Municipal bond traders are returning to work on Monday to face a moderate new issue calendar, which features big offerings from California, Kentucky and Wisconsin.

The upcoming slate totals $7.02 billion and consists of $5.96 billion of negotiated deals and $1.06 billion of competitive sales.

Secondary market

U.S. Treasuries were narrowly mixed on Monday. The yield on the two-year Treasury was unchanged from 1.27% on Friday, while the 10-year Treasury yield rose to 2.29% from 2.28%, and the yield on the 30-year Treasury bond increased to 2.97% from 2.96%.

Top-shelf municipal bonds were weaker on Friday. The yield on the 10-year benchmark muni general obligation rose one basis point to 2.14% from 2.13% on Thursday, while the 30-year GO yield increased one basis point to 3.02% from 3.01%, according to the final read of Municipal Market Data's triple-A scale.

On Friday, the 10-year muni to Treasury ratio was calculated at 93.9%, compared with 92.8% on Thursday, while the 30-year muni to Treasury ratio stood at 102.3%, versus 101.4%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 34,178 trades on Friday on volume of $8.55 billion.

Prior week's actively traded issues

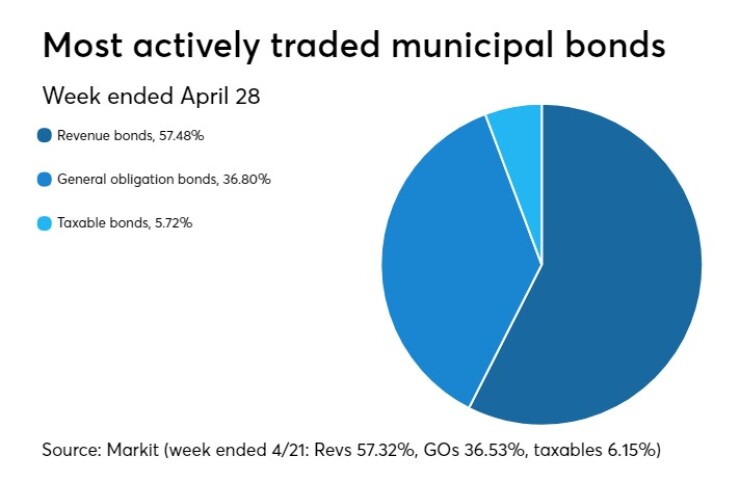

Revenue bonds comprised 57.48% of new issuance in the week ended April 28, up from 57.32% in the previous week, according to

General obligation bonds comprised 36.80% of total issuance, up from 36.53%, while taxable bonds made up 5.72%, down from 6.15%.

Some of the most actively traded issues by type were from Puerto Rico and California and Pennsylvania.

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 were traded 31 times. In the revenue bond sector, the California Health Facilities Financing Authority 5s of 2027 were traded 83 times. And in the taxable bond sector, the California 2.367s of 2022 were traded 117 times.

Previous week's top underwriters

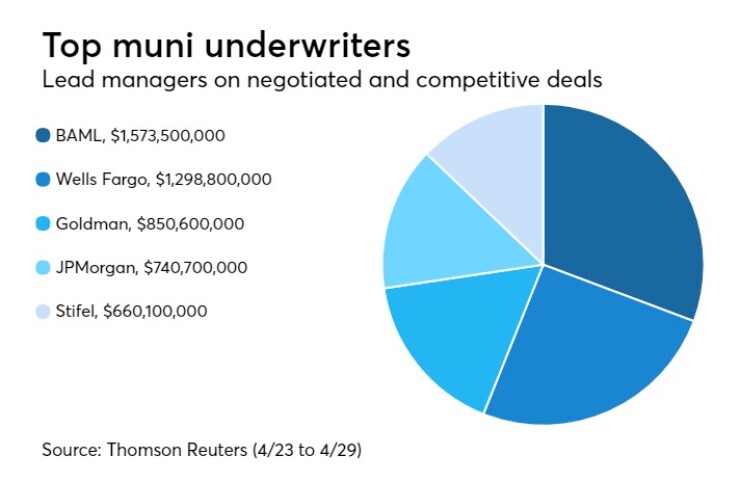

The top negotiated and competitive underwriters of last week included Bank of America Merrill Lynch, Wells Fargo Securities, Goldman Sachs, JPMorgan Securities, and Stifel, according to Thomson Reuters data.

In the week of April 23 to April 29, BAML underwrote $1.6 billion, Wells Fargo $1.3 billion, Goldman $850.6 million, JPMorgan $740.7 million and Stifel $660.1 million.

Primary market

Action will get underway on Tuesday with the pricing of several large deals.

The state of Wisconsin will be coming to market with $688.31 million of tax-exempt and taxable bonds in two separate sales.

Wells Fargo Securities is set to price the state’s $403.11 million of Series 2017C general fund annual appropriation refunding taxable bonds on Tuesday.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

JPMorgan Securities is set to price the state’s $285.21 million of Series 2017-1 transportation revenue bonds on Tuesday.

This deal is rated Aa2 by Moody’s, AA-plus by S&P and Fitch and triple-A by Kroll Bond Rating Agency.

Bank of America Merrill Lynch is slated to price the Kentucky Economic Development Finance Authority’s $495 million of Series 2017 A and B hospital revenue refunding bonds for Owensboro Health on Tuesday.

The deal is rated Baa3 by Moody’s and BBB by Fitch.

Raymond James is expected to price the Richardson Independent School District, Texas’ $207.43 million of unlimited tax school building bonds on Tuesday.

The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and S&P.

Citigroup is set to price Texas’ Austin Convention Enterprises Inc.’s $200 million of Series 2017 A and B convention center hotel revenue refunding bonds, consisting of first and second tier tranches, on Tuesday.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar increased $667.5 million to $13 billion on Monday. The total is comprised of $3.62 billion of competitive sales and $9.38 billion of negotiated deals.