A spate of mid-sized deals priced Wednesday as the muni market strengthened ahead of what should be the busiest day of the week.

More than $1.3 billion in bid lists were circulating, according to a New York trader.

“Despite the onslaught of bid lists the liquidity is solid,” he said. “Retail is more active and new deals today have done well.”

Citing the New York City general obligation deal, the trader said there was strong retail demand, while the Ohio deal was likely oversubscribed and repriced at lower yields.

Bank of America Merrill Lynch held the second day of a retail order period on New York City’s $855.405 million of tax-exempt fixed-rate bonds, consisting of Fiscal 2019 Series D Subseries D-1 and Fiscal 2008 Series J Subseries J-1 and J-11 as a reoffering. Institutional pricing will take place on Thursday.

Goldman Sachs priced the state of Ohio’s $188 million of GO highway capital improvements bonds.

The Florida Department of Transportation sold $312 million of turnpike revenue bonds on Wednesday.

Wednesday’s bond sales

Secondary market

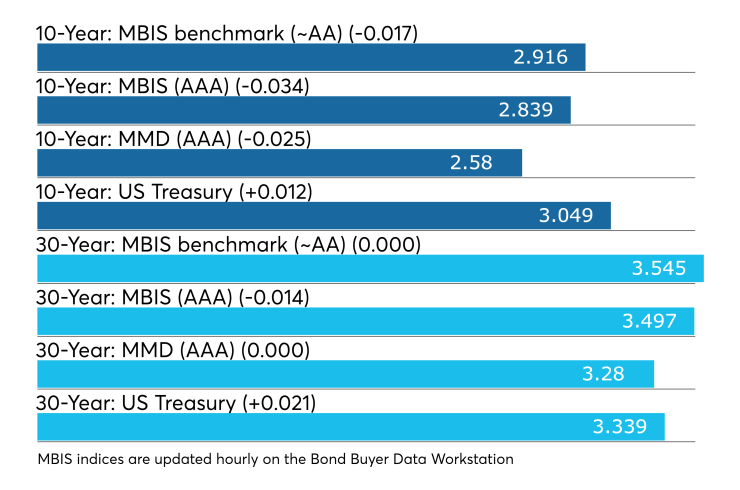

Municipal bonds were mostly stronger on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell no more than one basis point in the three- to 29-year maturities. The remaining three maturities were had yields that were either unchanged or slightly higher, by less than a basis point.

High-grade munis were also mostly stronger, with yields calculated on MBIS' AAA scale decreasing as much as two basis points in the six- to 30-year maturities. The remaining five maturities were either flat or higher by less than one basis point.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation lower by two basis points, while the yield on 30-year muni maturity was flat. Treasurys were little changed as stocks rallied after comments by Federal Reserve Chair Jerome Powell spurred speculation that policy makers were getting closer to ending interest rate increases.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 84.9% while the 30-year muni-to-Treasury ratio stood at 98.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Fed speak

Interest rates are

Treasury auctions

The Treasury Department Wednesday auctioned $32 billion of seven-year notes, with a 2 7/8% coupon and a 2.974% high yield, a price of 99.378525.

The bid-to-cover ratio was 2.55.

Tenders at the high yield were allotted 21.73%. All competitive tenders at lower yields were accepted in full.

The median yield was 2.939%. The low yield was 2.488%.

Treasury also auctioned $18 billion of one-year 11-month floating rate notes with a high discount margin of 0.050%, at a 0.045% spread, a price of 99.989687.

The bid-to-cover ratio was 2.62.

Tenders at the high margin were allotted 93.01%.

The median discount margin was 0.040%. The low discount margin was 0.020%.

The index determination date is Dec. 26 and the index determination rate is 2.370%.

Previous session's activity

The Municipal Securities Rulemaking Board reported 50,615 trades on Tuesday on volume of $11.735 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 17.232% of the market, the Empire State taking 11.584% and the Lone Star State taking 10.784%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.