Prices of top-rated municipal bonds finished little changed in subdued trading on Monday, traders said, after plunging in secondary trading Friday. Yields were unchanged to one basis point higher on some maturities ahead of this week's $12.4 billion new issue calendar.

Primary Market

Barclays Capital is set to price the biggest deal of the week - the University of California's $2.8 billion offering, coming to market in two separate issues. Raymond James is co-manager on two series of limited project revenue bonds, consisting of $1.2 billion of tax-exempt 2015 Series I bonds and $440 million of taxable 2015 Series J bonds.

Stifel is the co-manager on the two general revenue bond series, consisting of $770 million of tax-exempt Series AO bonds and $370 million of taxable 2015 Series AP bonds.

A retail order period will be held Tuesday for all issues. The institutional pricing for both general revenue bond series and the taxable limited project revenue bonds is set for Wednesday, followed by a pricing on Thursday of the $1.2 billion Series I tax-exempt limited project revenue bonds.

"The refunding portion of the issue is approximately $2.2 billion and the new money portion of the issue is approximately $600 million," said John H. Augustine, managing director, Barclays Capital and one of four joint-senior managers on the deal. "Each portion of the issue will consist of taxable and tax-exempt series. The size of the issue is determined by the fact that there is refunding savings in the current market.".

New muni issuance hit a year-to-date high this week, continuing the 2015 surge.

"Volume in the first two months of 2014 was 62% ahead of last year, and this trend is likely to continue given March's strong start," Alan Schankel, Managing Director at Janney Capital Markets, wrote in a research report, "But the underlying story of volume is refinancing. Most of new issuance in 2015 has been for refunding purposes, with the new money total actually 11% lower than last year. Since new refunding issues usually lead to roughly offsetting redemptions of outstanding bonds, there is minimal volume pressure and in fact the amount of municipal bonds outstanding is shrinking, not growing."

In the competitive arena on Tuesday, New York State will sell $325 million of tax-exempt, taxable and tax-exempt refunding general obligation bonds in three separate competitive sales while Boston will sell $270 million of GO and GO refunding bonds in two separate offerings.

Also on Tuesday, Citigroup Global Markets is expected to price the Rhode Island Tobacco Settlement Finance Corp.'s $600 million of asset-backed bonds.

Secondary Market

The yield on the 10-year benchmark muni general obligation finished up one basis point to 2.18% from 2.17% on Friday, while the yield on 30-year GO was unchanged at 3.02%, according to the final read of Municipal Market Data's triple-A scale.

So far this year, yields have been especially volatile. Since March 2, yields on the 10-year have risen by 12 basis points and yields on the 30-year are up by 12 basis points. Since Feb. 2, yields on the 10-year are up by 43 basis points and yields on the 30-year are 52 basis points higher. And since Jan. 2, yields on the 10-year have risen by 16 basis points and yields on the 30-year are up by 19 basis points.

Treasury prices were higher on Monday. The yield on the two-year Treasury note dropped to 0.70% from 0.72% on Friday, while the 10-year yield decreased to 2.20% from 2.24% and the 30-year yield declined to 2.80% from 2.83%.

"It does not appear, however, that favorable supply/demand metrics are having a positive impact on municipal to Treasury ratios, which are an oft used indicator of municipal market relative value," Schankel wrote. "After spending much of 2014 in the 80% band, 10 year M/T ratios are on the rise, averaging 99.3% in 2015 compared to 89.9% in 2014. The municipal asset class outperformed Treasuries and other areas of fixed income in 2014, but so far in 2015, has lagged Treasuries."

On Monday, the 10-year muni to Treasury ratio was calculated at 99.4% versus 97.3% on Friday, while the 30-year muni to Treasury ratio stood at 107.9% compared to 106.7%.

Last Week's Top Traded Munis by Sector

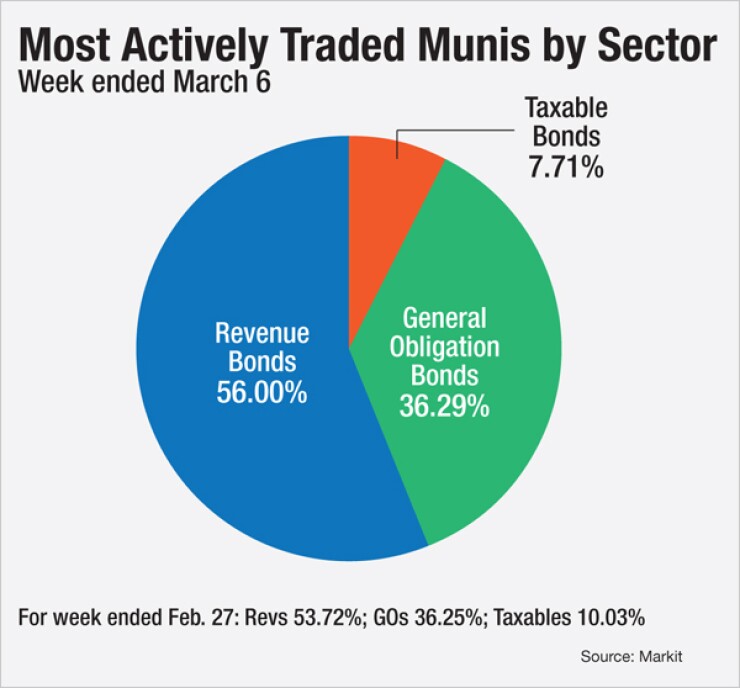

Munis from issuers from California, Georgia and Iowa were the top traded bonds by market sector in the week ended March 6, according to data released by Markit.

Revenue bonds comprised 56.00% of new issuance in the week ended March 6, up from 53.72% in the week ended Feb. 27. GOs comprised 36.29% of total issuance, up from 36.25%, while taxables made up 7.71%, down from 10.03%.

In the GO bond sector, California 3s of 2029 were traded 78 times. In the revenue bond sector, the Atlanta water and wastewater 5s of 2040 were traded 99 times. And in the taxable bond sector, the Iowa special obligation 6.75s of 2034 were traded 39 times, according to Markit.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $886.4 billion to $15.158 billion on Monday. The total is comprised of $3.406 billion competitive sales and $11.752 billion of negotiated deals.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 30,990 trades on Friday on volume of $7.601 billion. Most active on Friday, based on the number of trades, was the Iowa Higher Education Loan Authority's Series 2015 private college facilities revenue refunding 5s of 2037, which traded 263 times at an average price of par, with an average yield of 5%; (initial offering price of 100.00/initial offering yield of yield of 5%).