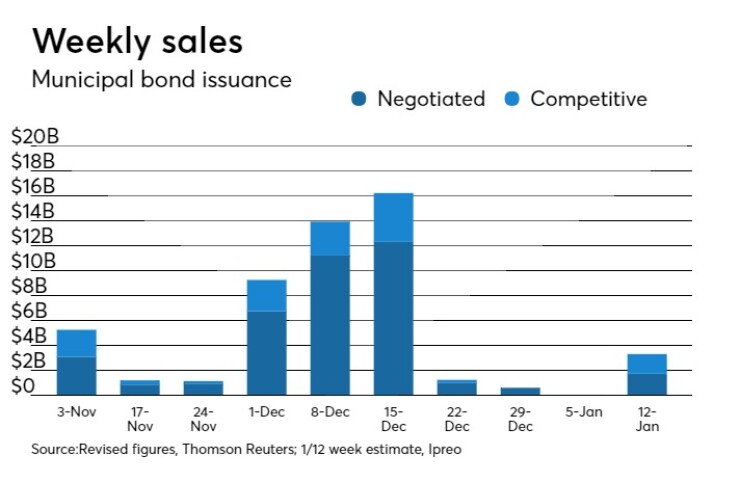

The municipal bond market is looking ahead to a new issue slate that's dominated by two big competitive sales from Massachusetts and three large taxable deals in the negotiated sector.

Ipreo estimates the weekly supply calendar will total $3.30 billion, which is made up of $1.72 billion of negotiated deals and $1.58 billion of competitive sales.

Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management said that although it has been a slow start to the year volume wise, munis are positioned well, getting a better bid under them and doing well compared to Treasuries right now.

"Demand will be decent, the market has got to work through some of residual overhang from the rush at the end year," he said. "I also think that people are trying to figure out what all the tax reform changes mean."

He added that as we get into the next few weeks, we will have a better footprint how not only the month will go, but the first quarter in general.

"It is tough for firms to generate revenue, even with a lot of supply, so it's even harder still with less supply," Heckman said. "The bid market is starting to perk up and improve. We think it will be extremely active this year."

Massachusetts is competitively offering $600 million of general obligation bonds in two separate sales on Tuesday.

The issues consist of $400 million of consolidated loan of 2018 Series A GOs and $200 million of consolidated loan of 2018 Series B GOs.

Both deals are rated Aa1 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

In the negotiated sector, taxable bond deals dominate the slate.

"Coming into the year, we thought taxable issuance would continue to rise and the calendar is showing that early on," said Heckman. "With the new tax low provisions and the rate down to 21%, it makes things more difficult for some buyers. Underwriters may be telling issuers that although a taxable financing is a little more costly, issuers can lock something in and have a broader investor base. Today's higher cost might look relatively cheap three or four months from now."

Morgan Stanley is expected to price the Stanford Health Care’s $500 million of Series 2018 corporate CUSIP taxables on Wednesday. The deal is rated Aa3 by Moody’s, AA-minus by S&P and AA by Fitch.

RBC Capital Markets is expected to price the Pennsylvania Commonwealth Financing Authority’s $410 million of Series 2-018A taxable revenue bonds on Thursday. The deal is rated A1 by Moody’s, A by S&P and A-plus by Fitch.

And JPMorgan is set to price the Illinois Finance Authority’s $218.67 million of Series 2018 taxable revenue refunding bonds for the Ann and Robert H. Lurie Children’s Hospital of Chicago. The deal is rated AA-minus by S&P and AA by Fitch.

N.Y. expects to sell $3.12B of bonds in Q1

New York State, New York City and their major public authorities will sell $3.12 billion of municipal bonds in the

The planned sales include $1.73 billion of new money and $1.39 billion of refundings or reofferings, with $2.7 billion scheduled for January, of which $1.4 billion is new money and $1.3 billion is refundings or reofferings, and $425 million scheduled for March of which $335 million is new money and $90 million is refundings.

The anticipated sales in the first quarter compare to $8.02 billion in the fourth quarter of 2017 and $4.27 billion in the first quarter of 2017.

The following issuers are expected to sell bonds in the first quarter: the Dormitory Authority of the State of New York; the Metropolitan Transportation Authority; the New York State Energy Research & Development Authority; the Port Authority of New York & New Jersey; the State of New York, the State of New York Mortgage Agency; and the Triborough Bridge & Tunnel Authority.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was weaker in late trading.

The 10-year muni benchmark yield rose to 2.266% on Friday from the final read of 2.252% on Thursday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipal bonds ended weaker on Friday. The yield on the 10-year benchmark muni general obligation rose two basis points to 2.01% from 1.99% on Thursday, while the 30-year GO yield gained two basis points to 2.58% from 2.56% according to the final read of MMD’s triple-A scale.

U.S. Treasuries were mixed in late activity. The yield on the two-year Treasury was unchanged on Friday from 1.96% on Thursday, the 10-year Treasury yield gained to 2.48% from 2.45% and the yield on the 30-year Treasury increased to 2.81% from 2.78%.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 81.2% compared with 81.3% on Thursday, while the 30-year muni-to-Treasury ratio stood at 91.8% versus 92.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 40,912 trades on Thursday on volume of $12.68 billion.

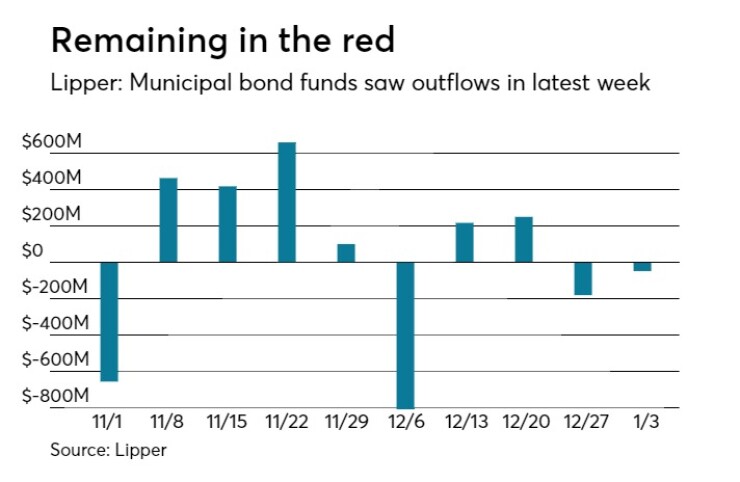

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds again pulled cash out of the funds in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $47.880 million of outflows in the week of Jan. 3, after outflows of $180.177 million in the previous week.

Exchange traded funds reported inflows of $195.493 million, after outflows of $15.570 million in the previous week. Ex-ETFs, muni funds saw $243.373 million of outflows, after outflows of $164.606 million in the previous week.

The four-week moving average was positive at $59.882 million, after being negative $129.949 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $255.775 million in the latest week after inflows of $122.015 million in the previous week. Intermediate-term funds had inflows of $8.637 million after inflows of $43.649 million in the prior week.

National funds had inflows of $138.051 million after inflows of $37.812 million in the previous week.

High-yield muni funds reported inflows of $73.675 million in the latest week, after inflows of $225.414 million the previous week.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Jan. 5 were from New York and Illinois issuers, according to

In the GO bond sector, the New York City zeroes of 2042 were traded 31 times. In the revenue bond sector, the New York City Municipal Water Finance Authority zeroes of 2050 were traded 24 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 12 times.

Week's actively quoted issues

Puerto Rico, Chicago and Illinois names were among the most actively quoted bonds in the week ended Jan. 5, according to Markit.

On the bid side, Puerto Rico Commonwealth GO 5s of 2041 were quoted by 56 unique dealers. On the ask side, the Chicago taxable 5.432s of 2042 were quoted by 190 dealers. And among two-sided quotes, Illinois taxable 5.1s of 2033 were quoted by 23 unique dealers.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.