Munis closed out the week stronger as yields on some maturities were three basis points lower, according to traders.

There is not much to look forward to next week, as issuance will be limited and the largest deal scheduled is only $38 million.

Secondary Market

The yield on the 10-year benchmark muni general obligation fell two basis points to 1.93% from 1.95% on Thursday, while the 30-year yield was three basis points lower to 2.81% from 2.84%, according to a final read of Municipal Market Data's triple-A scale.

U.S. Treasury bonds were also stronger at Friday's close. The yield on the two-year yield fell to 0.96% from 0.99% on Thursday, while the 10-year Treasury was lower to 2.20% from 2.24% and the 30-year Treasury yield decreased to 2.91% from 2.94%.

The 10-year muni to Treasury ratio was calculated on Friday at 87.8% compared to 87.4% on Thursday, while the 30-year muni to Treasury ratio stood at 96.7% compared to 96.8%, according to MMD.

Primary Market

Volume for the week of Christmas looks bleak, as an estimated $73 million will be hitting the primary market, according to Ipreo, down from $1.98 billion that priced this week, according to Thomson Reuters.

There were only two negotiated deals on the Dalcomp calendar – and both under $40 million – while there are only a handful of competitive sales up for bid, none of which were larger than $5 million.

"The tax‐exempt primary market will start a hiatus that practically shuts the municipal bond market down for the next few weeks," wrote Daniel Berger, senior market strategist, Thomson Reuters/Municipal Market Data, in a weekly outlook. "New Issue supply will be under $100 million and that's versus the yearly weekly average of about $7 billion."

Boenning & Scattergood are expected to price Bucks County, Pa.'s $38 million of water and sewer revenue bonds on Tuesday. The deal is scheduled to mature serially from 2016-2040.

Added to the calendar on Friday, Loop Capital is scheduled to price the Massachusetts Housing Finance Agency's $24 million of multifamily conduit revenue bonds, Series A for the Wood Ridge Homes Project on Tuesday.

"During the past few months, municipal bond new issuance volume has been lower than last year. This lighter calendar led to muni bond outperformance," Berger wrote.

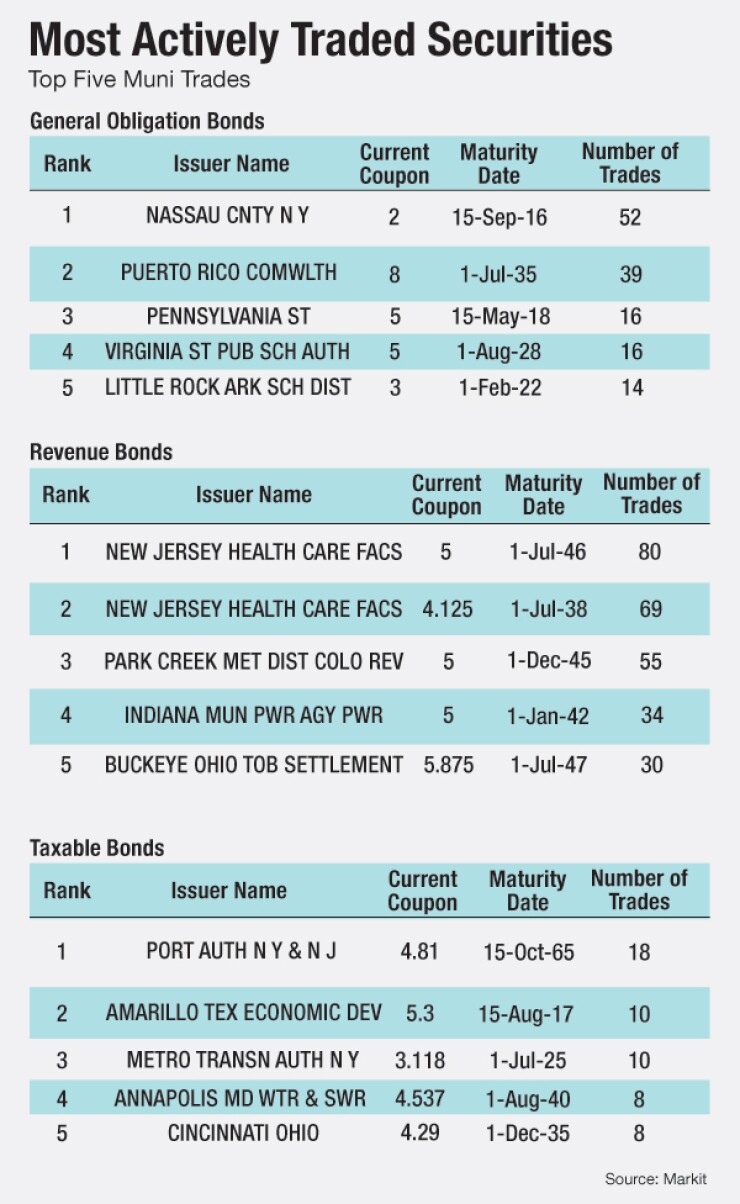

The Week's Most Actively Quoted Issues

New York & New Jersey, Texas, and California were some of the most actively quoted names in the week ended Dec. 18, according to data released by Markit.

On the bid side, the New York & New Jersey Port Authority taxable 4.81s of 2065 were quoted by 13 unique dealers. On the ask side, the North Texas Tollway Authority revenue 5s of 2040 were quoted by 17 unique dealers. And among two-sided quotes, the state of California taxable 7.55s of 2039 were quoted by 17 dealers, Markit said.

The Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Dec. 18 were in New York and New Jersey, according to Markit.

In the revenue bond sector, the New Jersey Healthcare Facility Finance Authority 5s of 2046 were traded 80 times. In the GO bond sector, the Nassau County N.Y. 2s of 2016 were traded 52 times. And in the taxable bond sector, The Port Authority of New York and New Jersey 4.81s of 2065 were traded 18 times, Markit said.

Municipal Bond Funds See Inflows for 11 Straight Weeks

Municipal bond funds reported inflows for the 11th straight week, according to Lipper data released on Thursday.

Weekly reporting funds experienced $303.495 million of inflows in the week ended Dec. 16, after inflows of $741.968 million in the previous week.

The latest inflow brings to 30 out of 51 weeks this year that the funds have seen cash flowing in. Flows for the year to date remain positive, totaling over $4.5 billion.

The four-week moving average remained positive at $523.453 million after being in the green at $543.721 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced inflows, gaining $200.533 million in the latest week, on top of inflows of $249.348 million in the previous week. Intermediate-term funds had inflows of $155.613 million after inflows of $357.572 million in the prior week.

National funds saw inflows of $273.837 million on top of inflows of $734.578 million in the prior week. High-yield muni funds reported inflows of $26.694 million in the latest reporting week, after an inflow of $203.227 million the previous week.

Exchange traded funds reported outflows of $4.642 million, after inflows of $121.669 million in the previous week.