Municipal bond traders on Tuesday will be eyeing rising yields as the first of the week’s new supply is set to hit the market.

Secondary market

U.S. Treasuries were weaker on Tuesday. The yield on the two-year Treasury rose to 1.26% from 1.23% on Monday, while the 10-year Treasury yield gained to 2.31% from 2.27%, and the yield on the 30-year Treasury bond increased to 2.96% from 2.92%.

Municipal bonds ended weaker on Monday. The yield on the 10-year benchmark muni general obligation rose four basis points to 2.09% from 2.05% on Friday, while the 30-year GO yield gained five basis points to 2.95% from 2.90%, according to the final read of Municipal Market Data's triple-A scale.

On Monday, the 10-year muni to Treasury ratio was calculated at 91.9%, compared with 92.0% on Friday, while the 30-year muni to Treasury ratio stood at 100.7%, versus 100.4%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,130 trades on Monday on volume of $8.64 billion.

Primary market

Kaiser Pemanente is coming to market this week with two separate issues – totaling nearly $4 billion.

One deal is a corporate CUSIP taxable offering for $2 billion slated to be priced by Goldman Sachs on Tuesday or Wednesday.

The other sale is a $1.9 billion deal issued through the California Health Facilities Financing Authority, also to be priced by Goldman on Tuesday.

Both deals are rated AA-minus by S&P Global Ratings and A-plus by Fitch Ratings.

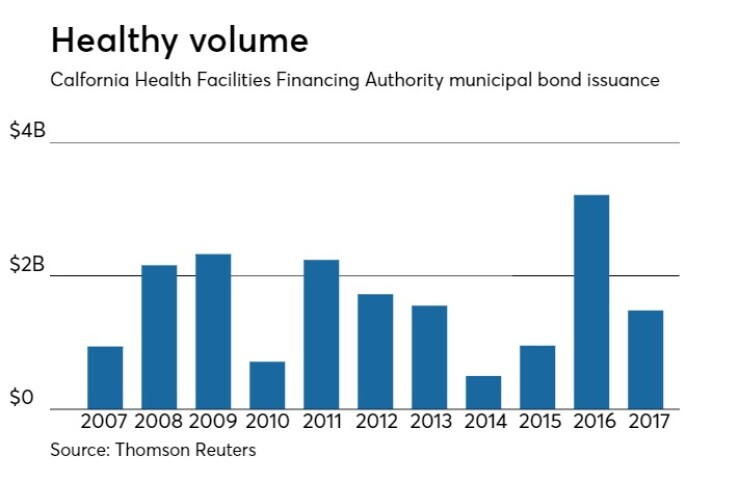

Since 2007, the California HFFA has sold more than $18 billion of securities with the largest issuance occurring last year when it came with a whopping $3.21 billion. The authority has only issued less than $1 billion four times, with the lowest year of issuance in the period in 2014.

Wells Fargo Securities is set to price the Port Authority of New York and New Jersey’s $994.74 million of consolidated bonds on Tuesday for retail investors ahead of the institutional pricing on Wednesday.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P and Fitch.

Stifel is expected to price the Chino Valley Unified School District, Calif.’s $262 million of Series 2017A election of 2016 general obligation bonds on Tuesday.

The deal is rated AA2 by Moody’s and AA-minus by S&P.

Siebert Cisneros Shank is set to price Atlanta’s $226.82 million of Series 2017A water and wastewater revenue refunding bonds on Tuesday.

The deal is rated Aa2 by Moody’s, AA-minus by S&P and A-plus by Fitch.

In the competitive arena on Tuesday, Rhode Island will sell $158.95 million of Series A consolidated capital development loan of 2017 general obligation bonds.

The deal is rated Aa2 by Moody’s.

The Hayward Unified School District, Calif., is selling $134 million of Series 2017 election of 2014 GOs.

The deal is rated A-plus by S&P and AAA by Fitch.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar increased $35.7 million to $14.69 billion on Tuesday. The total is comprised of $4.17 billion of competitive sales and $10.52 billion of negotiated deals.