Top-quality municipal bonds were stronger at mid-session as the market is seeing the lion’s share of issuance hit the screens, led by California’s $2.5 billion general obligation bond deal and the Greater Orlando Aviation Authority’s revenue bond offering.

Secondary market

Bonds were stronger while stocks slumped after North Korea fired a ballistic missile over Japan, causing a flight-to-quality bid in morning trade. Gasoline prices rose as energy firms were set to see a hit from what was Hurricane Harvey in Texas.

The yield on the 10-year benchmark muni general obligation fell two to four basis points from 1.88% on Monday, while the 30-year GO yield dropped two to four basis points from 2.73%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were stronger on Tuesday. The yield on the two-year Treasury fell to 1.31% from 1.33% on Monday, the 10-year Treasury yield declined to 2.12% from 2.16% and the yield on the 30-year Treasury bond decreased to 2.73% from 2.75%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 87.2%, compared with 86.7% on Friday, while the 30-year muni-to-Treasury ratio stood at 99.3% versus 99.2%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 30,847 trades on Monday on volume of $5.55 billion.

Primary market

Goldman Sachs priced California’s $2.51 billion of various purpose GO and refunding GOs for institutions after the retail pricing on Monday.

The $788.82 million of various purpose GOs were priced for institutions to yield from 0.77% with 3% and 5% coupons in a split 2018 maturity to 2.26% with a 5% coupon in 2028 and 2.50% with a 5% coupon in 2031, 2.86% with a 4% coupon and 2.56% with a 5% coupon in a split 2032 maturity, 2.73% with a 5% coupon in 2035 and 3.30% with a 4% coupon and 2.95% with a 5% coupon in a split 2047 maturity.

The $1.72 billion of various purpose refunding GOs were priced for institutions to yield from 0.77% with 3% and 4% coupons in a split 2018 maturity to 3.12% with a 4% coupon and 2.79% with a 5% coupon in a split 2037 maturity.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

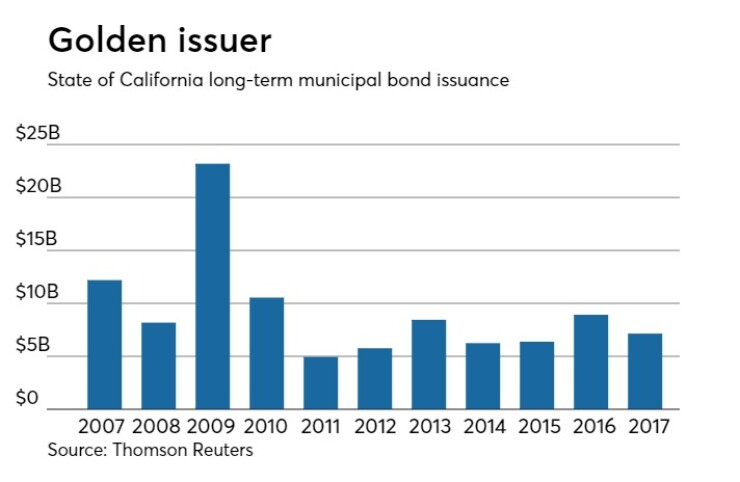

Since 2007, the state has sold $101.94 billion of securities, with the most issuance occurring in 2009 when it brought $23.18 billion of bonds to market. During that time span, the Golden State has never issued less than $4.9 billion in a year, which it did it 2011.

In the competitive arena on Tuesday, Prince George’s County, Md., sold $480.85 million of GOs in two separate offerings.

Bank of America Merrill Lynch won the $366.46 million of Series 2017A GO consolidated public improvement bonds with a true interest cost of 2.46%. The issue was priced to yield from 0.85% with a 5% coupon in 2018 to 3.14% with a 3% coupon in 2037.

BAML also won the $114.39 million of Series 2017B GO consolidated public improvement refunding bonds with a TIC of 1.69%. The issue was priced as 5s to yield from 0.85% in 2018 to 2.25% in 2031.

The deals are rated triple-A by Moody’s, S&P and Fitch.

Beaumont, Texas, competitively sold $113.94 million of Series 2017 unlimited tax refunding bonds.

BAML won the bonds with a TIC of 2.85%. The issue was priced to yield from 0.85% with a 5% coupon in 2018 to about 3.17% with a 3% coupon in 2036; a 2038 maturity was priced as 3 1/8s to yield about 3.26%.

The deal, which is backed by the Permanent School Fund guarantee program, is rated AAA by S&P.

In the negotiated sector, RBC Capital Markets priced the Greater Orlando Aviation Authority, Fla.’s $926.57 million of Series 2017A priority subordinated airport facilities revenue bonds subject to the alternative minimum tax.

The issue was priced as 5s to yield from 1.71% in 2023 to 3.14% in 2037. A split 2042 maturity was priced as 5s to yield 3.25 and as 3 1/2s to yield 3.65%; a triple split 2047 maturity was priced as 5s to yield 3.31%, as 4s to yield 3.63% and as 3 5/8s to yield 3.73%; a split 2052 maturity was priced as 5s to yield 3.41% and as 4s to yield 3.77%.

The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

Also on Tuesday, BAML is expected to price the Illinois Finance Authority’s $558 million of Series 2017 revolving fund revenue bonds under the state of Illinois' clean water initiative.

The deal is rated AAA by S&P and Fitch.

BAML is also set to price the Wisconsin Health and Educational Facilities Authority’s $308 million of Series 2017B and 2017C revenue bonds for the Marshfield Clinic Health System.

The deal is rated A-minus by S&P and Fitch.

And BAML is expected to price the Oregon Department of Housing and Community Services’ $107 million of single-family mortgage revenue bonds.

The deal, which consists of Series 2017D bonds not subject to the alternative minimum tax and Series 2017E AMT bonds, is rated Aa2 by Moody’s.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $672.4 million to $10.26 billion on Tuesday. The total is comprised of $3.27 billion of competitive sales and $6.99 billion of negotiated deals.