The municipal market saw the last significant issuance come and go swiftly, closing out the week on a high note.

The city of New York sold about $1.2 billion of general obligation bonds, comprised of $855 million of tax-exempt fixed-rate bonds and $350 million of taxable fixed-rate bonds.

“The NYC deal did well today,” said one New York trader. “The supply has been absorbed" as December redemptions fuel investment.

In a press release late Thursday, the city said that during the two-day retail order period for the tax-exempt bonds, it received $327 million of retail orders, of which approximately $283 million was usable.

“During the institutional order period, the City received approximately $1.2 billion of priority orders, representing 2.2x the bonds offered for sale to institutional investors. Given the strong market demand, yields were reduced for maturities in twelve different years,” the release said.

Yields were reduced by 1 basis point for the 2022 maturity, 2-3 basis points for maturities in 2025 through 2027, 1 basis point for maturities in 2028 through 2031 and 2 basis points for maturities with a 5% coupon in 2032 through 2035. Final stated yields ranged from 1.98% in 2020 to 3.95% in 2045 for a 4% coupon bond and 3.55% for a 5% coupon bond.

The tax-exempt bonds were sold via negotiated sale through the City’s underwriting syndicate, led by book-running lead manager BofA Merrill Lynch and joint lead manager Blaylock Van LLC, with Citigroup, Goldman Sachs & Co. LLC, J.P. Morgan, Jefferies, Loop Capital Markets, Ramirez & Co. Inc., RBC Capital Markets and Siebert Cisneros Shank & Co. LLC serving as co-senior managers.

The City also sold $350 million of taxable fixed-rate bonds, comprised of two subseries, via competitive bid. The first subseries of approximately $224 million of bonds maturing in 2020 through 2028 attracted eight bidders, with Citigroup winning at a true interest cost of 3.655%. The second subseries of approximately $126 million of bonds, which mature in 2029 through 2032 and are also callable at par in 2028, attracted eight bidders, with BAML winning at a true interest cost of 3.994%.

In a week with over $6 billion in new issuance, demand on Thursday was firm inside of 18 years, but lagging on the long end, while liquidity was selective, according to two New York sources.

“The run-up in our market has curbed some of the recent tax loss swapping,” a New York municipal manager observed. “Prior to this recent move [up in price], deals were getting hung up on the long end and had trouble getting sold.”

Others agreed, and said there is clear demand for securities shorter rather than longer.

“It seems that inside of 2033, there’s definitely a reasonable bid side emerging,” a New York trader said. “Out beyond 2038, it’s really a struggle,” he added, noting that arbitrage accounts and banks are still involved in selling as evidenced by a flurry of daily bid wanted lists.

“There is an overlay of customer offerings,” he said.

At the same time, he said swapping has slowed. “The high-cost items have already been swapped out of and now it’s harder to get swaps done,” the trader said.

“It feels to me that we are in a range bound trade and can’t get ourselves out of it,” the trader said. "The municipal market needs to get cheaper before there is seemingly much more interest.

“Right now we are off the lows in Treasurys that we saw over the past two weeks,” he said.

The 4% coupon structure at par has gone from being “very attractive to non-attractive,” he said.

Last week, he recalled, the market had a real struggle on the long end. “The negotiated product really did not do well and that continues to be the case for the most part,” he said.

Meanwhile, he said the percentages of municipal yield to Treasurys “are nothing special,” as they have remained a little higher than 100% on the long end.

“It doesn’t seem like the market has a positive pulse,” he explained. “I don’t see any real conviction in our market. There has been reasonable outflows, and I believe the market is just treading water.”

The City of Detroit’s Downtown Development Agency sold $318 million tax increment revenue refunding and subordinate general tax increment revenue refunding bonds on Thursday. The entire deal was insured by Assured Guaranty.

Wednesday’s bond sales

Secondary market

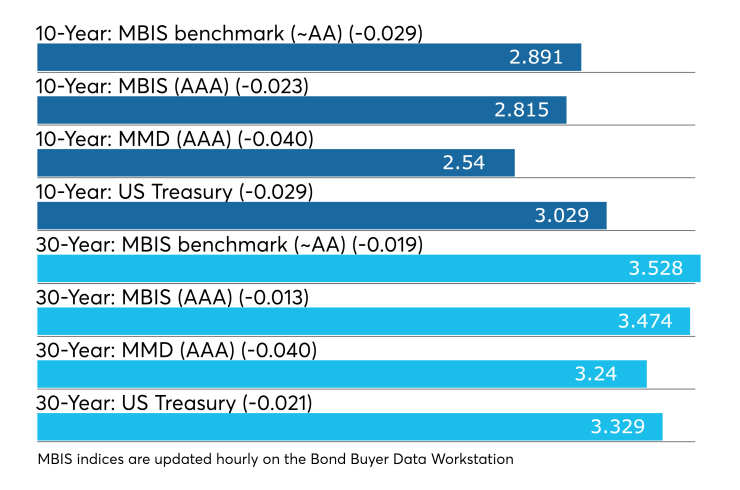

Municipal bonds were stronger on Thursday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell by as much as three basis points in all 30 maturities.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale decreasing as much as three basis points across the board.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yields on the 10-year muni general obligation and the 30-year muni maturity both four basis points lower.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 83.8% while the 30-year muni-to-Treasury ratio stood at 97.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

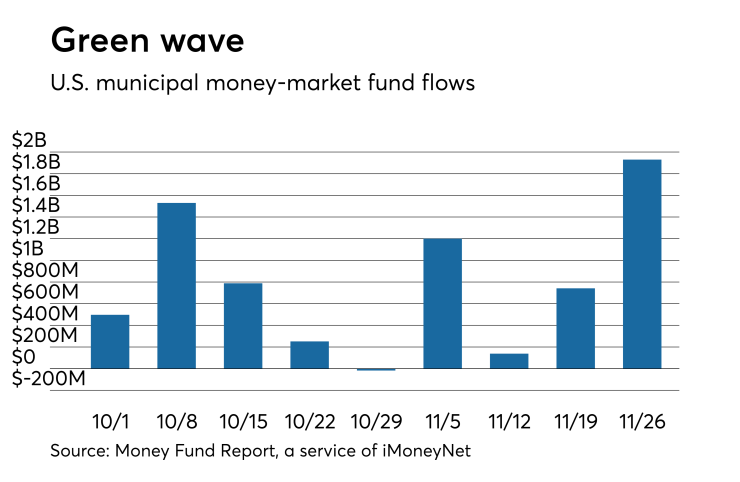

Muni money market funds sees big inflow

Tax-free municipal money market fund assets increased $1.93 billion, raising their total net assets to $138.08 billion in the week ended Nov. 26, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds rose to 1.26% from 1.23% last week.

Taxable money-fund assets decreased $580.5 million in the week ended Nov. 27, lowering total net assets to $2.761 trillion.

The average, seven-day simple yield for the 816 taxable reporting funds inched up to 1.86% from 1.85% last week.

Overall, the combined total net assets of the 1,006 reporting money funds gained $1.35 billion to $2.900 trillion in the week ended Nov. 27.

Previous session's activity

The Municipal Securities Rulemaking Board reported 51,621 trades on Wednesday on volume of $13.167 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 17.303% of the market, the Empire State taking 12.175% and the Lone Star State taking 9.212%.

Treasury auctions announced

The Treasury Department announced these auctions:

-

$26 billion 364-day bills selling on Dec. 4;

-

$36 billion 182-day bills selling on Dec. 3; and

- $39 billion 91-day bills selling on Dec. 3.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.