Municipal bonds were trading mixed at mid-session as issuers in New York and Massachusetts hit the market with several big bond deals.

Secondary market

The yield on the 10-year benchmark muni general obligation was unchanged from 1.93% on Tuesday, while the 30-year GO yield rose as much as two basis points from 2.67%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Wednesday. The yield on the two-year Treasury was flat from 1.55%, the 10-year Treasury yield gained to 2.34% from 2.30% and yield on the 30-year Treasury bond increased to 2.85% from 2.81%.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.1% compared with 84.8% on Monday, while the 30-year muni-to-Treasury ratio stood at 96.3% versus 96.5%, according to MMD.

AP-MBIS 10-year muni at 2.268%, 30-year at 2.815%

The Associated Press-MBIS 10-year municipal benchmark 5% general obligation was at 2.268% at midday, compared to the final read of 2.273% on Tuesday, according to

The AP-MBIS index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,152 trades on Tuesday on volume of $9.46 billion.

Primary market

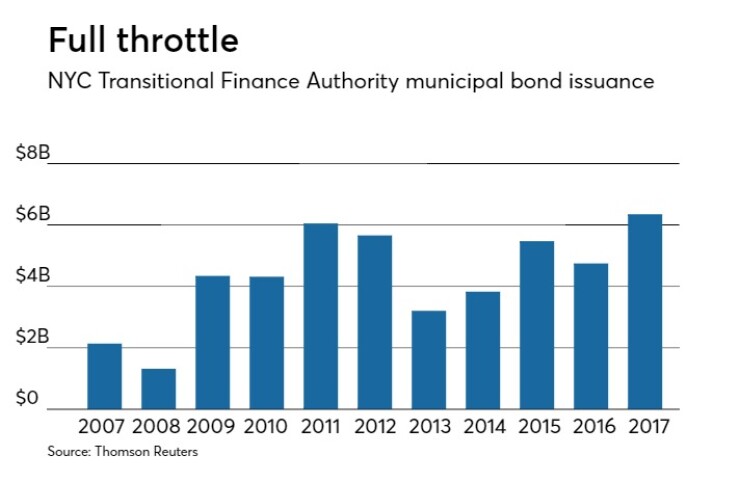

Goldman Sachs priced the New York City Transitional Finance Authority’s $850 million of Fiscal 2018 Series B Subseries B-1 future tax secured subordinate bonds for institutions after holding a two-day retail order period.

The deal was priced for institutions to yield from 1% with 3% and 5% coupons in a split 2019 maturity to 3.07% with a 4% coupon in 2038; a split 2045 maturity was priced as 3 3/8s to yield approximately 3.40% and as 5s to yield 2.93%.

In the competitive arena, the TFA auctioned $140 million of taxable Fiscal 2018 Series B Subseries B-2 future tax secured subordinate bonds. JPMorgan Securities won the bonds with a true interest cost of 2.9086%. Pricing information was not immediately available.

The deals are rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

Since 2007, the TFA has sold $47.45 billion of securities, with the least issuance occurring in 2008 when it sold $1.32 billion. With Wednesday’s sales, 2017 marks the highest yearly issuance total for the authority during the past decade with $6.35 billion.

Massachusetts competitively sold $818.125 million of general obligation bonds in three offerings on Wednesday.

Bank of America Merrill Lynch won the $300 million of Series F consolidated loan of 2017 GOs with a TIC of 3.7813%. The issue was priced as 5s to yield from 2.64% in 2037 to 2.83% in 2046.

BAML also won the $300 million of Series E consolidated loan of 2017 GOs with a TIC of 2.8724%. The issue was priced to yield from 0.96% with a 5% coupon in 2018 to 3.11% with a 3% coupon in 2036.

Jefferies won the $218.13 million of Series 2017E GO refunding bonds with a TIC of 1.8023%. The issue was priced as 5s to yield from 1.40% in 2022 to 2.03% in 2027.

The deals are rated Aa2 by Moody’s, AA by S&P and AA-plus by Fitch.

The Douglas County (Omaha) Public School District No 001, Neb., competitively sold $114.61 million of Series 2017 GOs.

Citigroup won the bonds with a TIC of 3.0102%. Pricing information was not immediately available.

The deal is rated Aa2 by Moody’s and AA-plus by S&P.

In the negotiated sector, Citigroup is set to price the San Diego Unified School District’s $500 million of Election of 2012 Series I and J GO dedicated ad valorem property tax bonds. The deal is rated Aa2 by Moody’s and AAA by Fitch. Citi is also expected to price West Virginia’s $219.7 million of Series 2017A surface transportation improvements special obligation notes. The deal is rated A2 by Moody’s and AA by S&P.

Citi received the written award on the Berks County Industrial Development Authority, Pa.’s $590.5 million of Series 2017 health system revenue bonds for the Tower Health project.

The issue was priced to yield from 1.60% with a 5% coupon in 2021 to 3.73% with as 4% coupon in 2039. A 2042 maturity was priced as 3 3/4s to yield 3.92%, a split 2047 maturity was priced as 4s to yield 3.84% and as 5s to yield 3.49% and a split 2050 maturity was priced as 4s to yield 3.90% and as 5s to yield 3.55%.

The deal is rated A3 by Moody’s and A by S&P and Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $4.36 billion to $12.46 billion on Wednesday. The total is comprised of $3.45 billion of competitive sales and $9.01 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.