The muni market was steady, as traders waited for the last of this week’s deals to come rolling in, including the biggest deal of the week.

Secondary market

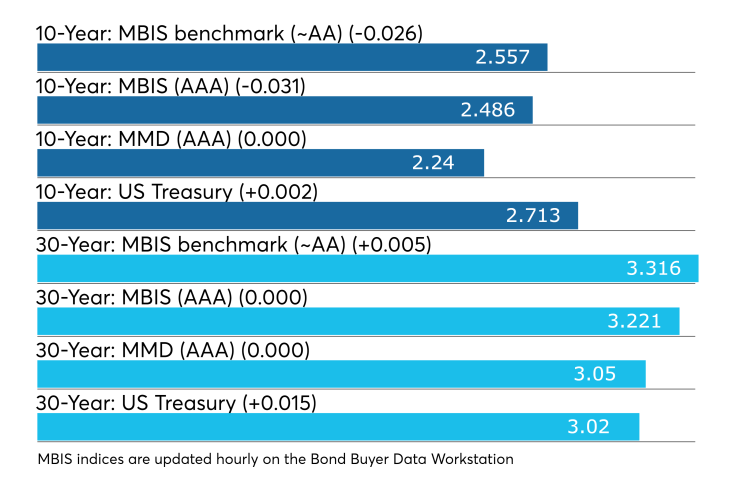

Municipal bonds were weaker on Thursday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as five basis points in the one- year and four- to 27-year maturities. the four-year was unchanged. The remaining maturities saw yields rise by as much as five basis points.

High-grade munis were also weaker, with yields calculated on MBIS' AAA scale falling as much as two basis points in the one-year and five- to 28-year maturities. The remaining four maturities saw higher yields by as much as four basis points.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the 30-year muni maturity flat.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 81.8% while the 30-year muni-to-Treasury ratio stood at 101.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Muni weakness and mixed demand ahead

The political environment and Federal Reserve Board uncertainty, will lead to volatility in 2019, according to a report by Court Street Group Research LLC. Sharply divided and constantly changing views on the potential for a recession should lead to “rapidly changing perceptions regarding the outlook for Fed policy,” according to managing partner George Friedlander.

Other sources for volatility include potential pressures on municipal credits after a strong period in 2018, capped off by much stronger state budget trends, Friedlander noted in a Jan. 8 municipal perspective report.

According to the National Association of State Budget Officers, total state spending rose in fiscal 2018, exceeding $2 trillion for the first time, but in both fiscal 2018 and fiscal 2017, spending growth was below the 32-year NASBO survey historical average — not adjusted for inflation, Friedlander pointed out.

Meanwhile, state tax collections accelerated in fiscal 2018, increasing 6.2% compared to 2.5% growth in fiscal 2017, he wrote.

Friedlander added that transportation, Medicaid, and K-12 education all experienced strong spending growth from state funds in fiscal 2018, as did deposits to rainy day funds, which he referred to as good news for credit.

“Last year, states put a lot of their surplus into rainy day funds, which boosted those totals from 5.3% of general fund spending to 6.4%,” he said. Some one-time increases in revenues came from the acceleration of taxable revenue into 2017 by some individuals, according to Friedlander.

That, he noted, was a response to the then-impending “sharp reduction in deductibility of state and local taxes.”

Several sources of renewed pressure will surface, he reported. “Given a somewhat weaker economy, it seems unlikely that states will experience the dramatic increases in revenues that occurred in FY 2018.”

“We expect that, given the painful drop in the equity markets, with the Dow down about 7.4%, pension fund experiences are likely to come under some pressure,” Friedlander said in the report.

He also predicted the market could be in the early stages a transition toward broader differences in relative credit strength.

The forecast is supported by the fact that more communities are damaged by climate change both in terms of climate events and in terms of revenue generation as property values in affected communities weaken, according to Friedlander.

In addition, economic activity by large tech-based companies continues to be concentrated in technologically attractive communities, he added.

Although Friedlander is watching credit differentiation, he doesn’t expect it will occur quickly.

Meanwhile, elsewhere in the municipal market, Friedlander forecasts that demand will remain mixed in 2019.

“Demand by banks for municipals turned sharply negative in 2018 as their tax rate was cut to 21%, and as the cost of funding through consumers increased sharply,” Friedlander explained.

Going forward, he believes property and casualty and life insurance holdings “will likely increase only modestly, after a stronger 2018.”

“Direct retail remains mixed — mostly through separately managed accounts, with a 10-year maximum maturity, and we still wait for fund flows to continually turn positive after spending all of the fourth quarter of 2018 in negative territory,” Friedlander wrote.

He said he remains wary of mixed demand throughout this year — especially on the heels of collapsing supply in 2018.

“We expect new-money issuance to increase at least moderately during 2019 as state and local governments address infrastructure, and, by the third or fourth quarter, we expect to see a rebound in current refundings, after that sector remained extremely quiet during 2018,” Friedlander predicted.

A 10% increase in total issuance to $378 billion from $338 billion is expected.

Net supply will remain sharply negative at $50-plus billion, according to Friedlander.

“The impetus behind retail demand will remain mixed, with the yield curve having flattened so dramatically,” he wrote. “More current refundings would reflect more supply on the longer intermediate range, beyond the scope of SMAs,” he continued. “The relative good news for demand is the weakness of the stock market, which could push more investors over to fixed income and munis.”

Municipals could weaken a bit — especially if Treasury rates were to rebound — given the widespread economic and political uncertainty, more supply, and the flatter yield curve, Friedlander noted.

“Nevertheless, the magnitude of any yield increase is likely to be modest, with net supply still coming in at around minus $50 billion,” he added.

Primary market

On Thursday, JPMorgan Securities is expected to price the San Francisco Airport Commission’s $1.78 billion of tax-exempt and taxable revenue and revenue refunding bonds. The deal, which consists of bonds subject to the alternative minimum tax and non-AMT bonds, is rated A1 by Moody’s and A-plus by S&P and Fitch.

Previous session's activity

The Municipal Securities Rulemaking Board reported 46,849 trades on Wednesday on volume of $14.233 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 14.828% of the market, the Empire State taking 12.981% and the Lone Star State taking 9.618%.

Treasury auctions announced

The Treasury Department announced these auctions:

- $13 billion 10-year TIPs selling on Jan. 17;

- $36 billion 182-day bills selling on Jan. 14;

- $39 billion 91-day bills selling on Jan. 14.

Treasury auctions bills

The Treasury Department Thursday auctioned $40 billion of four-week bills at a 2.380% high yield, a price of 99.814889. The coupon equivalent was 2.418%. The bid-to-cover ratio was 3.07. Tenders at the high rate were allotted 41.20%. The median rate was 2.360%. The low rate was 2.330%.

Treasury also auctioned $30 billion of eight-week bills at a 2.390% high yield, a price of 99.628222. The coupon equivalent was 2.432%. The bid-to-cover ratio was 3.25. Tenders at the high rate were allotted 90.62%. The median rate was 2.370%. The low rate was 2.340%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.