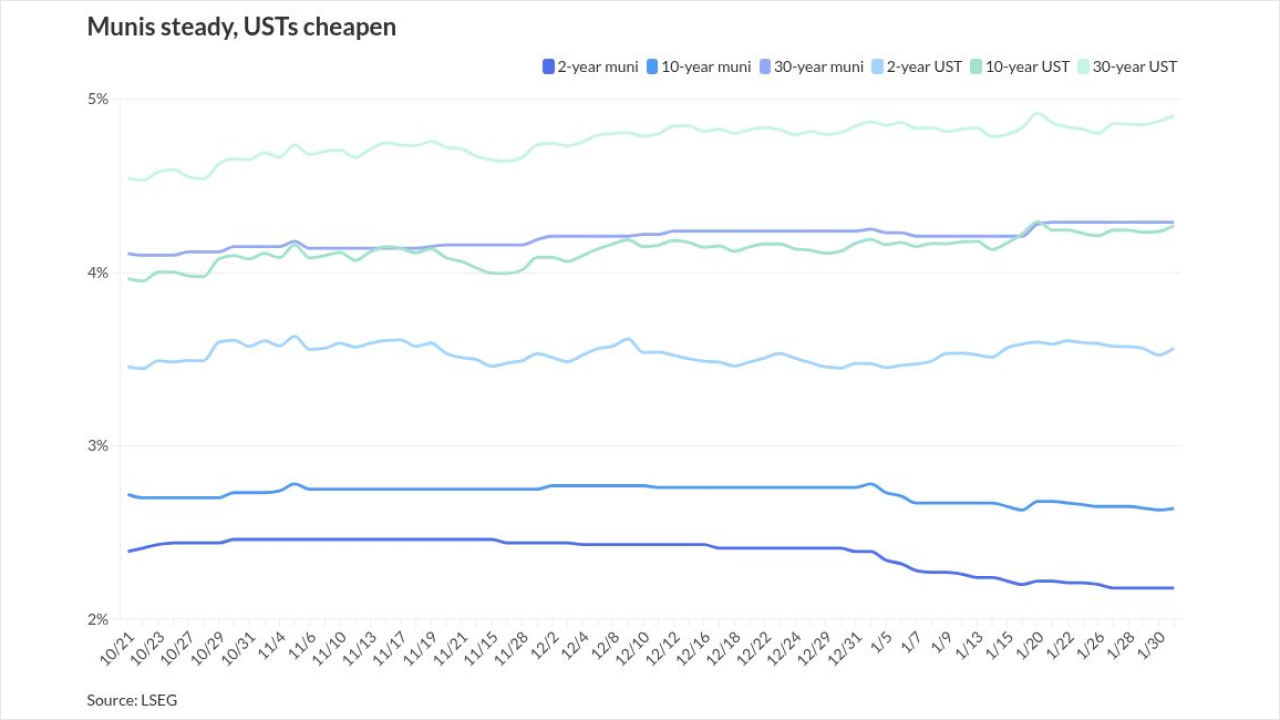

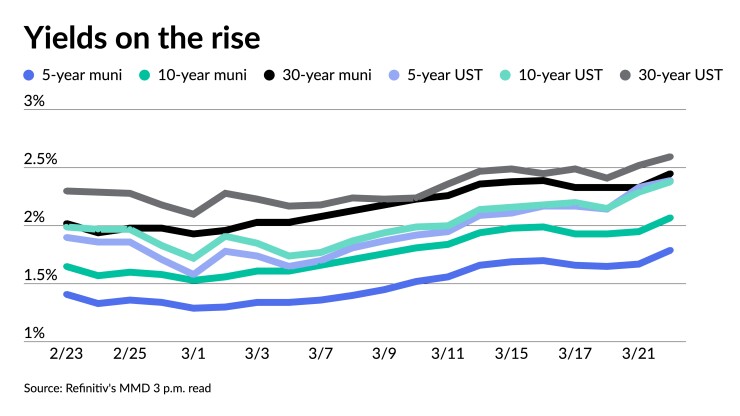

Triple-A benchmark yields were cut up to 12 basis points, with the asset class unable to ignore the ongoing pressure from U.S. Treasuries, which saw yields rise another eight to nine basis points.

The Refinitiv MMD 10-year spot has risen above 2.0% for the first time since March 24, 2020, sitting at 2.07% on Tuesday.

Secondary selling was evident out of the gates Tuesday with large blocks trading at much higher yields. The short end of the muni curve saw more activity, playing catch up to the rise in short UST, but pain was felt across the yield curve. A block of Wake County, North Carolina 5s of 2025 traded at 1.59%-1.57%. Maryland 5s of 2025 traded at 1.72% versus 1.57%-1.64% Monday. Georgia 5s of 2026 traded at 1.79%.

The hawkish comments by Federal Reserve Board chairman Jerome Powell have raised investor expectations for a 50 basis point rate hike at the next FOMC meeting just as municipal valuations are at historically attractive levels, according to Anthony G. Valeri, executive vice president and director of investment management at Zions Wealth Management.

“Muni bonds entered the year with very expensive valuations, but valuations are back to their most attractive levels since late 2020,” he said.

Municipal to UST ratios on Tuesday were at 75% in five years, 87% in 10-years and 95% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 73%, the 10 at 89% and the 30 at 96% at 4 p.m.

Bonds out for the bid was also met with an active new-issue calendar pricing Tuesday.

Citigroup Global Markets held a one-day retail order period for New York City (Aa2/AA/AA-/AA+/) for $892.495 million of tax-exempt general obligation bonds. The first tranche, $649.275 million, Fiscal 2022 Series B, Subseries B-1, saw bonds in 8/2034 with a 5% coupon yield 2.62% and 5s of 2036 at 2.71%, callable at 8/1/2032.

The second tranche, $243.220 million, Fiscal 2022 Series C, saw bonds in 8/2022 with a 5% coupon yield 1.19%, 5s of 2027 at 2.01%, 5s of 2032 at 2.48% and 5s of 2033 at 2.57%, callable in 8/1/2032.

A block of New York City 5s of 2039 traded at 2.84-2.85%.

Ramirez & Co. priced for New York State Housing Finance Agency (Aa2///) $235.790 million of affordable housing revenue bonds. The first tranche, $123.410 million of climate bond certified/sustainability bonds, 2022 Series A-2, saw bonds in 11/2060 with a mandatory tender date of 5/1/2027 with a 2.5% coupon are priced at par, callable at 3/1/2024.

The second tranche, $94.535 million of sustainability bonds, 2022 Series A-2, saw bonds in 11/2060 with a mandatory tender date of 5/1/2027 with a 2.5% coupon are priced at par, callable at 3/1/2024.

The third tranche, $17.845 million of federally taxable of climate bond certified/sustainability bonds, 2022 Series C, saw bonds in 5/2027 with a 3.25% coupon are priced at par, callable at 7/1/2025.

BofA Securities priced for Louisville-Jefferson County Metro Government, Kentucky (/A-/BBB+/) $208.395 million of University of Louisville Health Project hospital revenue bonds, Series 2022A. Bonds in 5/2047 with a 5% coupon yield 3.45-3.65% and 5s of 2052 at 3.73%, callable in 5/15/2032.

In the competitive market, Palo Alto Unified School District, California (Aaa/AAA//) sold $240 million of general obligation bonds (Election of 2018), Series 2022, to Citigroup Global Markets. Bonds in 8/2022 with a 5% coupon yield 1.27%. 5s of 2025 at 1.645%, 4s of 2032 at 2.21%, 3s of 2037 at 3.06% and 3.25s of 2042 at 3.30%, callable at 8/1/2030.

An elevated supply calendar and ongoing municipal bond outflows could be a headwind in the near-term, Valeri said. Bond Buyer 30-day visible supply sits at $13.55 billion. Deals being posted on MuniOS show a POS for $360 million deal for the Los Angeles Department of Water and Power, a $330 million Boston MA general obligation deal and $1.1 billion of taxable Dallas-Fort Worth Airports.

Because munis underperformed corporates last week, some taxable investment-grade investors may have a limited window of opportunity to add munis to their portfolios, said CreditSights strategists Pat Luby and John Ceffalio.

“With the risk-off market conditions and the recent wider spreads offered in the primary market, taxable investment-grade credit

The penalty for buying munis can be reduced by buying double-exempt bonds for taxable investors subject to a state and federal 21% corporate income tax. When compared to similarly rated corporate bonds, they said local double-exempt municipals may offer a marginal yield boost.

Over the previous four years, banks, insurance companies and other financial institutions have had few opportunities to justify adding tax-exempt securities to their portfolios, but CreditSights strategists believe this week's calendar will help.

“But benchmark yields have now reattained, roughly, longer-term average nominals and are thus likely at a level that could sustain demand under normal market conditions; this would particularly be the case for more defensive coupons,” Fabian said. “And outflows could, potentially, begin to reverse.”

He said a hypothetical market rescue now could help contain looming downside volatility from de minimus-related losses to lower coupons, but these points will be for naught if fund outflows continue or accelerate. He said it has been years since the municipal demand side has operated well without a strong push from the funds.

“Muni bond inflows, which were such a powerful support for most of 2021, have faded,” Valeri said. “Muni bond fund redemptions have historically been elevated during tax season so redemptions may remain high and not just due to Fed rate hike fears."

Muni CUSIP volume rises

Monthly municipal volume rose on a month-to-month basis in February, according to CUSIP Global Services. The aggregate total of all municipal securities, including municipal bonds, long-term and short-term notes, and commercial paper, rose 2.8% versus January totals. But on a year-over-year basis, overall municipal volumes were down 11.6%. Texas led state-level municipal request volume with a total of 108 new CUSIP requests in February, followed by New York with 68 and California with 60.

For muni bonds specifically, there was an increase in request volume of 2.8% month-over-month, but they are down 9.7% on a year-over-year basis.

"Issuers have been active this month as they balance a complicated set of dynamics that includes significant geopolitical instability, rising inflation and the threat of rising interest rates," said Gerard Faulkner, direct of operations for CUSIP Global Services.

Secondary trading

Georgia 5s of 2022 at 1.22%-1.34%. Illinois Finance Authority 5s of 2023 at 1.47%-1.49%. San Antonio, Texas 5s of 2024 at 1.63%-1.67%.

Ohio Water Development Authority 5s of 2025 at 1.75%-1.79%. Maryland 5s of 2025 at 1.72% versus 1.57%-1.64% Monday. Minnesota 5s of 2025 at 1.64% versus 1.60% Monday, 1.55% on Thursday and 1.61% Wednesday. Columbus, Ohio 5s of 2026 at 1.81-1.83%. Connecticut 5s of 2026 at 1.97-1.98%.

New York City TFA 5s of 2029 at 2.17%-2.16%. Georgia 5s of 2032 at 2.10%. California 5s of 2032 at 2.32%. NY Dorm PIT 5s of 2033 at 2.59%.

Washington GOs 5s of 2037 at 2.47%. New York City 5s of 2039 at 2.84%-2.85%.

NY Dorm PIT 5s of 2041 at 3.00%-3.01% versus 3.00%-3.05% original. California 5s of 9/2041 at 2.58%-2.59% versus 2.53%-2.54% Monday and 2.58%-2.62% Wednesday. California 5s of 10/2041 at 2.58%-2.59% versus 2.50%-2.54% Monday.

NY Dorm PIT 5s of 2046 at 3.00%-3.01 versus 2.92%-2.95% Thursday. NYC Municipal Water Finance Authority 5s of 2051 at 2.92%-2.93% versus 2.86-2.87% Thursday. LA DPW 5s of 2051 at 2.75% versus 2.63% Monday. NYC Municipal Water Finance Authority 5s of 2052 at 2.93%-2.94% versus 2.88% Friday and 2.92%-2.93% Wednesday.

AAA scales

Refinitiv MMD's scale were cut 12 basis points at the 3 p.m. read: the one-year at 1.30% (+12) and 1.53% in two years (+12). The five-year at 1.79% (+12), the 10-year at 2.07% (+12) and the 30-year at 2.45% (+12).

The ICE municipal yield curve was cut nine to 12 basis points: 1.25% (+12) in 2023 and 1.55% (+9) in 2024. The five-year at 1.77% (+9), the 10-year was at 2.09% (+8) and the 30-year yield was at 2.48% (+7) in a 4 p.m. read.

The IHS Markit municipal curve was cut a basis point: 1.29% (+12) in 2023 and 1.52% (+12) in 2024. The five-year at 1.79% (+12), the 10-year at 2.06% (+12) and the 30-year at 2.46% (+12) at a 4 p.m. read.

Bloomberg BVAL saw 9 to 11 basis point cuts: 1.24% (+9) in 2023 and 1.50% (+10) in 2024. The five-year at 1.78% (+10), the 10-year at 2.06% (+10) and the 30-year at 2.44% (+11) at a 4 p.m. read.

Treasuries rose while equities rallied.

The two-year UST was yielding 2.163%, the five-year was yielding 2.395%, the seven-year 2.424%, the 10-year yielding 2.379%, and the 30-year Treasury was yielding 2.604% at 4 p.m. The Dow Jones Industrial Average gained 254 points or 0.74%, the S&P up 1.13% while the Nasdaq gained 1.95% at the close.

Will May bring a 50 bp hike?

Talk of the possibility of a 50 basis point rate hike at some point, perhaps at the Federal Open Market Committee’s May meeting, remains rampant after Fed Chair Jerome Powell said the panel would move faster if needed.

Federal Reserve Bank of St. Louis President James Bullard, speaking on Bloomberg TV Tuesday,

At the latest FOMC meeting, where rates were bumped a quarter point, Bullard

“Bullard has it right, let’s take the pain now and get inflation under control sooner and get on with it,” said AE Wealth Management CIO Tom Siomades.

But Wall Street now expects a 50-basis-point rate hike and an announcement of balance sheet runoff when the FOMC next meets in May, said Edward Moya, senior market analyst at OANDA. “Normally Bullard's expectations for Fed policy is the most aggressive,” he said, “but it seems he may be spot on for the May meeting.”

While a half-point increase at one meeting could happen this year, BCA Research said, it would require “long-maturity inflation expectations [to] become unanchored or core PCE inflation prints consistently above 0.30%-0.35% per month.”

While “Fed interest rate projections show that seven out of 16 FOMC participants think that at least one 50 bps rate hike will be necessary,” BCA sees inflation easing in the coming months and the Fed sticking to “a steady pace of tightening (25 bps per meeting).”

But unlike previous cycles, Morgan Stanley researchers say widening credit spreads won’t halt the rate increases this time. “Credit spreads have widened rapidly in recent weeks, and the magnitude of recent spread moves mirrors those in 2015-16 and 2018-19, when the Fed paused monetary tightening,” they said. “This time around, the bar for a policy pivot is substantially higher, as long as credit market functioning is not impaired.”

The reasons this time is different include: spreads had been tight by historical standards, meaning the increases won’t have as big an impact on the economy and inflation is surging.

“The Fed therefore may feel more pressure to continue on its telegraphed policy path toward tightening, even if policymakers would prefer to take a wait-and-see approach on credit market developments,” Morgan Stanley said.

But the Fed, according to David Kelly, chief global strategist at JPMorgan Asset Management, “sometimes appears to be trying to steer a big boat, through violent rapids, armed only with a small paddle.”

And despite their efforts, he said, “the reality is that forces well beyond their control will mostly determine the fate of the economy.” He sees strong consumer and private fixed investment spending propelling growth above its long-term potential.

“Importantly, it is hard to see how even the seven interest rate hikes the Fed projects for 2022 will put a dent in this growth,” Kelly said. “The most interest-sensitive sectors of the economy, home-building, capital spending and, to a lesser extent, auto sales, are all experiencing massive pent-up demand which is unlikely to be reduced significantly by modest increases in very low interest rates.”

And if the economy grows strongly, he asks, will the Fed raise rates more aggressively?

“If the Fed is sufficiently determined to battle inflation in the short-run and frustrated in its lack of short-term success,” Kelly said, “America may have reverted to an era of higher and more normal interest rates by the time the inflation tide finally begins to ebb.”

On Tuesday, the Federal Reserve Bank of Philadelphia’s March nonmanufacturing index suggested prices, while still high, have moderated a bit, with the Federal Reserve Bank of Richmond’s March manufacturing survey also showing a dip in its prices index. But the Richmond Fed’s service sector survey showed prices rose faster in March.

Primary to come:

Hoag Memorial Hospital Presbyterian, California, (/AA/AA/) is set to price Wednesday $538.700 million of corporate CUSIP taxable revenue bonds, Series 2022. J.P. Morgan Securities.

New York City Housing Development Corp. is set to price Thursday $400.395 million of taxable sustainable development capital fund grant program revenue bonds, Series 2022A. J.P. Morgan Securities.

New York State Housing Finance Agency (Aa2///) is also set to price Wednesday $192.855 million of affordable housing revenue bonds, consisting of $85.065 million of climate bond certified/sustainability bonds, 2022 Series A-1, serials 2024-2034, terms 2037, 2040,2042, 2045, 2047, 2052, 2055 and 2060 and $107.790 million of social bonds, 2022 Series B-1, serials 2022-2034, terms 2037, 2040, 2042, 2045 and 2052. Jefferies.

Lamar Consolidated Independent School District, Texas, (Aaa/AAA//) is set to price Thursday $393.035 million of unlimited tax schoolhouse bonds, Series 2022, serials 2024-2062, insured by Permanent School Fund Guarantee Program. RBC Capital Markets.

The Chicago Transit Authority (/A+//AA-/) is set to price Wednesday $349.925 million of second lien sales tax receipts revenue bonds, Series 2022A, serials 2041-2042, terms 2047, 2052 and 2057. Cabrera Capital Markets.

California Public Finance Authority (/AA/AA/) is set to price Wednesday $168.540 million of fixed period revenue bonds, Series 2022A. J.P. Morgan Securities.

North Carolina Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $150 million of non-alternative minimum tax social home ownership revenue bonds, Series 48, serials 2023-2034, terms 2037, 2042, 2045 and 2052. RBC Capital Markets.

Competitive:

Beverly Hills Unified School District, California, (Aa1/AA+/) is set to sell $110 million of taxable Election of 2018 general obligation bonds, Taxable Series B-1, at noon eastern Wednesday.

Beverly Hills Unified School District, California, (Aa1/AA+/) is set to sell $115 million of Election of 2018 general obligation bonds, Taxable Series B, at 1 p.m. Wednesday.

Anne Arundel County, Maryland, (Aaa/AAA//) is set to sell $67.625 million of general obligation bonds, consisting of $44.780 million of consolidated general improvement series, 2022 Refunding Series and $22.845 million of consolidated water and sewer series, 2022 Refunding Series, at 10:45 a.m. Wednesday.

Anne Arundel County, Maryland, (Aaa/AAA//) is set to sell $194.690 million of general obligation bonds, consisting of $137.145 million of consolidated general improvement series, 2022 Series and $57.545 million of consolidated water and sewer series, 2022 Series, at 10:15 a.m. Wednesday.

The Virginia Transportation Board (Aa1/AA+/AA+/) is set to sell $115.320 million of transportation revenue bonds, Series 2022 at 10:30 a.m. Wednesday.

Albuquerque, New Mexico, is set to sell $104.315 million of general obligation bonds, consisting of: $76.395 million of general purpose bonds, Series 2022A; $4.305 million of storm sewer bonds, Series 2022B and $23.615 million of refunding bonds, Series 2022D, at 11 a.m. eastern Thursday.

Christine Albano contributed to this report.