The municipal bond market is taking a breather on Friday since no major bond deals are scheduled to be priced in the primary.

Traders will be looking ahead to next week’s calendar which features big offerings from California, Kentucky and Wisconsin.

Secondary market

U.S. Treasuries were weaker on Friday. The yield on the two-year Treasury rose to 1.27% from 1.25% on Thursday, while the 10-year Treasury yield gained to 2.31% from 2.29%, and the yield on the 30-year Treasury bond increased to 2.98% from 2.96%.

Municipal bonds finished steady on Thursday. The yield on the 10-year benchmark muni general obligation was unchanged from 2.13% on Wednesday, while the 30-year GO yield was steady from 3.01%, according to the final read of Municipal Market Data's triple-A scale.

On Thursday, the 10-year muni to Treasury ratio was calculated at 92.8%, compared with 92.2% on Wednesday, while the 30-year muni to Treasury ratio stood at 101.4%, versus 101.3%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 42,314 trades on Thursday on volume of $12.88 billion.

Week's actively traded issues

Some of the most actively traded issues by type in the week ended April 28 were from Puerto Rico and California and Pennsylvania, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 were traded 31 times. In the revenue bond sector, the California Health Facilities Financing Authority 5s of 2027 were traded 83 times. And in the taxable bond sector, the California 2.367s of 2022 were traded 117 times.

Week's actively quoted issues

Puerto Rico, Illinois and California names were among the most actively quoted bonds in the week ended April 28, according to Markit.

On the bid side, the Puerto Rico Commonwealth GO 5s of 2041 were quoted by 49 unique dealers. On the ask side, the Illinois 6.63s of 2035 were quoted by 113 unique dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 22 unique dealers.

Week’s primary market

Goldman Sachs priced and repriced the California Health Facilities Financing Authority’s $2.12 billion of Series 2017A revenue bonds for Kaiser Permanente.

The deal consisted of Subseries 2017A-1 green bonds, Subseries 2017A-2 fixed-rate bonds, and Series 2017B, C and D mandatory put bonds.

The deal is rated AA-minus by S&P Global Ratings and A-plus by Fitch Ratings.

Wells Fargo Securities priced the Port Authority of New York and New Jersey’s $554.28 million of tax-exempt consolidated bonds, consisting of 200th Series bonds not subject to the alternative minimum tax, 202nd Series bonds subject to the AMT and 203rd Series AMT bonds.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P and Fitch.

Bank of America Merrill Lynch priced the Los Angeles Department of Water and Power’s $533.78 million of Series 2017A water system revenue bonds. The deal is rated Aa2 by Moody’s, AA-plus by S&P and AA by Fitch.

Piper Jaffray priced the Beaverton School District No. 48J, Ore.’s $282.898 million of bonds. Consisting of Series 2017B DIBs, Series 2017C CIBs and Series 2017D convertible DIBs. The deal is backed by the Oregon School Bond Guarantee Program and is rated Aa1 by Moody’s and AA-plus by S&P.

Siebert Cisneros Shank priced Atlanta’s $226.82 million of Series 2017A water and wastewater revenue refunding bonds. The deal is rated Aa2 by Moody’s, AA-

Wells Fargo Securities priced the town of Mt. Pleasant, S.C.’s $111 million of Series 2017 waterworks and sewer system revenue bonds. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Wells Fargo priced the Minnesota Higher Education Facilities Authority’s $124.91 million of Series 2017 revenue and refunding bonds for Carleton College. The deal is rated Aa2 by Moody’s.

In the competitive arena, the Maryland Department of Transportation sold $265 million of Series 2017 consolidated transportation bonds, which were won by Bank of America Merrill Lynch with a true interest cost of 2.64%. The deal is rated AA1 by Moody’s, AAA by S&P and AA-plus by Fitch.

Rhode Island sold $158.95 million of general obligation bonds. BAML won the bonds with a TIC of 2.94%. The deal is rated Aa2 by Moody’s and AA by S&P and Fitch.

The Metropolitan Council of the Minneapolis-St. Paul, Minn., area competitively sold two separate issues totaling $145 million. The $105 million of Series 2016C GO wastewater revenue bonds were won by BAML with a TIC of 2.87%. The $40 million of Series 2017B GO transit bonds were won by Robert W. Baird & Co. with a TIC of 1.78%. Both deals are rated triple-A by Moody’s and S&P.

The Hayward Unified School District, Calif., competitively sold $134 million of Series 2017 election of 2014 GOs. BAML won the bonds with a TIC of 3.71%. The deal is rated A-plus by S&P and AAA by Fitch. The deal was insured by Assured Guaranty Municipal.

The Delaware Transportation Authority competitively sold $103.86 million of Series 2017 transportation system revenue bonds, which were won by BAML with a TIC of 2.63%. The deal is rated Aa2 by Moody’s and AA-plus by S&P.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar increased $1.94 billion to $12.33 billion on Friday. The total is comprised of $3.24 billion of competitive sales and $9.09 billion of negotiated deals.

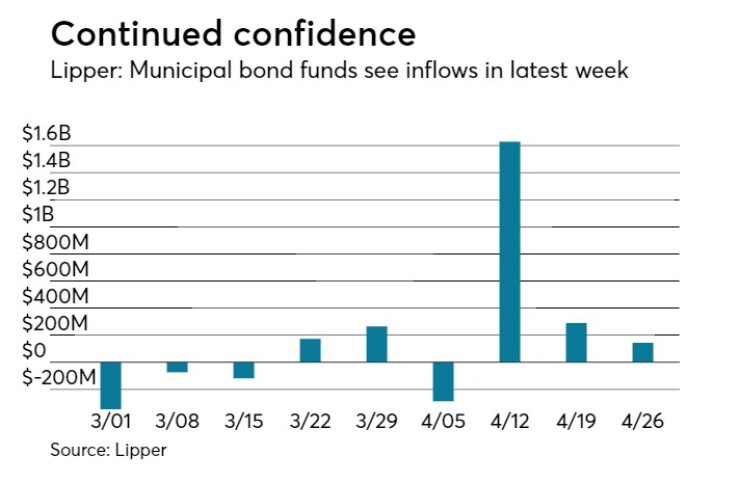

Lipper: Muni bond funds see inflows

Investors in municipal bond funds continued to put cash back into the funds in the latest week, according to Lipper data released late on Thursday.

The weekly reporters saw $144.519 million of inflows in the week ended April 26, after inflows of $290.227 million in the previous week.

The four-week moving average was still in the green at positive $443.814 million, after being positive at $473.945 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had inflows, gaining $291.183 million in the latest week after rising $382.696 million in the previous week. Intermediate-term funds had outflows of $2.015 million after inflows of $129.744 million in the prior week.

National funds had inflows of $195.710 million after inflows of $317.247 million in the previous week. High-yield muni funds reported outflows of $129.979 million in the latest reporting week, after inflows of $227.034 million the previous week.

Exchange traded funds saw outflows of $72.246 million, after inflows of $96.644 million in the previous week.