As tax season gets set to begin, people who work on their filings will come to realize what municipal bonds bring to the table -- if they haven't already, says Dan Heckman, Senior Fixed-Income Strategist at U.S. Bank Wealth Management.

"Demand shouldn't decrease, there is a strong motivation by taxpayers and high-income individual to reassess their allocations,” he said, adding that the market could use more volume, as the supply drought that began last year persists.

"There are lots of bonds being called and matured, a trend that will continue and only make the supply/demand imbalance even worse," he said. "We have been hoping for a serious pick-up in supply and although it may happen, we haven't seen it yet."

Heckman said that supply could pick up if spreads and yields get tight and low.

"I think in this current environment, investors need to be patient," he said. "Hoping for issuance is not a plan. You gotta do research when new issues come and try to pick your spots to put money to work -- don't continue to wait on the sidelines."

He added that he is advising investors to not go down in credit quality and don't overpay for anything.

"If anything, move up on the on the credit quality ladder and find value," Heckman said. "You also have to look at the yield curve, extend the duration and don't stay too short."

And in a plot twist on two of the week’s largest deals will help keep spreads historically tight, Peter Delahunt, Managing Director of Municipals at Raymond James & Associates, predicted.

As current refundings, the $2.3 billion California general obligation sale and New York City’s $914.24 million GO sale will have bonds called away from existing holders rather than having them pre-refunded, he noted on Friday.

“Historically, we have seen larger multi-billion dollar California GO deals lead to wider spreads, which revert back in as the outstanding supply dissipates over the following weeks,” he said.

The new California deal will see “embedded demand” among the mostly mutual fund holders that will need to replace their called bonds, Delahunt pointed out. That should “keep spreads more contained than typical for a pricing of this size,” he said.

Meanwhile, he said the NYC pricing is weighted to the shorter and intermediate part of the curve “where much of the demand has currently migrated” and will attract inherent demand due to its specialty state status.

“While this part of the curve has certainly become quite rich relative to taxable comparisons, New York paper continues to be attractive versus taxable equivalents due to higher tax rates and the elimination of SALT deductions,” Delahunt said. “Again, this is a current refunding, where bonds will be called away and replacement demand should surface.”

Anthony Valeri, Portfolio Manager at Zions Bancorp, said the upcoming supply next week could be a catalyst to ease expensive valuations -- especially in the short and intermediate parts of the curve -- or could be met with obstacles.

Next week’s slate is coming at a challenging time, he said on Friday, as the 10-year triple-A municipal-to-Treasury yield ratio has dropped to a multi-year low of 79% and the average 10-year triple-A muni yield has declined to 2.17% -- a 13-month low.

While municipals have outperformed their Treasury counterparts so far in 2019 and have shown good resilience in the last few days to modest global government bond weakness, the combination of more expensive valuations relative to Treasuries and lower absolute yields may deter some investors, he said.

But, since the increase in supply isn’t that onerous and the bulk of the new-issue volume next week hails from California and New York -- where investor demand is particularly strong -- Valeri believes the deals will get done.

“The cap on SALT deductions hits investors particularly hard in each [state] and municipals are one of the only ways to truly limit tax exposure,” he said.

He noted that both California and New York are expensive compared to national averages because of the hearty investor demand “and that’s not likely to change,” he said.

State level debt obligations trade at yield levels that are in line, or slightly below, comparable triple-A national levels, he noted.

“While valuations, as measured by muni/Treasury ratios reflect expensive valuations for 10-year debt, they are not egregious,” Valeri said. “The 30-year triple-A municipal-Treasury ratios reflect a fair valuation compared to the 10-year.”

Overall going forward, he predicted that any weakness from supply is likely to be mild and possibly short-lived.

“The broader backdrop –- an economic slowdown, a Fed on hold, and inflation likely to stay low –- should remain supportive of municipal bonds even if early-year 2019 strength is unlikely to be repeated,” he said.

Others believes that the week’s larger deals will have to be priced at a concession to clear the market, as relative value will fuel demand in states like California and New York, noted Michael Pietronico, Chief Executive Officer at Miller Tabak Asset Management.

Both issuers, he said, are already widely held in both retail and institutional accounts, he said.

“Given the strong demand of late we sense that local credits in both New York and California will hold their value on a relative basis as scarcity of municipal bond supply continues to haunt these states overall,” Pietronico added.

“Our sense is that the overbought nature of the very short end of the market will bring extra money into the longer intermediate portion of the yield curve,” he added.

Pietronico believes 3% coupons at a slight discount around 15 years in both California and New York make sense to consider given both the absolute yield and recent spread to 5% coupons.

Primary market

Municipal bond buyers are looking forward to more supply. IHS Markit Ipreo forecasts weekly bond volume will increase to $5.84 billion from a revised total of $4.71 billion in the prior week, according to updated data from Refinitiv. The calendar is composed of $4.58 billion of negotiated deals and $1.27 billion of competitive sales.

Topping the slate is the $2.3 billion general obligation bond deal from California (Aa3/AA-/AA-).

The Golden State offering consists of $2.05 billion of various purpose refunding GOs and $250 million of various purpose new-money GOs.

Citigroup and BofA Securities are lead managers on the deal, with PRAG as the financial advisor and Orrick as bond counsel.

Also on tap is a $914.245 million GO offering from New York City (Aa1/AA/AA).

On Friday, Moody's Investors Service upgraded the city’s GO to Aa1 from Aa2 in an action that affects about $38 billion of outstanding GO debt.

“The upgrade to the general obligation rating reflects continued strengthening and diversification of New York City's economy, reducing its reliance on volatile financial services,” Moody’s said. “The upgrade also reflects the city's ongoing strong financial management, including stronger reserves that position it better to withstand an economic downturn. Budgetary and financial management are strong and frequent updates to multi-year financial plans provide the city a transparent view of future budget pressures New York City's revenue base is large and diverse.”

Siebert Cisneros Shank is set to price the city’s Fiscal 2019 Series E and F tax-exempt bonds on Wednesday after a two-day retail order period. BofA Securities, Citigroup, Goldman Sachs, JPMorgan Securities, Jefferies, Loop Capital Markets, Ramirez & Co. and RBC Capital Markets are co-senior managers.

On Wednesday, the city will competitively sell $71.89 million of taxable Fiscal 2019 Series F, Subseries F-2 GOs. The financial advisors are Public Resources Advisory Group and PFM Financial Advisors. The bond counsel are Norton Rose and Bryant Rabbino.

Also in the competitive market, Boston (Aaa/AAA/NR) is selling $145.13 million of GOs on Tuesday.

Proceeds will be used to finance the city’s various capital projects.

The financial advisor is PFM Financial Advisors. The bond counsel is Locke Lord.

Bond Buyer 30-day visible supply at $7.57B

The supply calendar increased $2.83 billion to $7.57 billion for Friday. The total is composed of $2.73 billion of competitive sales and $4.84 billion of negotiated deals.

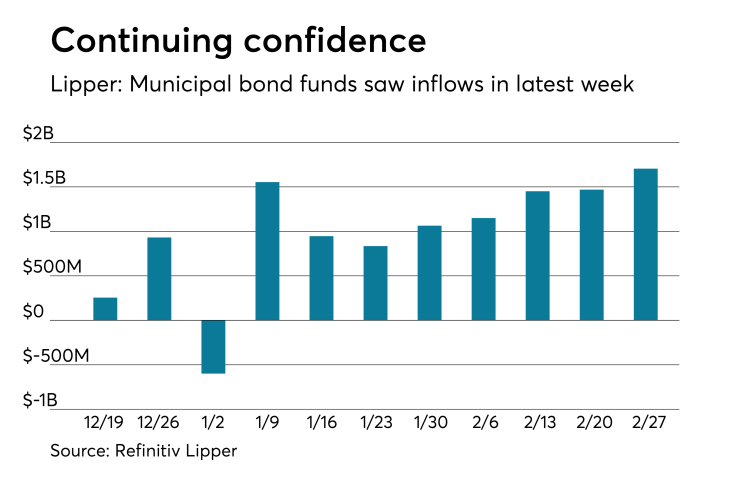

Lipper: Muni bond funds see inflows

Investors in municipal bond funds kept their confidence and put cash into them in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $1.705 billion of inflows in the week ended Feb. 27 after inflows of $1.469 billion in the previous week.

Exchange traded funds reported inflows of $144.400 million, after inflows of $95.270 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.560 billion after inflows of $1.374 billion in the previous week.

The four-week moving average remained positive at $1.444 billion, after being in the green at $1.283 billion in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $1.110 million in the latest week after inflows of $919.663 million in the previous week. Intermediate-term funds had inflows of $469.295 million after inflows of $377.716 million in the prior week.

National funds had inflows of $1.515 billion after inflows of $1.291 billion in the previous week. High-yield muni funds reported inflows of $472.731 million in the latest week, after inflows of $397.226 million the previous week.

Secondary market

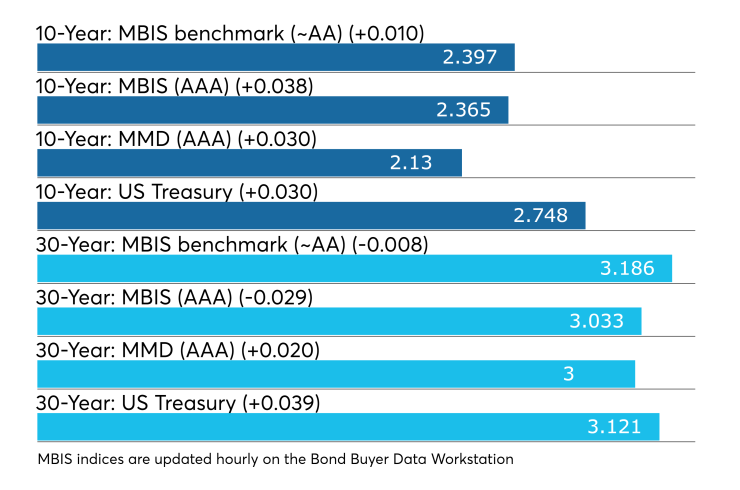

Municipal bonds were mixed Friday, according to the MBIS benchmark scale, with muni yields falling as much as one basis point in the two- to seven-year, nine-year, 13- to 15-year, 17-year, 21-year, 25-year and 27- to 30-year maturities, rising as much as one basis in the 10- and 11-year, 18- to 20-year and 22- to 24-year maturities and remaining unchanged in the one-year, eight-year and 12-year maturities.

High-grade munis were mostly weaker, with yields falling less than one basis point in the three and four-year maturities, rising as much as two basis points in the one- and two-year, five-year and seven- to 30-year maturities and remaining unchanged in the six-year maturity.

Investment-grade municipals were weaker on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year and 30-year muni rising two basis points.

Treasury bonds were weaker as stock prices traded little changed.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 77.2% while the 30-year muni-to-Treasury ratio stood at 96.4%, according to MMD.

Previous session's activity

The MSRB reported 42,385 trades on Thursday on $12.34 billion of volume.

California, Texas and New York were most traded, with the Golden State taking 13.796% of the market, the Lone Star State taking 11.042% and the Empire State taking 10.547%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended March 1 were from Puerto Rico issuers, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 5 times. In the revenue bond sector, the COFINA 5s of 2058 traded 104 times. In the taxable bond sector, the COFINA 5s of 2058 traded 31 times.

Week's actively quoted issues

Puerto Rico and Nevada names were among the most actively quoted bonds in the week ended March 1, according to IHS Markit.

On the bid side, the COFINA revenue 5s of 2058 were quoted by 328 unique dealers. On the ask side, the Clark County, Nev., GO 5s of 2048 were quoted by 103 dealers. Among two-sided quotes, the COFINA revenue 5s of 2058 were quoted by 58 dealers.

Robust demand ahead

Overall steady municipal performance and strong demand -- especially for the 10-year slope of the yield curve -- are demonstrating investors’ ongoing preference for the tax-exempt market, Jeffrey Lipton, head of municipal research and strategy and municipal capital markets at Oppenheimer & Co. Inc. said in a new report.

In fact, the demand component, he noted, could see an increase in the midst of individual income tax season and due to other market and policy factors.

“High net worth investors will be even more compelled to allocate cash to the municipal asset class given expanded tax liabilities for many filers -- despite the fact that the Tax Cuts and Jobs Act lowered the top marginal tax rate for individuals,” Lipton wrote in his Feb. 26 weekly “Basis Points” report.

“Most high net worth muni investors pay their federal taxes at a sub-30% tax rate,” he said.

Heightened demand could surface, he said, as a result of a less-threatening legislative environment and a more “market-friendly” Federal Reserve Board as investors are demonstrating a willingness to move further out along the yield curve, Lipton observed.

“The short-end had become rich as concerns over monetary policy and thinner participation from certain institutional buyers on the longer end tempered duration psychology and kept the muni yield curve steep relative to the Treasury curve -- which continues to remain flat,” he explained.

The municipal 10- and 30-year yield curve presently stands at 89 basis points, versus 37 basis points for the comparable U.S. Treasury curve, Lipton pointed out.

He said 10-year munis “remain relatively expensive” with the benchmark ratio at 79%, and the 30-year ratio just under parity.

Lipton noted that he expects the 10-year range to hold its current demand and not cheapen much in the current environment.

“We suspect that if interest for longer-dated munis accelerates -- particularly from institutional buyers -- then we could see 30-year tax-exempts becoming somewhat more expensive relative to same maturity U.S. Treasuries,” he wrote.

Due to the recent steepening of the muni yield curve, Lipton said the firm is finding value from 17 to 21 year maturities -- extending its previous target range by a few years.

Using the MMD benchmark triple-A yield curve, 88% of the long-bond yield can be captured by purchasing the 17-year maturity, while 95% can be attained by investing in the 21-year maturity, he noted.

In other strategic moves, Lipton said the firm recommends high net worth investors trade up in credit quality where appropriate -- owning a balance of general obligation and revenue bonds with dedicated revenue streams -- to maintain proper diversification that will help insulate portfolios from the “vagaries of economic, political and market behavior.”

“The positive benefits of the Tax Cuts and Jobs Act along with other fiscal stimulus measures have begun to taper, yet we do think that Fed policy will help to keep the recovery on track for a while longer,” Lipton added.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.