Municipal bond volume will finish the year above $400 billion for the fourth time since 2010 and third time in the past four years.

“Considering how slow the year started, no one had that number or thought we would get there,” said one New York trader. “We were one pace for only about $330 billion six months in and then boom, all of a sudden all the taxables hit and here we are.”

The muni market saw $433.27 billion back in 2010, $444.79 billion in 2016, and a record high $448.61 billion in 2017.

“Expectations are high for next year volume wise,” he said. “Buyers should still be eager to buy munis as a true taxes safe haven, with principal, interest and callable bonds that should amplify demand as well. Munis are poised for another big year."

There are no deals on the calendar until the week of Jan. 6. The New York MTA is scheduled to sell $1.5 billion in two separate competitive sales on Monday, Jan. 6. They are then scheduled to jump back into the market on Thursday, Jan. 9 when the authority is expected to sell a total of $939.555 million of green bonds in three separate sales.

Secondary market

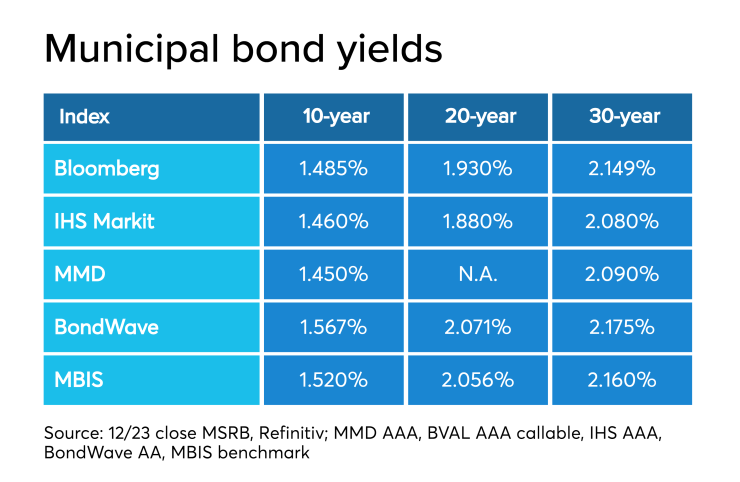

Munis were stronger on the MBIS benchmark scale, with yields decreasing by two basis points in the 10-year maturity and by less than a basis point in the 30-year. High-grades were also stronger, with yields on MBIS AAA scale falling by no more than basis points in the 10-year and by no more than one basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yields were unchanged on both the 10- and 30-year maturities at 1.45% and 2.09%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 75.9% while the 30-year muni-to-Treasury ratio stood at 89.4%, according to MMD.

Treasuries were mostly lower, while stocks were a mixed bag. The Nasdaw completed a 10-day win streak, while the Dow and S&P closed lower for the first time in 10 days.

The Dow Jones Industrial Average was down about 0.13% as the S&P 500 Index fell 0.05% in afternoon trading while the Nasdaq gained 0.08%.

The Treasury three-month was yielding 1.546%, the two-year was yielding 1.645%, the five-year was yielding 1.724%, the 10-year was yielding 1.914% and the 30-year was yielding 2.345%.

Tobacco bonds: Up in smoke

As part of the spending bill passed by Congress and signed by the President’s on Dec. 20, the national legal age to buy tobacco and vaping products will be raised from 18 to 21. Moody’s Investors Service tobacco bond analysts have opined on the impact of this pending legislation, in particular on the asset backed securities backed by tobacco sales.

“Passage of federal legislation to increase the legal age to buy tobacco and vaping products from 18 to 21 is credit negative for tobacco settlement asset-backed securities,” Inga Smolyar, vice president and senior credit officer at Moody’s said. “Raising the age will likely accelerate the rate of future domestic cigarette shipment declines, lessening revenue available to the ABS. Tobacco bonds are backed by tobacco settlement revenues due to states pursuant to the 1998 master settlement agreement with tobacco companies.”

The Blackrock municipal bond group said that the tobacco bond sector is faced with a new headwind after Massachusetts Governor Baker signed into law the nation’s toughest ban on flavored vaping products and menthol cigarettes. The bill also included a hefty excise tax for unflavored vaping products as well as restrictions on nicotine content.

“The ban could pave the way for other states to pass similar measures to curtail youth smoking as the prospects for a federal ban have softened,” the group wrote in a report. “Specifically, New York will be voting on legislation this January. Offsetting this development is the possibility that the restructuring of Ohio’s $5.7 billion of Buckeye Bonds may result in higher ratings for the new bonds, thereby reducing the supply of high yield tobacco bonds and ultimately improving market technicals in the muni high yield sector.”

Previous session's activity

The MSRB reported 25,909 trades Monday on volume of $6.588 billion. The 30-day average trade summary showed on a par amount basis of $11.61 billion that customers bought $6.18 billion, customers sold $3.41 billion and interdealer trades totaled $2.03 billion.

California, New York and Texas were most traded, with the Golden State taking 13.21% of the market, the Empire State taking 11.881% and the Lone Star State taking 10.187%.

The most actively traded security was the State of Texas tax anticipation notes, revenue, 4s of 2020, which traded 16 times on volume of $19.85 million.

Treasury auctions

The Treasury Department Tuesday auctioned $41 billion of five-year notes, with a 1.75% coupon, a 1.756% high yield, a price of 99.971399.

The bid-to-cover ratio was 2.49.

Tenders at the high yield were allotted 30.15%. All competitive tenders at lower yields were accepted in full.

The median yield was 1.730%. The low yield was 1.500%.

Treasury to sell $35B 4-week bills

The Treasury Department said it will sell $35 billion of four-week discount bills Thursday. There are currently $35.451 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.