The municipal market will get a pause from the breakneck issuance, as things will slow down for Thanksgiving but should pick up right where they left off the first week of December.

The muni market is projected to produce about $1.4 billion of new paper for the week of Nov. 25, down from the revised total of $9.38 billion in the past week. The calendar consists of $1.12 billion of negotiated deals and $356 million of competitive sales. The last time we saw a lower issuance week was, not surprisingly, another holiday week, as the muni market got $139 million during the week of July 1.

"This will be a much-needed and deserved break for the market and all of its participants," said one New York trader. "Things have been full throttle for months now non-stop, so now everyone can step away and take a breath."

The trader noted that he hopes everyone takes the time to rest up while they can, since the week of Dec. 2 is already shaping up to be a mammoth volume week.

"There are already eight deals $100 million and up scheduled and I am sure there will be more added once we get closer," he said.

Some of the deals the trader referenced are: Nearly $2 billion from The Michigan Finance Authority, as it should sell $1.6 billion of taxable bonds and $384 million of taxable bonds for the Trinity Health Obligated Group; The Metropolitan Pier & Exposition Authority, Illinois, plans to issue $923 million of appropriation debt carrying BBB/BBB- ratings for the McCormick Place expansion; The Metropolitan Nashville Airport Authority is expected to sell $807.7 million of subordinate revenue alternative-minimum tax bonds; The Los Angeles Department of airports is planning on issuing $402 million of AMT bonds; and West Virginia will competitively sell $600 million in two separate sales.

A Texas trader said that he hopes the mini break result in clearer heads and more thoughtful minds.

"Practically anything is selling right now and I would say some of the deals we have seen go way oversubscribed, are a little suspect — whether it be the call protection, the covenants, structure or the credit," he said. "I get the feeling some people aren't thinking about potential long-term ramifications and are caught in the moment, just trying to get as many bonds as they can, while they still can."

With Thanksgiving, it is no surprise that there is a lack of deals considering it will only be a three day work week. There are only eight long-term deals and one note deal scheduled $100 million or larger in par amount, all of which are expected to hit on Tuesday.

Goldman will get the honor of pricing the largest deal of the week — Emerald Renewable Diesel LLC’s (Aaa, MIG-1/ / )$315 million of noncallable project exempt facility revenue refunding bonds — limited offering for the National Finance Authority, New Hampshire. The entire deal matures in 2049 with a mandatory tender date of 8/31/2020.

The New York Triborough Bridge and Tunnel Authority ( / /AA-) is expected to competitively sell $200 million of general revenue bonds.

In the short-term sector, Hudson County, New Jersey will competitively sell $182.121 million of bond anticipation notes.

PNC Capital Markets is scheduled to price the Arlington Higher Education Finance Corporation, Texas’ ( / /AAA) $172.635 million of revenue refunding bonds for Riverwalk Education Foundation, Inc.

Ziegler is anticipated to price the Illinois Finance Authority’s (NR/NR/NR) $150.27 million of revenue bonds for the Lutheran Life Communities Obligated Group.

RBC Capital Markets is expected to price the

Lipper sees seventh consecutive billion-dollar inflow

For 46 weeks in a row investors have poured cash into municipal bond funds, according to the latest data released by Refinitiv Lipper on Thursday.

Tax-exempt mutual funds that report weekly received $1.970 billion of inflows in the week ended Nov. 20 after inflows of $1.275 billion in the previous week. This marks the seventh week in a row and eighth time in the past 12 weeks inflows have exceeded $1 billion. It is also the largest inflow in the past 12 weeks.

Exchange-traded muni funds reported inflows of $368.233 million after inflows of $176.045 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.602 billion after inflows of $1.099 billion in the previous week.

The four-week moving average remained positive at $1.377 million, after being in the green at $1.242 billion in the previous week.

Long-term muni bond funds had inflows of $1.231 billion in the latest week after inflows of $826.817 million in the previous week. Intermediate-term funds had inflows of $358.234 million after inflows of $262.672 million in the prior week.

National funds had inflows of 1.779 billion after inflows of $$1.177 billion in the previous week. High-yield muni funds reported inflows of $470.625 million in the latest week, after inflows of $249.308 million the previous week.

Secondary market

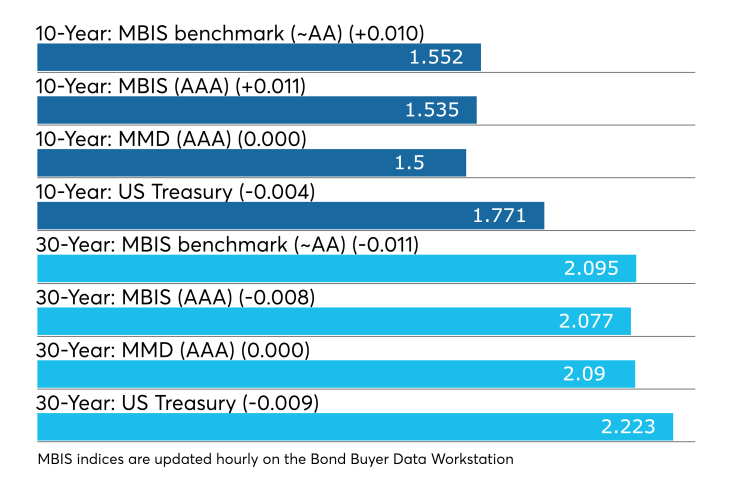

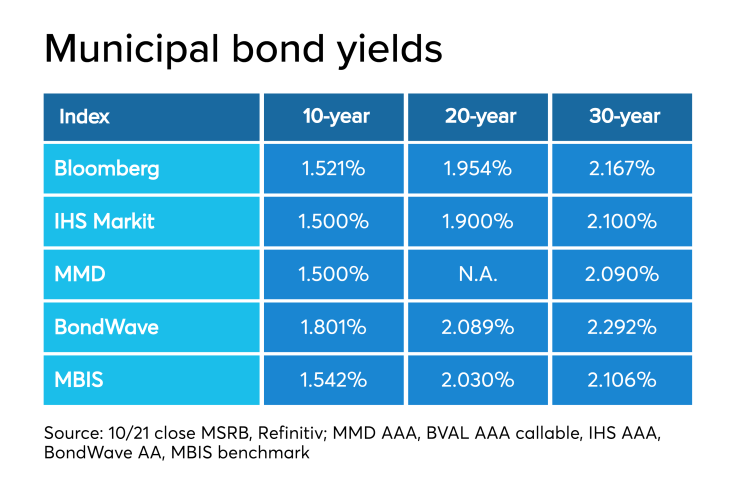

Munis were mixed on the MBIS benchmark scale, with yields rising by a basis point in the 10-year and falling one basis point in the 30-year maturity. High-grades were also mixed, with yields on MBIS AAA scale increasing by a basis point in the 10-year and decreasing by less than one basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yields on both the 10- and 30-year GOs were unchanged at 1.50% and 2.09%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 84.7% while the 30-year muni-to-Treasury ratio stood at 94.1%, according to MMD.

Stocks were trading higher as Treasuries were mixed. The Dow Jones Industrial Average was up about 0.37% in late trading as the S&P 500 Index gained around 0.18% while the Nasdaq was higher by about 0.09%.

The Treasury three-month was up and yielding 1.584%, the two-year was up and yielding 1.636%, the five-year was up and yielding 1.629%, the 10-year was lower and yielding 1.771% and the 30-year was lower and yielding 2.223%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Nov. 22 were from New York, Wisconsin and California issuers, according to

In the GO bond sector, the City of New York., 0s of 2040 traded 20 times. In the revenue bond sector, the Wisconsin Health and Educational Facilities Authority, 3.125s of 2049 traded 67 times. In the taxable bond sector, the California Health Facilities Financing Authority, 1.896s of 2021 traded 42 times.

Week's actively quoted issues

Illinois, New York and California bonds were among the most actively quoted in the week ended Nov. 22, according to IHS Markit.

On the bid side, the State of Illinois., taxable 5.1s of 2033 were quoted by 23 unique dealers. On the ask side, New York State Thruway Authority revenue, 3s of 2046 were quoted by 156 dealers. Among two-sided quotes, the State of California taxable, 7.6s of 2040 were quoted by 19 dealers.

Previous session's activity

The MSRB reported 38,131 trades Thursday on volume of $17.573 billion. The 30-day average trade summary showed on a par amount basis of $10.69 million that customers bought $5.94 million, customers sold $2.83 million and interdealer trades totaled $1.92 million.

California, Texas and New York were most traded, with the Golden State taking 14.763% of the market, the Lone Star State taking 10.553% and the Empire State taking 10.496%.

The most actively traded security was the University of Pittsburgh taxable 3.555s of 2019, which traded 17 times on volume of $41.5 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.