Municipals are looking somewhat less attractive following last week’s strong rally, but should maintain a firm tone through year-end due to favorable market technical factors, according to Peter Block, managing director of credit research at Ramirez & Co.

Those conditions include higher absolute yields of 20% year to date, strong December and January coupon reinvestment, slowing global growth, and slightly negative net supply, Block said in a weekly municipal report issued on Wednesday.

“The macro risks to our view include fair-to-rich muni credit spreads and ratios, still bloated dealer balance sheets, ongoing market volatility, Fed balance sheet taper, inflation, and higher Treasury supply to fund the Federal deficit,” Block wrote.

If interest rates remain somewhat range-bound, the Municipal Market Data curve’s steepness through 15 years — two-year and 15-year at plus 83 basis points to the generic triple A scale — supports Block’s investment thesis of higher quality 5% coupon bonds with maturities of 15 to 20 years that capture 90% of the MMD curve.

“This structure with optional calls inside 5 years are, in some cases, trading cheaper versus longer calls of similar maturities,” Block said.

Muni CUSIP requests decline in November

Municipal CUSIP requests declined in November, according to CUSIP Global Services.

The aggregate total of all municipal securities – including municipal bonds, long-term and short-term notes, and commercial paper – fell 4.8% last month from October, CUSIP said in a report released Tuesday.

On a year-over-year basis, total municipal identifier request volume is down 12.7% versus the same period last year.

“Uncertainty over the future of interest rates is clearly starting to show up in the CUSIP data set, particularly as we start to see some volatility in the monthly activity,” said Gerard Faulkner, Director of Operations for CUSIP Global Services. “While the Fed has signaled that it will raise rates again in December, it is not yet clear what's in store for 2019, so we expect to continue to see a fair amount of volatility in our monthly CUSIP request volumes.”

There were a total of 1,152 new municipal requests during the month. On a year-over-year basis, total municipal identifier request volume is down 12.7% through November, reflecting a significant slowdown in request volume in the first quarter of 2018.

Among top state issuers, CUSIPs for scheduled public finance offerings from Texas, New York, and California were the most active in November

Secondary market

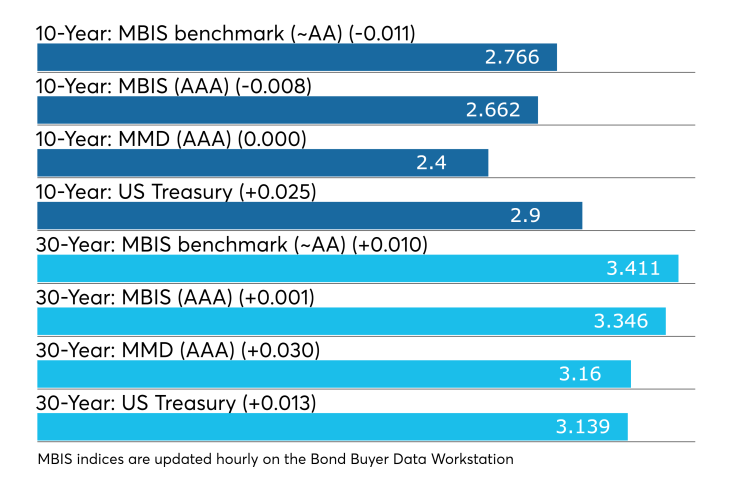

Municipal bonds were mixed on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields dipped less than one basis point in the six- and seven-year and 10- and 12-year maturities and rose as much as two basis points in the one- to five-year, eight- and nine-year and 13- to 30-year maturities.

High-grade munis were also mixed, with yields calculated on MBIS' AAA scale falling less than one basis point in the six- and seven-year, 10- to 12-year and 22- to 28-year maturities, rising as much as one basis point in the one- to five-year, eight- and nine-year, 14- to 20-year and 30-year maturities and remaining unchanged in the seven-year, 13-year, 21-year and 29-year maturities.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining steady while the yield on the 30-year muni maturity rose three basis points.

“Today feels like a lower flow, but higher bid-wanted day,” said one Southern trader on Wednesday. “Bid-wanted’s seem to be the story with continued tax swap selling and bank portfolio liquidation. A lot of the BW’s are lower coupon and have shorter call, but the bidding seems fairly orderly. To me, today feels like the first trading day of the holiday season.”

Treasury bonds were stronger amid continued stock market volatility. The Treasury 30-year was yielding 3.139%, the 10-year yield stood at 2.900%, the five-year was at 2.758%, the two-year was at 2.758% while the Treasury three-month bill stood at 2.430%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 82.8% while the 30-year muni-to-Treasury ratio stood at 100.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 48,272 trades on Tuesday on volume of $14.26 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 16.056% of the market, the Empire State taking 12.41% and the Lone Star State taking 10.114%.

ICI: Long-term muni funds saw $635M outflow

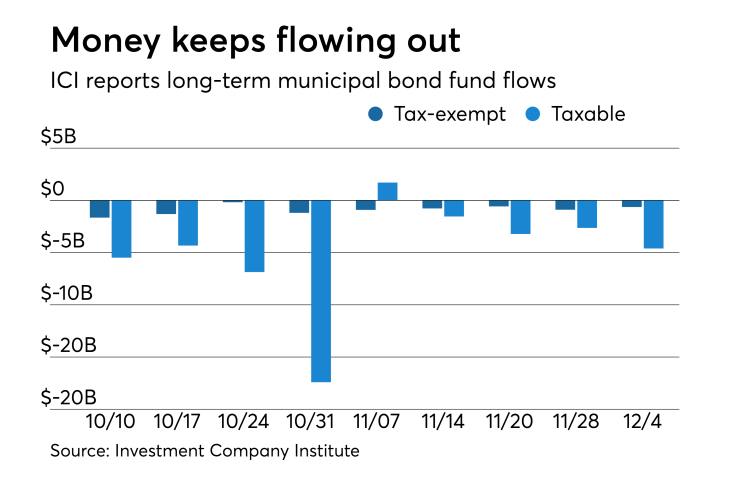

Long-term tax-exempt municipal bond funds saw an outflow of $635 million in the week ended Dec. 4, the Investment Company Institute reported Wednesday.

This followed an outflow of $896 million in the week ended Nov. 26 and outflows of $578 million, $770 million, $909 million, $1.196 billion, $179 million, $1.310 billion, and $1.653 billion in the previous seven weeks.

Taxable bond funds saw an estimated outflow of $4.607 billion in the latest reporting week, after seeing outflows of $2.638 billion and $3.220 billion in the previous two weeks.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $4.427 billion after outflows of $13.271 billion and $6.693 billion in the prior two weeks.

Primary market

Bank of America Merrill Lynch priced the Municipal Electric Authority of Georgia’s $242.95 million of Series HH power revenue bonds and Series 2018A general power revenue bonds.

The Series HH bonds are rated A1 by Moody’s Investors Service, A by S&P Global Ratings and A-minus by Fitch except for the 2049 maturity which is insured by Assured Guaranty Municipal Corp. and rated A2 by Moody’s and AA by S&P. The Series 2018A bonds are rated A1 by Moody’s Investors Service, A by S&P Global Ratings and A-minus by Fitch except for the 2034-2040 maturities which are insured by Assured and rated A2 by Moody’s and AA by S&P.

BAML also priced the Public Facilities Financing Authority of the City of San Diego’s $246.72 million of Series 2018A subordinated water revenue bonds.

The deal is rated Aa3 by Moody’s and AA-minus by Fitch.

Wells Fargo Securities received the written award on the Washoe County, Nev.’s $183.24 million of Series 2018 highway revenue fuel tax refunding bonds.

The deal is rated Aa3 by Moody’s and AA by S&P Global Ratings.

RBC Capital Markets received the official award on the Public Finance Authority of Wisconsin’s $147.68 million of Series 2018 student housing revenue bonds for CHF-Wilmington, LLC-University of North Carolina at Wilmington Project.

The deal is insured by Assured and rated A2 by Moody’s and AA by S&P.

Jefferies received the written award on Nassau County, N.Y.’s $169.01 million of Series 2018B general improvement bonds.

The deal is insured by Assured and rated A2 by Moody’s, AA by S&P and A by Fitch.

Bond sale results

Georgia

California

Wisconsin

New York

Nevada

Bond Buyer 30-day visible supply at $7.67B

The Bond Buyer's 30-day visible supply calendar decreased $2.63 billion to $7.67 billion for Wednesday. The total is comprised of $1.54 billion of competitive sales and $6.13 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.