Top-rated municipal bonds were mixed at mid-session as traders take a break as the market quiets down ahead of the looming Labor Day holiday weekend.

The primary sector is wrapped up for the week, as there are no major competitive or negotiated deals scheduled for Thursday or Friday.

Secondary market

The yield on the 10-year benchmark muni general obligation was unchanged from 1.86% on Tuesday, while the 30-year GO yield dipped as much as one basis point from 2.71%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were little changed on Thursday. The yield on the two-year Treasury was flat from 1.33% on Wednesday, the 10-year Treasury yield dipped to 2.13% from 2.14% and the yield on the 30-year Treasury bond decreased to 2.73% from 2.75%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 87.1%, compared with 87.1% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 98.7% versus 98.7%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 39,644 trades on Wednesday on volume of $13.97 billion.

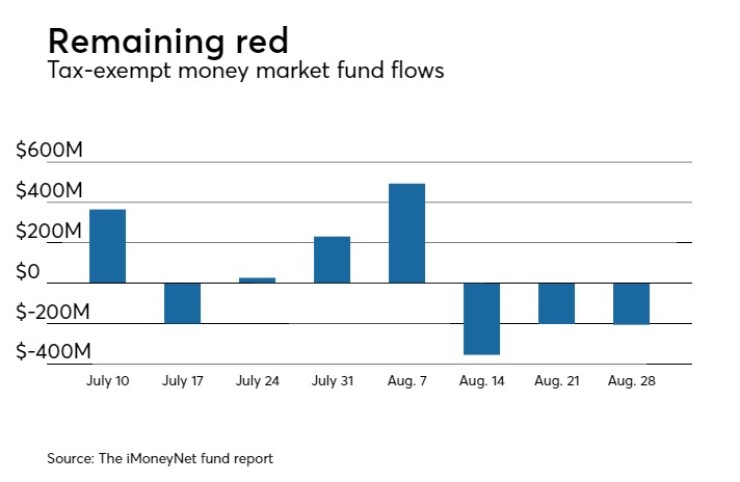

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $206.4 million, bringing total net assets to $129.96 billion in the week ended Aug. 28, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $203 million to $130.17 billion in the previous week.

The average, seven-day simple yield for the 231 weekly reporting tax-exempt funds increased to 0.35% from 0.33% the previous week.

The total net assets of the 850 weekly reporting taxable money funds decreased $17.21 billion to $2.551 trillion in the week ended Aug. 29, after an inflow of $25.64 billion to $2.568 trillion the week before.

The average, seven-day simple yield for the taxable money funds remained at 0.67% for the third week in a row.

Overall, the combined total net assets of the 1,081 weekly reporting money funds decreased $17.41 billion to $2.681 trillion in the week ended Aug. 29, after inflows of $25.4 million to $2.698 trillion in the prior week.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $434.1 million to $5.79 billion on Thursday. The total is comprised of $2.72 billion of competitive sales and $3.07 billion of negotiated deals.

Seix: Congress looking at munis as HQLA

Two bills are moving through Congress that would designate some municipal bonds as high quality liquid assets [HQLA] for bank compliance liquidity coverage ratios [LCR], according to a market comment released Tuesday by Seix Investment Advisors.

After the 2008 financial crisis, regulators made banks hold enough liquid assets in order to survive a short-term liquidity crunch, Ronald Schwartz, managing director, and Scott Andreson, director, wrote in the comment. The LCR is used to measure HQLA held against liquidity needs over a 30-day liquidity stress period.

Seix said the HQLA designation is made up of assets divided into three categories, Level 1, Level 2A, and Level 2B:

- Level 1 assets are the most liquid with little credit risk and there are no restrictions on the amount that can be held. Examples include cash, central bank reserves, and securities issued or guaranteed by sovereigns and central banks.

- Level 2A assets are not as liquid as Level 1, but are still considered to be readily marketable, but may make up no more than 40% of total HQLA. Examples include guarantees by U.S. government-sponsored enterprises, other sovereign or multilateral development bank securities and conventional MBS.

- Level 2B assets are not as liquid as Level 1, but are still considered to be readily marketable, but may make up no more than 15% of total HQLA. Examples include publicly traded corporate debt and some corporate equity shares.

“Bank regulators did not include municipal bonds as HQLA under the original regulation because they felt the securities were not liquid enough,” Schwartz and Andreson wrote. “Municipal market participants were successful in getting the Federal Reserve Board in April 2016 to count liquid investment grade general obligation municipal bonds that meet the same criteria that currently applies to corporate debt securities, as Level 2B HQLA assets. However, the other two major financial regulating agencies, FDIC and Office of the Comptroller of the Currency have not included munis as HQLA."

The current bills before Congress have solid bipartisan support in the House and Senate and would require the Fed, FDIC, and OCC to use munis as HQLAs, Schwartz and Andreson said. However, while it is positive for the asset class that both Congress and the Trump administration support having high-grade munis designated as HQLA, the likelihood of passage this year looks slim, they said.

“We believe most highly rated munis should be classified as Level 2A. Clearly their strong credit quality characteristics justify at least a Level 2A designation and the largest index issuers including states, large cities, etc. are generally very liquid instruments,” Schwartz and Andreson wrote. “We expect politicians in D.C. to pass HQLA legislation eventually which should help increase demand somewhat for municipal bonds.”