Municipal bonds were steady at mid-session, according to traders, who will be looking ahead to the week’s hefty new issue slate.

Secondary market

The yield on the 10-year benchmark muni general obligation was flat from 1.86% on Friday, while the 30-year GO yield was unchanged from 2.69%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Monday. The yield on the two-year Treasury rose to 1.30% from 1.28% on Friday as the 10-year Treasury yield gained to 2.17% from 2.16% while the yield on the 30-year Treasury bond increased to 2.83% from 2.81%.

On Friday, the 10-year muni to Treasury ratio was calculated at 86.2%, compared with 85.8% on Thursday, while the 30-year muni to Treasury ratio stood at 95.7% versus 95.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 39,416 trades on Friday on volume of $9.62 billion.

Prior week's actively traded issues

Revenue bonds comprised 55.28% of new issuance in the week ended June 2, down from 55.54% in the previous week, according to

Some of the most actively traded bonds by type were from Iowa, Maryland and Illinois issuers.

In the GO bond sector, the Coralville, Iowa, 4s of 2037 were traded 20 times. In the revenue bond sector, the Baltimore, Md., Convention Center 5s of 2046 were traded 46 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 41 times.

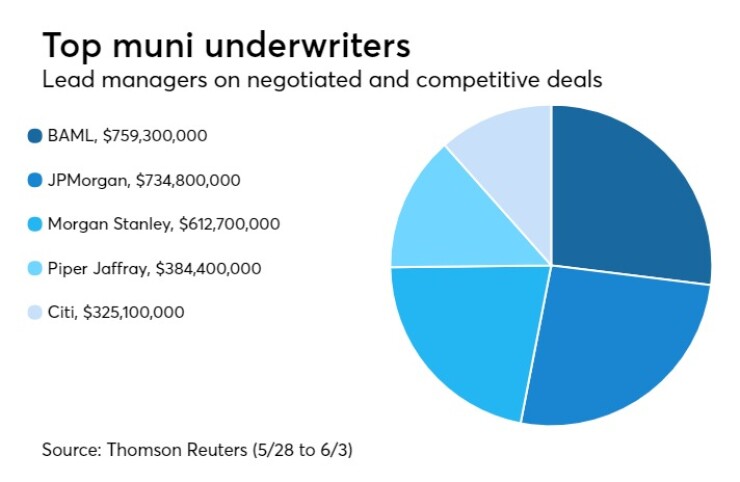

Previous week's top underwriters

The top negotiated and competitive underwriters of last week included Bank of America Merrill Lynch, JPMorgan Securities, Morgan Stanley, Piper Jaffray and Citigroup Lynch, according to Thomson Reuters data.

In the week of May 28 to June 3, BAML underwrote $759.3 million, JPMorgan $734.8 million, Morgan Stanley $612.7 million, Piper Jaffray $384.4 million and Citi $325.1 million.

Primary Market

As is typical, activity is muted on Monday with action set to get underway on Tuesday with the pricing of several large deals in the negotiated, competitive and short-term sectors.

RBC Capital Markets is expected to price the Metropolitan Washington Airports Authority’s $533.79 million of Series 2017A airport system revenue refunding bonds, subject to the alternative minimum tax, on Tuesday.

The deal is rated Aa3 by Moody’s Investors service and AA-minus by S&P Global Ratings and Fitch Ratings.

Barclays Capital is expected to price the East Bay Municipal Utility District, Calif.’s $453.84 million of Series 2017A water system revenue green bonds and Series 2017B water system revenue refunding bonds.

The deal is rated Aa1 by Moody’s, AAA by S&P and AA-plus by Fitch.

Siebert Cisneros Shank is set to price the city of Chicago’s $399.71 million of Series 2017A project and Series 2017B refunding second lien wastewater transmission revenue bonds.

The deal is rated A by S&P and AA-minus by Fitch and Kroll Bond Rating Agency.

BANK of America Merrill Lynch is expected to price the Board of Regents of the Texas A&M University System’s $398.66 million of Series 2017B revenue financing system bonds.

The deal is rated triple-A by Moody’s, S&P and Fitch.

In the short-term negotiated sector, Citigroup is set to price Los Angeles County, Calif.’s $800 million of tax and revenue anticipation notes.

The TRANs are rated MIG1 by Moody’s, SP1-plus by S&P and F1-plus by Fitch.

In the competitive arena on Tuesday, the Virginia College Building Authority is selling $251.04 million of Series 2017A education facilities revenue bonds for the 21st Century College and equipment program.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Seattle, Wash., is selling $239.92 million of Series 2017 drainage and wastewater system improvement and refunding revenue bonds.

The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Orange County, Fla., is selling $202.73 million of Series 2017 tourist development tax refunding revenue bonds.

The deal is rated Aa3 by Moody’s, AA-minus by S&P and AA by Fitch.

And the New Hampshire Bond Bank is selling $118.71 million of Series 2017B revenue bonds.

The deal is rated Aa2 by Moody’s and AA-plus by S&P.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $375.1 million to $12.12 billion on Monday. The total is comprised of $4.94 billion of competitive sales and $7.18 billion of negotiated deals.