The municipal bond market will see a second week of chunky new issuance, with almost $20 billion of new deals lining up for sale.

Ipreo estimates volume for next week at $19.8 billion, up from a revised total of $13.9 billion this week, according to updated data from Thomson Reuters. The calendar is composed of $16.4 billion of negotiated deals and $3.3 billion of competitive sales.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was weaker in midday trading.

The 10-year muni benchmark yield rose to 2.243% on Friday from the final read of 2.206% on Thursday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipal bonds were weaker on Friday. The yield on the 10-year benchmark muni general obligation rose four to six basis points from 1.88% on Thursday, while the 30-year GO yield gained five to seven basis points from 2.49%, according to a read of MMD’s triple-A scale.

U.S. Treasuries were mixed on Friday. The yield on the two-year Treasury declined to 1.80% from 1.81%, the 10-year Treasury yield dipped was unchanged from 2.38% and the yield on the 30-year Treasury increased to 2.78% from 2.77%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 79.3% compared with 83.9% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 89.8% versus 95.9%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 50,018 trades on Wednesday on volume of $21.295 billion.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Dec. 8 were from New York, Florida and New Jersey issuers, according to

In the GO bond sector, the New York City 4s of 2034 were traded 57 times. In the revenue bond sector, the Florida Development Finance Corp. 5.625s of 2047 were traded 116 times. And in the taxable bond sector, the New Jersey Turnpike Authority 3.729s of 2036 were traded 37 times.

Week's actively quoted issues

Puerto Rico, New York and California names were among the most actively quoted bonds in the week ended Dec. 8, according to Markit.

On the bid side, Puerto Rico Commonwealth GO 5s of 2041 were quoted by 74 unique dealers. On the ask side, New York Metropolitan Transportation Authority revenue 3.25s of 2036 were quoted by 264 dealers. And among two-sided quotes, California taxable 7.625s of 2040 were quoted by 23 unique dealers.

Week’s primary market

This week’s calendar was hefty for this time of year.

Bank of America Merrill Lynch priced Trinity Health’s $992.38 million of hospital revenue bonds. The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings. BAML also priced the Michigan State Hospital Finance Authority’s $214.735 million of refunding revenue bonds for Trinity Health as a remarketing. This deal is also rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Ramirez & Co. priced New York City’s $943.51 million of Fiscal 2018 Series C and D GOs. The deal is rated Aa2 by Moody’s and AA by S&P and Fitch.

Wells Fargo Securities priced Miami-Dade County, Fla.’s $940.34 million of water and sewer system revenue and revenue refunding bonds. The deal is rated Aa3 by Moody’s and A-plus by S&P and Fitch.

JPMorgan priced the Illinois Finance Authority’s $709.14 million of Series 2017A&B revenue bonds for Northwestern Memorial Healthcare. The deal is rated Aa2 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

RBC Capital Markets priced the Oklahoma Turnpike Authority’s $684.36 million of turnpike system bonds. The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Jefferies priced Chicago’s Sales Tax Securitization Corp.’s $574.53 million of sales tax securitization bonds for retail investors. The deal is rated AA by S&P and AAA by Fitch and Kroll Bond Rating Agency.

Wells Fargo priced the Central Florida Expressway Authority’s $345.21 million of Series 2017 senior lien refunding revenue bonds. The deal is rated Aa2 by Moody’s, AAA by S&P and AA-plus by Fitch.

RBC priced the Pennsylvania Housing Finance Agency’s $300.21 million of single-family mortgage revenue bonds. The deal is rated Aa2 by Moody’s and AA-plus by S&P.

JPMorgan priced the New York City Housing Development Corp.’s $298.47 million of multi-family housing revenue bonds. The deal is rated Aa2 by Moody’s and AA-plus by S&P.

Goldman priced the California Department of Water Resources $288.89 million of Series AX water system revenue bonds for the Central Valley project. The deal is rated Aa1 by Moody’s and AAA by S&P.

Goldman priced the Sacramento Municipal Utility District, Calif.’s $217.67 million of Series 2017E electric revenue refunding bonds. The deal is rated Aa3 by Moody’s and AA by S&P and Fitch.

BAML priced the Harris County, Texas, Cultural Education Facilities Finance Corp.’s $211.26 million of Series 2017 thermal utility revenue refunding bonds for the Teco project. The deal is rated Aa3 by Moody’s and AA by S&P.

JPMorgan Securities priced King Co., Wash.’s $149.49 million of Series 2017 sewer refunding revenue bonds. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Wells Fargo priced Richmond, Va.’s $118.54 million of Series 2017D GO public improvement refunding bonds. The deal is rated Aa2 by Moody’s and AA-plus by S&P and Fitch.

RBC priced the Minnesota Housing Finance Agency’s $104.22 million of residential housing finance bonds. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Citigroup priced the Lexington County, Ky., Health Services District. Inc.’s $146.51 million of Series 2017 hospital revenue refunding bonds. The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

Citi priced the Tampa-Hillsborough County Expressway Authority, Fla.’s $202.34 million of Series 2017C refunding revenue and revenue bonds. The deal is rated A2 by Moody’s and A-plus by S&P.

BAML priced the Kentucky Economic Development Finance Authority’s $175.72 million of taxable refunding revenue bonds for the Louisville Arena Authority, Inc. The deal is insured by Assured Guaranty Municipal and rated A2 by Moody’s and AA by S&P.

Hilltop Securities priced Galveston County, Texas’ $102.375 million of bonds. The deal is rated Aaa by Moody’s and AA-plus by Fitch.

Goldman Sachs priced the California Infrastructure and Economic development Bank’s $171.19 million of Series 2017 revenue bonds for UCSF 2130 Third Street. The deal is rated Aa3 by Moody’s and AA by S&P.

Wells Fargo Securities priced Upland, Texas’ $132.2 million of certificates of participation for the San Antonio Regional Hospital. The COPs are rated Baa2 by Moody’s and BBB-plus by S&P.

In the short-term sector, Citigroup priced Nassau County, N.Y.’s $472.44 million of tax anticipation and bond anticipation notes. The deal is rated SP1-plus by S&P and F1 by Fitch.

In the competitive arena, the Florida Board of Education sold $272.91 million of Series 2017C public education capital outlay refunding bonds.

Morgan Stanley won the bonds with a true interest cost of 2.8565%. The deal is rated Aa1 by Moody’s and AAA by S&P and Fitch.

Ohio sold $496.86 million of general obligation bonds in four separate sales. JPMorgan Securities won the $206.37 million of Series 2017B common schools refunding bonds with a true interest cost of 1.9179%. Citigroup won the $196.74 million of Series 2017C higher education refunding bonds with a TIC of 1.9183%; Citi won the $69.74 million of Series 2017B infrastructure improvement refunding bonds with a TIC of 2.0496% and the $24.01 million of Series V natural resources refunding bonds with a TIC of 1.897%. The deals are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Clark County, Nev., sold $126.16 million of Series 2017C limited tax GO Las Vegas Convention and Visitor Authority crossover refunding bonds additionally secured with pledged revenues. RBC won the bonds with a TIC of 2.9163%. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Westchester County, N.Y., sold $178.89 million of GOs in three separate offerings. The $135.87 million of Series 2017A tax-exempt GOs were won by JPMorgan with a TIC cost of 1.92%. The $19.93 million of Series 2017C tax-exempt GOs were won by JPMorgan with a TIC of 2.45%. The $23.09 million of Series 2017B taxable GOs were won by BAML with a TIC of 2.78%. All three deals are rated Aa1 by Moody’s and AAA by S&P and Fitch.

Texas sold $155.72 million of general obligation college student loan bonds subject to the alternative minimum tax. BAML won the bonds with a true interest cost of 3.1122%. The deal is rated triple-A by Moody’s and S&P.

The Board of Education of the Alpine School District, Utah, sold $113.25 million of Series 2017B GO school building bonds under the Utah School Bond Guaranty program. Citi won the bonds with a TIC of 2.548%. The deal is rated triple-A by Moody’s and Fitch.

Bond Buyer 30-day visible supply at $21.96B

The Bond Buyer's 30-day visible supply calendar increased $6,0 billion to $21.96 billion on Friday. The total is comprised of $4.0 billion of competitive sales and $17.96 billion of negotiated deals.

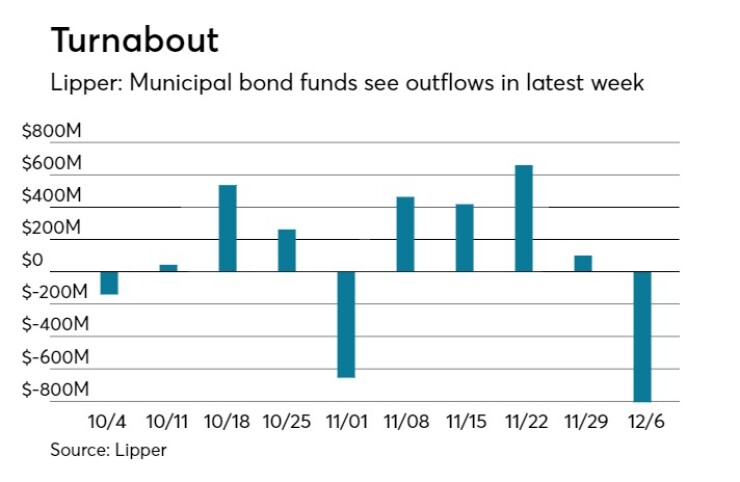

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds pulled put cash out of the funds in the latest week, according to Lipper data released on Friday.

The weekly reporters saw $807.203 million of outflows in the week of Dec. 6, after inflows of $100.434 million in the previous week.

Exchange traded funds reported inflows of $127.808 million, after inflows of $61.076 million in the previous week. Ex-ETFs, muni funds saw $935.011 million of outflows, after inflows of $39.358 million in the previous week.

The four-week moving average was positive at $92.547 million, after being in the green at $410.109 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $140.663 million in the latest week after inflows of $185.461 million in the previous week. Intermediate-term funds had outflows of $285.696 million after inflows of $18.641 million in the prior week.

National funds had outflows of $637.093 million after inflows of $136.295 million in the previous week.

High-yield muni funds reported outflows of $236.365 million in the latest week, after inflows of $71.670 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.