Municipal bond market participants will be keeping one eye on the upcoming sale calendar and the other on developments between the U.S. and China on trade.

IHS Markit Ipreo forecasts weekly bond volume will rise to $6.75 billion from a revised total of $6.1 billion in the prior week, according to updated data from Refinitiv. The calendar is composed of $4.19 billion of negotiated deals and $2.56 billion of competitive sales.

Primary market

RBC Capital Markets is set to price the Allegheny County Hospital Development Authority, Pa.’s (A1/A+/A+) $738 million of Series 2019A UPMC revenue bonds on Wednesday.

Proceeds will be used to refund outstanding revenue bonds and notes of the University of Pittsburgh Medical Center, the Allegheny County Hospital Development Authority, the Lycoming County Authority, the Monroeville Finance Authority, and the Dauphin County General Authority.

The bond counsel is Eckert Seamans.

The authority was last in the negotiated market in August of 2018 when Citigroup priced $943 million of Series 2018A revenue bonds for the Allegheny Health Network Obligated Group. That deal (NR/A/NR) was priced to yield from 2.26% in 2022 to 4.17% in 2044 and 3.87% in 2047. The 2028 maturity was priced as 5s to yield 3.18%; the MMD 10-year AAA muni was calculated at 2.43% on Aug. 16, 2018.

The 4s of 2044 from that deal, clearly rated lower than today, originally priced yielding 4.17%. On May 6 they traded in blocks at 3.41%-3.39%.

Also on tap, Roosevelt & Cross is expected to price the Dormitory Authority of the State of New York’s $498 million of school districts revenue bond financing program revenue bonds in five series.

The issue consists of $427.88 million of Series 2019A bonds (Aa3/NR/AA-), $12.62 million of Series 2019B bonds (Aa3/NR/AA-), $11.245 million of Series 2019C bonds (Aa2/NR/AA-), $24.66 million of Series 2019D bonds (NR/AA/AA-) and $9.24 million of Series 2019E bonds (Aa3/NR/AA-).

The financial advisors are Bernard P. Donegan, Fiscal Advisors & Marketing, Municipal Solutions and R.G. Timbs. The bond counsel are Barclay Damon and BurgherGray.

In the competitive arena, the Virginia College Building Authority (Aa1/AA+/AA+) is selling $512.17 million of Series 2019A educational facilities revenue bonds for the 21st Century College and Equipment program.

Hilltop Securities is the financial advisor; Kutak Rock is the bond counsel.

The authority last competitively sold comparable bonds on May 16, 2018 when Morgan Stanley won $76 million of Series 2018A educational facilities revenue bonds for the 21st Century College and Equipment program with a true interest cost of 2.2191%.

Secondary market

On Friday, President Donald Trump raised the tariff rate to 25% from 10% on $200 billion of Chinese exports after the two countries failed to reach a trade agreement by a midnight deadline.

“China has vowed to retaliate although they have yet to provide specific details on any countermeasures,” said Scott Anderson, chief economist at Bank of the West. “Trade talks between the two countries are ongoing and President Trump tweeted there’s ‘no need to rush’ on a deal.”

For most of the week, volatility in the equities market caused munis to rally as traders reacted with unease over the possible longer-term consequences of a possible widening trade war.

Munis were stronger on the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year muni GO and the 30-year muni yield remained unchanged.

Treasuries were mostly stronger as stock prices remained volatile.

The 10-year muni-to-Treasury ratio was calculated at 71.4% while the 30-year muni-to-Treasury ratio stood at 84.7%, according to MMD.

Trump’s tweets that the Chinese “broke the deal” triggered a bout of global stock and bond market volatility not seen since December, Anderson wrote in a Friday market comment.

"We interpret this week’s market tremors as an early warning of a tougher U.S. and global economic environment ahead," Anderson said. "A 2020 economic recession is not inevitable, but the window for the Fed to achieve a soft landing is closing quickly. We think the most likely outcome as we approach 2020 is a period of sluggish growth that will require support from the Fed in the form of three quarter-point rate cuts from today’s levels."

He said that while economic conditions weren’t all gloom and doom, caution was warranted.

"The U.S. labor market’s strength and resilience is impressive, keeping the consumer in the game a little longer," Anderson said. "However, the tea leaves suggest a consumer spending slowdown ahead."

Previous session's activity

The MSRB reported 39,245 trades for Thursday on volume of $16.10 billion. The 30-day average trade summary showed on a par amount basis of $12.45 million that customers bought $6.22 million, customers sold $4.08 million and interdealer trades totaled $2.15 million.

California, New York and Texas were most traded, with the Golden State taking 15.201% of the market, the Empire State taking 9.709% and the Lone Star State taking 8.592%.

The most actively traded security was the Puerto Rico Government Development Bank Debt Recovery Authority taxable 7.5s of 2040, which traded 95 times on volume of $116.55 million.

Lipper: More inflows into muni funds

For the 18th week in a row, investors placed cash into municipal bond funds, according to data from Refinitiv Lipper released Thursday.

Tax-exempt mutual funds which report flows weekly saw $1.502 billion of inflows in the week ended May 8 after inflows of $1.191 billion in the previous week.

Exchange traded muni funds reported inflows of $237.397 million after inflows of $314.019 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.264 billion after inflows of $877.330 million in the previous week.

The four-week moving average remained positive at $1.237 billion, after being in the green at $1.1 billion in the previous week.

Long-term muni bond funds had inflows of $982.190 million in the latest week after inflows of $707.615 million in the previous week. Intermediate-term funds had inflows of $440.006 million after inflows of $273.623 million in the prior week.

National funds had inflows of $1.313 billion after inflows of $1.112 billion in the previous week. High-yield muni funds reported inflows of $429.105 million in the latest week, after inflows of $294.690 million the previous week.

On Wednesday, the Investment Company Institute reported long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.134 billion in the week ended May 1, while long-term muni funds alone saw an inflow of $1.718 million and ETF muni funds saw an inflow of $416 million.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended May 10 were from Puerto Rico and Massachusetts issuers, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 23 times. In the revenue bond sector, the Mass. Development Finance Agency 4s of 2049 traded 94 times. In the taxable bond sector, the Puerto Rico GDB Bank Debt Recovery Authority 7.5s of 2040 traded 51 times.

Week's actively quoted issues

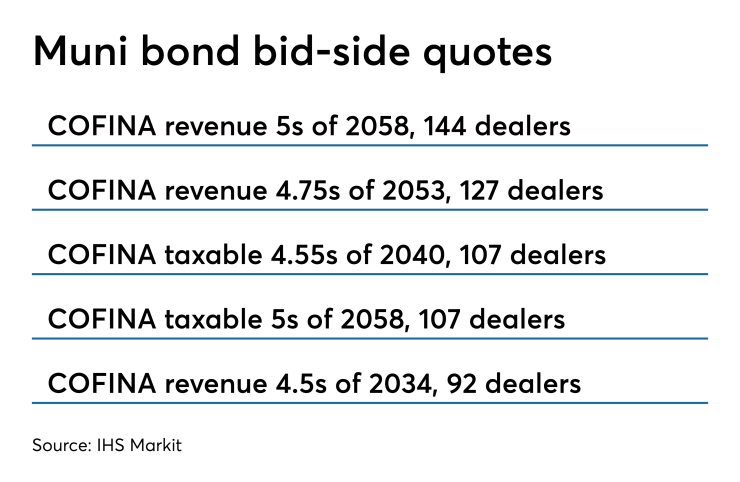

Puerto Rico, California and New Jersey names were among the most actively quoted bonds in the week ended May 10, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Finance Corp. revenue 5s of 2058 were quoted by 144 unique dealers. On the ask side, the California taxable 7.55s of 2039 were quoted by 102 dealers. Among two-sided quotes, the N.J. taxable 7.425s of 2029 were quoted by 29 dealers.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.