The primary market will see another busy day on Thursday, as issuers from New York, California, Oregon, Wisconsin and Texas are expected to hit the market.

Secondary Market

Treasuries were unchanged on Thursday. The yield on the two-year Treasury was flat from 0.74% on Wednesday, while the 10-year Treasury yield was unchanged from 1.82% and the 30-year Treasury bond yield was steady at 2.68%.

Top-rated municipal bonds weakened all day Wednesday. The yield on the 10-year benchmark muni general obligation was four basis points higher at 1.66% from 1.62% on Tuesday, while the 30-year muni yield rose six basis points higher to 2.78% from 2.72%, according to a final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated on Wednesday at 91.4% compared to 91.2% on Tuesday, while the 30-year muni to Treasury ratio stood at 103.4% versus 103.0%, according to MMD.

Primary Market

Ramirez & Co. is set to price the New York Metropolitan Transportation Authority's $722.88 million of revenue green bonds for institutions after a retail order period was held on Wednesday. The deal is rated A1 by Moody's Investors Service, AA-minus by Standard and Poor's, A by Fitch Ratings and AA-plus by Kroll Bond Rating Agency.

The $437.30 million series 2016A-1 was priced for retail to yield from 0.58% with a 4% coupon in 2017 to 2.85% with a 5% coupon in 2036. A split term bond in 2041 was priced to yield 3.62% and 3.12%, with 3.5% and 5% coupons, respectively. A 2046 term bond was priced to yield 3.17% with a 5% coupon. The 2016 maturity was offered as a sealed bid.

The $285.58 million series 2016A-2 was priced for retail to yield from 0.83% with a 5% coupon in 2019 to 2.50% at par and 2.32% with a 5% coupon in a split 2028 maturity.

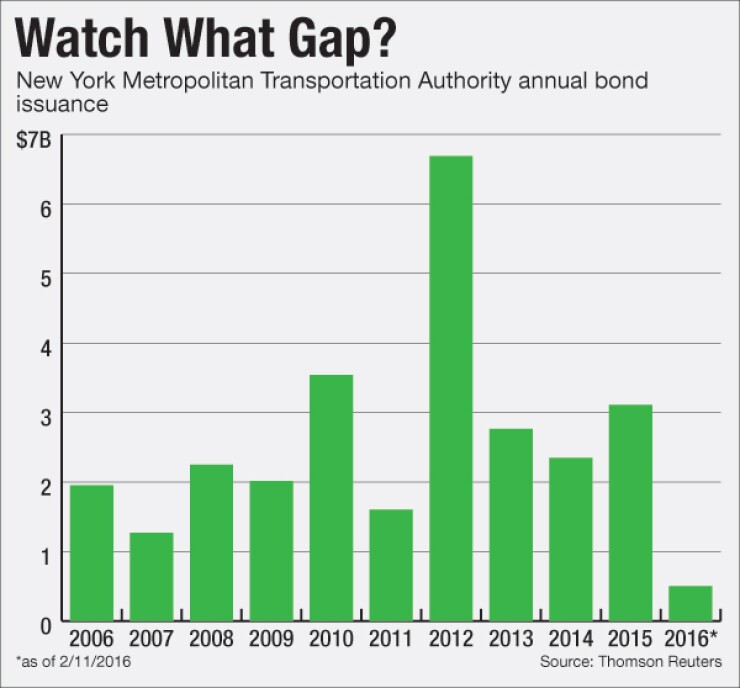

Since 2006, the New York City MTA issued bonds an average of 7.1 times a year, selling about $28 billion, with the largest issuances in 2010 and 2012 when it offered $3.5 billion and $6.7 billion, respectively, and the lows in 2007 and 2011, when it issued $1.3 billion and $1.6 billion.

JPMorgan Securities is expected to price the Oregon Health & Science University's $196.23 million of Series 2016B revenue bonds for institutions, after the deal priced for retail investors on Wednesday.

The bonds were priced for retail to yield 2.73% with a 2.5% coupon and 2.53% with a 4% coupon in a triple-split maturity in 2028, with the third split not available for retail. The bonds are also priced to yield from 3.25% with a 3.125% coupon in 2033 to 3.63% with a 3.5% coupon in a split 2039 maturity, with the second split not available for retail. The bonds were also priced to yield 3.67% with a 4% coupon in half of a split 2046 maturity, with the second split not available for retail. No retail orders were available for the 2034-2037 and 2044 maturities. The deal is rated Aa3 by Moody's and AA-minus by S&P and Fitch.

Also on tap, Morgan Stanley is scheduled to price the Wisconsin Public Finance Authority's $170.455 million of revenue refunding bonds for Celanese Corporation.

The Los Angeles County MTA will be selling $188.27 million of Proposition A first tier senior sales tax revenue refunding bonds via competitive sale. The deal is rated Aa1 by Moody's and AAA by S&P.

Frisco Independent School District in Texas will be selling $110.25 million of unlimited tax refunding bonds. The deal is backed by the PSFGP and is rated triple-A by Moody's and S&P.

Tax-Exempt Money Market Funds Post Outflows

Tax-exempt money market funds experienced outflows of $3.40 billion, bringing total net assets to $242.84 billion in the week ended Feb. 15, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $1.13 billion to $246.24 billion in the previous week.

The average, seven-day simple yield for the 354 weekly reporting tax-exempt funds remained at 0.01% for the 146th straight week.

The total net assets of the 945 weekly reporting taxable money funds increased $3.30 billion to $2.521 trillion in the week ended Feb. 16, after an outflow of $5.35 billion to $2.518 trillion in the prior week.

The average, seven-day simple yield for the taxable money funds remained at 0.10% for the second week in a row.

Overall, the combined total net assets of the 1,299 weekly reporting money funds fell $96.7 million to $2.764 trillion in the period ended Feb. 16, which followed an outflow of $6.48 billion to $2.764 trillion.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 37,736 trades on Wednesday on volume of $6.88 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar fell $114.4 million to $8.7 billion on Thursday. The total is comprised of $2.83 billion of competitive sales and $5.87 billion of negotiated deals.