Municipal bond buyers will see a slightly smaller slate of sales next week as supply dips from this week’s new issue calendar.

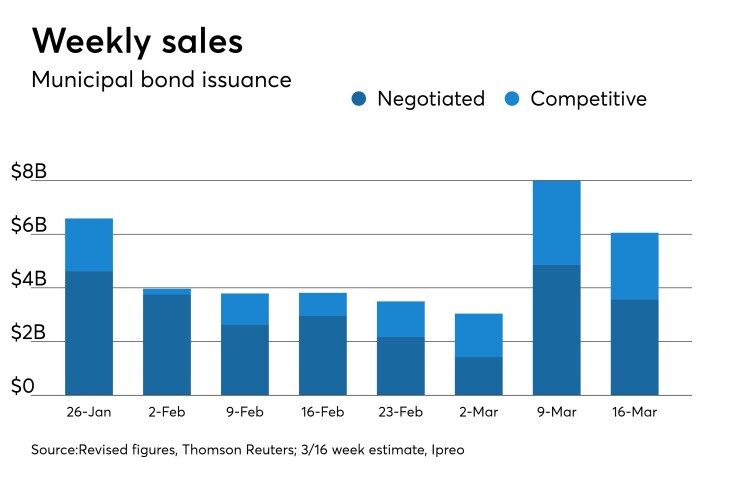

Ipreo estimates next week’s volume at $6.05 billion, which is down from this week’s revised total of $7.99 billion, according to updated data from Thomson Reuters.

Next week’s calendar is composed of $3.57 billion of negotiated deals and $2.49 billion of competitive sales. Average weekly volume so far this year has been around $4 billion; in 2017, average weekly volume was over $6 billion.

Some buyside analysts said volume and tax reform are still plaguing investors.

“There’s not enough supply in specialty states in general and I think smart money started to smell the change in SALT last year and you can tell by the performance of bonds in high tax states,” said John Mousseau, managing director of Cumberland Advisors.

“The removal of deductibility for taxpayers in the top marginal rate more than offsets the drop in the marginal federal tax rate, so that muni taxable equivalent yields for highest rate taxpayers is higher, not lower,” he said.

The biggest negotiated deal of the upcoming week will be the New York City Transitional Finance Authority’s $1.07 billion of tax-exempt and taxable building aid revenue bonds. While in the competitive sector, the New York State Dormitory Authority plans to sell about $1.33 billion on Tuesday, broken into five deals.

The $1 billion of TFA tax-exempt fixed rate bonds is set to be priced on Wednesday by an underwriting syndicate led by book-running senior manager Jefferies, with Bank of America Merrill Lynch and Ramirez & Co. serving as co-senior managers. There will be a two-day retail order period starting on Monday.

The TFA also intends to competitively sell $73 million of taxable fixed-rate bonds on Wednesday.

Proceeds from the BARB sales will be used to fund education capital projects and refund outstanding bonds.

Bond Buyer 30-day visible supply at $9.09B

The Bond Buyer's 30-day visible supply calendar increased $380.8 million to $9.09 billion on Friday. The total is comprised of $4.34 billion of competitive sales and $4.75 billion of negotiated deals.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended March 9 were from California and Oklahoma issuers, according to

In the GO bond sector, the California 3.625s of 2047 traded 145 times. In the revenue bond sector, the Oklahoma Development Financing Authority 5.5s of 2057 traded 64 times. And in the taxable bond sector, the Oklahoma DFA 5.45s of 2028 traded 70 times.

Week's actively quoted issues

Puerto Rico and California names were among the most actively quoted bonds in the week ended March 9, according to Markit.

On the bid side, the Puerto Rico Highway and Transportation Authority revenue 5s of 2032 were quoted by 49 unique dealers. On the ask side, the California taxable 7.55s of 2039 were quoted by 87 dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 27 unique dealers.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,125 trades on Thursday on volume of $11.65 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 16.58% of the market, the Lone Star State taking 11.475% and the Empire State taking 9.929%.

Lipper: Muni bond funds saw inflows

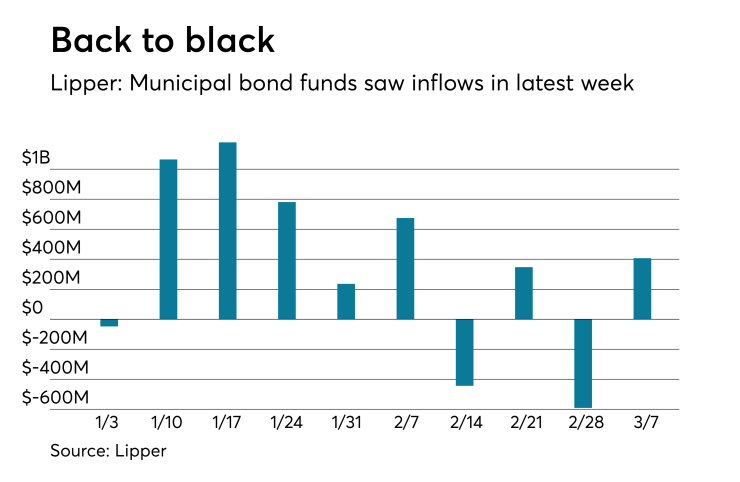

Investors in municipal bond funds reversed course and put cash back into the funds in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $406.753 million of inflows in the week of March 7, after outflows of $590.943 million in the previous week.

Exchange traded funds reported outflows of $97.946 million, after inflows of $1.276 million in the previous week. Ex-ETFs, muni funds saw $504.699 million of inflows, after outflows of $592.219 million in the previous week.

The four-week moving average remained negative at -$70.049 million, after being in the red at -$3.010 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $218.275 million in the latest week after outflows of $492.084 million in the previous week. Intermediate-term funds had inflows of $201.010 million after inflows of $29.617 million in the prior week.

National funds had inflows of $383.340 million after outflows of $373.190 million in the previous week. High-yield muni funds reported inflows of $127.660 million in the latest week, after outflows of $221.998 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.