Municipal bonds were unchanged at mid-session, according to traders, who are looking ahead to the next week's $6.7 billion new issue slate, which will be headlined by big offerings from Virginia and Maryland Issuers.

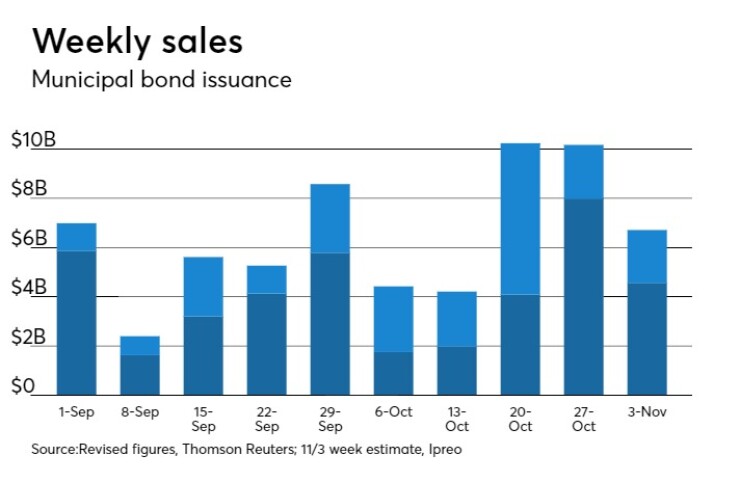

Ipreo estimates total bond volume for next week at $6.7 billion, down from a revised total of $10.19 billion this week, according to data from Thomson Reuters. The upcoming slate is composed of $4.6 billion of negotiated deals and $2.1 billion of competitive sales.

Secondary market

The yield on the 10-year benchmark muni general obligation was flat from 2.02% on Thursday, while the 30-year GO yield was unchanged from 2.84%, according to a read of Municipal Market Data`s triple-A scale.

U.S. Treasuries were stronger on Friday. The yield on the two-year Treasury declined to 1.59% from 1.63% on Thursday, the 10-year Treasury yield dropped to 2.42% from 2.45% and yield on the 30-year Treasury bond decreased to 2.94% from 2.96%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 82.3% compared with 82.1% on Wednesday, while the 30-year muni-to-Treasury ratio stood at 95.9% versus 95.6%, according to MMD.

AP-MBIS 10-year muni at 2.341%, 30-year at 2.908%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale showed weakness on Friday.

In midday trading, the 10-year muni benchmark yield rose to 2.341% from the final read of 2.332% on Thursday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session`s activity

The Municipal Securities Rulemaking Board reported 37,497 trades on Thursday on volume of $15.35 billion.

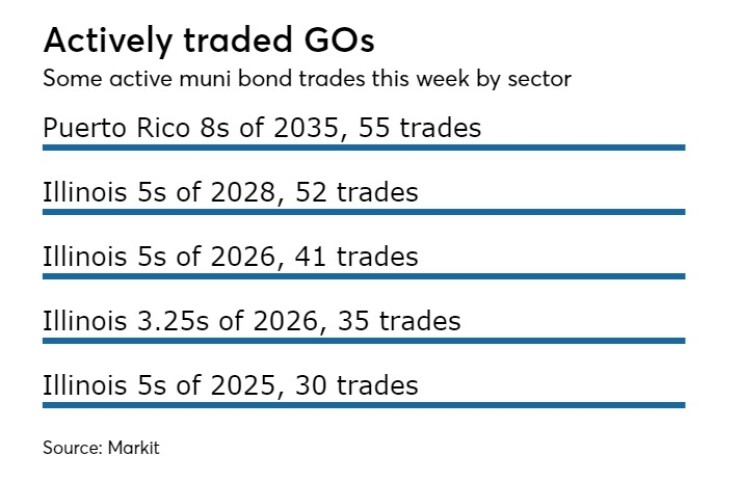

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Oct. 27 were from California and New York issuers, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 were traded 55 times. In the revenue bond sector, the Philadelphia Hospitals and Higher Education Facilities Authority 5s of 2034 were traded 38 times. And in the taxable bond sector, the Washington Health Care Facilities Authority 4.2s of 2047 were traded 28 times.

Week's actively quoted issues

Puerto Rico and California names were among the most actively quoted bonds in the week ended Oct. 27, according to Markit.

On the bid side, Puerto Rico Commonwealth GO 8s of 2035 were quoted by 71 unique dealers. On the ask side, New York City Transitional Facilities Authority 4s of 2042 were quoted by 257 dealers. And among two-sided quotes, California 7.55s of 2039 were quoted by 26 unique dealers.

Week’s primary market

On Friday, Goldman Sachs priced the Tennessee Energy Acquisition Corp.’s $680.29 million of Series 2017A gas project revenue bonds.

The issue was priced as 4s to yield 1.48% in 2019, 1.62% in 2020, 1.77% in 2021, 1.97% in 2022 and 2.16% in 2023.

The deal is rated A3 by Moody’s Investors Service and A by Fitch Ratings.

Earlier in the week a deluge of bonds came to market.

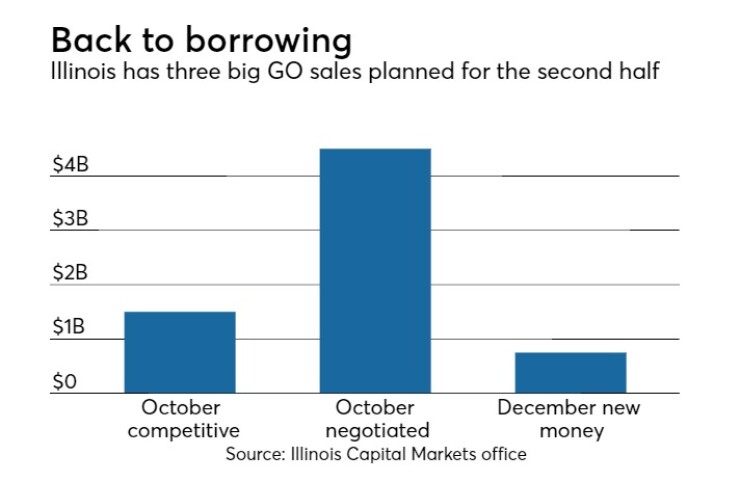

Barclays Capital priced Illinois $4.5 billion Series of November 2017D GOs. The deal priced was to yield 2.53% in 2020, 2.85% in 2021, 3.15% in 2022, 3.32% in 2023, 3.49% in 2024, 3.62% and 2.87% in a split 2025 maturity, 3.68% in both halves of a split 2026 maturity, 3.74% in 2027 and 3.77% in 2028.

The bonds are rated Baa3 by Moody’s, BBB-minus by S&P Global Ratings and BBB by Fitch, except for half of the 2025 split maturity which is insured by Build America Mutual.

Goldman Sachs priced Gainesville, Fla.’s $415.92 million of Series 2017A utility system revenue bonds. The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Jefferies priced Wisconsin’s $382.65 million of general obligation refunding bonds of 2017, Series 2. The deal is rated Aa1 by Moody’s, AA by S&P, and AA-plus by Fitch and Kroll Bond Ratings Agency.

RBC Capital Markets priced the Utility Debt Securitization Authority of New York’s $369.47 million of Series 2017 restructuring bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

Wells Fargo Securities priced the Washington Health Care Facilities Authority’s $324.81 million of Series 2017A taxable and Series 2017B tax-exempt revenue bonds for the MultiCare Health System. The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

JPMorgan Securities priced the Missouri Health and Educational Facilities Authority’s $284.7 million of Series 2017C health facilities revenue bonds for Mercy Health. The deal is rated Aa3 by Moody’s and AA-minus by S&P.

Morgan Stanley priced the Metropolitan Government of Nashville and Davidson County, Tenn.’s $245.38 million of Series 2017B water and sewer revenue bonds and Series 2017A water and sewer revenue green bonds. The deal is rated Aa3 by Moody’s and AA by S&P.

Morgan Stanley priced the Philadelphia Hospitals and Higher Education Facilities Authority’s $236.94 million of hospital revenue bonds for the Temple University Health System Obligated Group. The deal is rated Ba1 by Moody’s, BBB-minus by S&P and BB-plus by Fitch.

Raymond James & Associates priced the California State Public Works Board’s $189.04 million of Series 2017 F, G and H lease revenue refunding bonds. The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

Ramirez priced the New York State Housing Finance Agency’s $115.22 million of Series 2017K affordable housing climate bond certified green bonds. The deal is rated Aa2 by Moody’s.

In the competitive arena, the Washington Suburban Sanitary District, Md., sold $712.53 million of consolidated public improvement bonds in two separate sales.

Citigroup won the $493.77 million of consolidated public improvement bonds of 2017 with a true interest cost of 3.2764%.Goldman Sachs won the $218.76 million of consolidated public improvement refunding bonds of 2017 with a TIC of 2.4543%. The Washtub deals are rated triple-A by Moody’s, S&P and Fitch.

The Santa Clara Unified School District, Calif., competitively sold $392.76 million of general obligation bonds in two separate sales. Bank of America Merrill Lynch won the $232.3 million of Election of 2014 GOs with a TIC of 3.2604%. BAML also won the $160.46 million of Election of 2014 refunding GOs with a TIC of 2.9724%. Both deals are rated Aaa by Moody’s and AA by S&P.

Next week, Bank of America Merrill Lynch is set to price the Virginia Small Business Financing Authority’s $737 million issue while Montgomery County, Md., sells $606 million of bonds in three separate competitive deals.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $586.3 million to $9.59 billion on Friday. The total is comprised of $4.28 billion of competitive sales and $5.31 billion of negotiated deals.

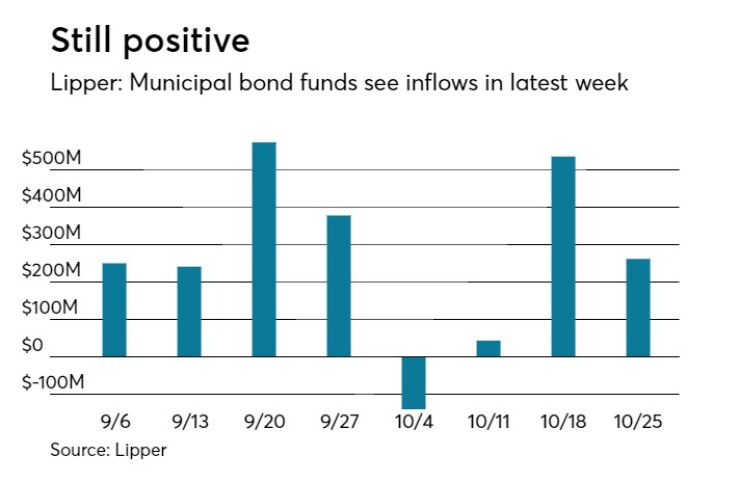

Lipper: Muni bond funds see inflows

Investors in municipal bond funds put cash into the funds in the latest week, according to Lipper data released late Thursday.

The weekly reporters saw $262.006 million of inflows in the week of Oct. 25, after inflows of $536.158 million in the previous week.

Exchange traded funds reported inflows of $151.373 million, after inflows of $184.768 million in the previous week. Ex-EFTs, muni funds saw $110.633 million of inflows, after outflows of $351.390 million in the previous week.

The four-week moving average was positive at $175.351 million, after being in the green at $204.402 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $416.137 million in the latest week after inflows of $424.977 million in the previous week. Intermediate-term funds had inflows of $527.272 million after inflows of $164.276 million in the prior week.

National funds had outflows of $41.524 million after inflows of $547.592 million in the previous week.

High-yield muni funds reported inflows of $175.779 million in the latest week, after inflows of $222.947 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.