Top-quality municipal bonds ended stronger on Tuesday as the lion’s share of the week’s issuance hit the screens, led by California’s $2.5 billion general obligation bond deal and the Greater Orlando Aviation Authority’s revenue bond offering.

Primary market

Goldman Sachs priced California’s $2.51 billion of various purpose GO and refunding GOs for institutions after the retail pricing on Monday.

The $788.82 million of various purpose GOs were priced for institutions to yield from 0.77% with 3% and 5% coupons in a split 2018 maturity to 2.26% with a 5% coupon in 2028 and 2.50% with a 5% coupon in 2031, 2.86% with a 4% coupon and 2.56% with a 5% coupon in a split 2032 maturity, 2.73% with a 5% coupon in 2035 and 3.30% with a 4% coupon and 2.95% with a 5% coupon in a split 2047 maturity.

The $1.72 billion of various purpose refunding GOs were priced for institutions to yield from 0.77% with 3% and 4% coupons in a split 2018 maturity to 3.12% with a 4% coupon and 2.79% with a 5% coupon in a split 2037 maturity.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

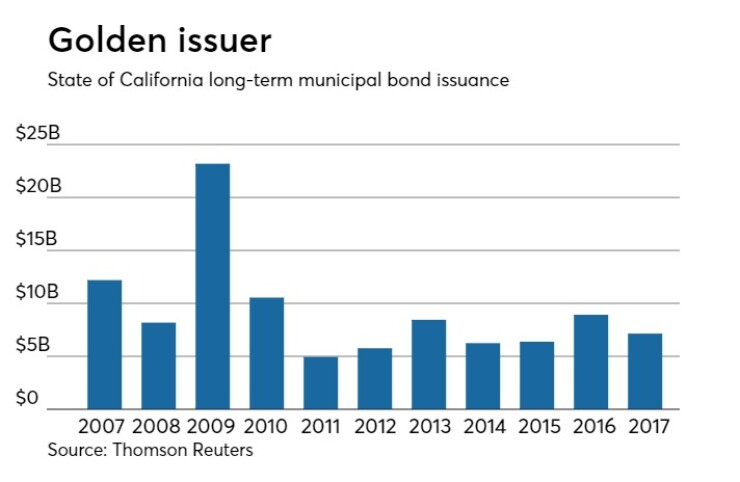

Since 2007, the state has sold $101.94 billion of securities, with the most issuance occurring in 2009 when it brought $23.18 billion of bonds to market. During that time span, the Golden State has never issued less than $4.9 billion in a year, which it did it 2011.

RBC Capital Markets priced and repriced the Greater Orlando Aviation Authority, Fla.’s $926.57 million of Series 2017A priority subordinated airport facilities revenue bonds subject to the alternative minimum tax.

The issue was repriced as 5s to yield from 1.66% in 2023 to 3.10% in 2037. A split 2042 maturity was priced as 5s to yield 3.22% and as 3 1/2s to yield 3.62%; a triple split 2047 maturity was priced as 5s to yield 3.28%, as 4s to yield 3.62% and as 3 5/8s to yield 3.71%; a split 2052 maturity was priced as 5s to yield 3.36% and as 4s to yield 3.76%.

The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

According to some traders, the two largest deals of the week both attracted strong demand.

“The Cal deal had roughly $1 billion in retail orders Monday and then was able to come to institutional pricing with no real changes, but it was slightly wider on the front end,” said one New York trader. “Obviously the higher Treasury market helped as well.”

Another New York trader agreed, saying that the California offering was oversubscribed by two times and in some maturities by three times.

“The two bellwether deals got what they needed with a firmer market and now the muni market will just be waiting on the employment report on Friday -- for those who will be at their desks and not making a long weekend an extra-long weekend,” he said.

The airport offering was also said to have received a warm reception.

“The Orlando Airport deal was also a success, as it got bumped three-to-five basis points across the front to intermediate and then one basis point on longer bonds,” the New York trader said.

In the competitive arena on Tuesday, Prince George’s County, Md., sold $471.43 million of GOs in two separate offerings.

Bank of America Merrill Lynch won the $366.46 million of Series 2017A GO consolidated public improvement bonds with a true interest cost of 2.46%. The issue was priced to yield from 0.85% with a 5% coupon in 2018 to 3.14% with a 3% coupon in 2037.

BAML also won the $104.97 million of Series 2017B GO consolidated public improvement refunding bonds with a TIC of 1.69%. The issue was priced as 5s to yield from 0.85% in 2018 to 2.25% in 2031.

The deals are rated triple-A by Moody’s, S&P and Fitch.

Beaumont, Texas, competitively sold $107.04 million of Series 2017 unlimited tax refunding bonds.

BAML won the bonds with a TIC of 2.85%. The issue was priced to yield from 0.85% with a 5% coupon in 2018 to about 3.17% with a 3% coupon in 2036; a 2038 maturity was priced as 3 1/8s to yield about 3.26%.

The deal, which is backed by the Permanent School Fund guarantee program, is rated AAA by S&P.

In the negotiated sector, BAML priced the Illinois Finance Authority’s $559.77 million of Series 2017 revolving fund revenue bonds issued under the state of Illinois' clean water initiative.

The bonds were priced to yield from 0.77% with a 5% coupon in 2018 to 2.87% with a 5% coupon in 2037.

The deal is rated AAA by S&P and Fitch.

BAML also priced the Wisconsin Health and Educational Facilities Authority’s $314.44 million of Series 2017B and 2017C revenue bonds for the Marshfield Clinic Health System.

The $27.64 million of Series 2017B revenue bonds were priced as 4s to yield 4.03% in a 2050 bullet maturity.

The $286.8 million of Series 2017B double tax-exempt revenue bonds were priced to yield from 0.89% with a 5% coupon in 2018 to 3.69% with a 4% coupon in 2037. A 2042 maturity was priced as 4s to yield 3.87%, a 2047 maturity was priced as 5s to yield 3.54% and a 2050 maturity was priced at par to yield 4%.

The deal is rated A-minus by S&P and Fitch.

BAML priced the Oregon Housing and Community Services Department’s $110.18 million of mortgage revenue bonds for the single-family mortgage program featuring alternative-minimum tax bonds and non-AMT bonds.

The $87.39 million of Series 2017D non-AMT bonds were priced at par to yield from 1.40% in 2022 to 2.55% and 2.60% in a split 2028 maturity. A term bond in 2032 was priced at par to yield 3.15%, a term bond in 2038 was priced at par to yield 3.45% and a term bond in 2048 was priced to yield 1.85% with a 3.5% coupon.

The $22.79 million of Series 2017E AMT bonds were priced at par to yield 0.95% and 1.05% in a split 2018 maturity to 1.75% and 1.85% in a split 2022 maturity. A term bond in 2040 was priced to yield 1.97% with a 3.5% coupon.

Both series are rated Aa2 by Moody’s.

There are no major bond sales slated for sale on Wednesday.

On Thursday, Goldman Sachs is expected to price the Southern California Public Power Authority’s $107.86 million of Series 2017-1 refunding revenue bonds for Magnolia Power Project A.

The deal is rated AA-minus by Fitch.

Secondary market

Bonds were stronger most of the day while stocks slumped after North Korea fired a ballistic missile over Japan, causing a flight to quality by investors. Gasoline prices rose as energy firms were set to see a hit from Hurricane Harvey in Texas.

The yield on the 10-year benchmark muni general obligation fell two basis points to 1.86% from 1.88% on Monday, while the 30-year GO yield dropped two basis points to 2.71% from 2.73%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were narrowly mixed. The yield on the two-year Treasury fell to 1.32% from 1.33% on Monday, the 10-year Treasury yield declined to 2.14% from 2.16% and the yield on the 30-year Treasury bond was unchanged from 2.75%.

The 10-year muni-to-Treasury ratio was calculated at 87.1% on Tuesday, compared with 87.2% on Monday, while the 30-year muni-to-Treasury ratio stood at 98.7% versus 99.3%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 30,847 trades on Monday on volume of $5.55 billion.