More municipal volume came to market on Wednesday as yields moved lower in the wake of this week’s supply surge and concerns over the direction of China-U.S. trade talks.

UBS Outlook 2020: Munis looking good

Municipal bonds are looking very good going into 2020, according to UBS Global Wealth Management.

Speaking Tuesday night at the unveiling of UBS GWM’s

“I think because of the tax changes that we saw at the end of 2017, municipal bonds will make a rather substantial comeback in 2020 as a haven for people who have to pay taxes,” he said, citing the loss of large SALT deductions. “Municipal bonds in the United States may have a pretty big year in 2020.”

Sustainable investing was called “the” trend to watch in 2020 and in the coming decade.

“There’s no doubt that sustainable investing is of very high interest across the globe,” said Paula Polito, UBS GWM global client strategy officer. “However, the interest is not keeping pace with investors’ portfolios. So particularly in the U.S., there’s a very high interest yet if you look at anyplace regionally we have the lowest penetration of sustainable investing.”

Speaking on a panel moderated by division vice chair Jolyne Caruso-FitzGerald, she said millennials especially wanted these type of securities in their portfolios.

“So, stay tuned,” Polito said, “I think there will be a lot more upside, not only in the U.S. but certainly globally as investors get more tuned into sustainable investing.”

Sanborn agreed.

“It’s very important we look the trend when we start to see transition in generations in our client base — the new generation of investors coming up care deeply about sustainable investing and the products and offerings that we are involved in,” he said

Primary market

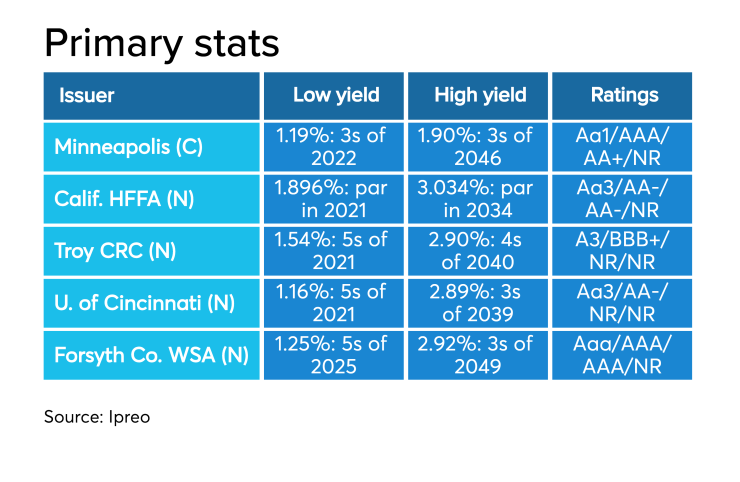

In the competitive arena, Minneapolis, Minn., sold $114.42 million of general obligation green bonds. Morgan Stanley won the deal with a true interest cost of 2.6894%. Ehlers Roseville was the financial advisor; Kennedy & Graven was the bond counsel. Proceeds will be used to finance the building of a new public service center.

Barclays Capital Markets priced the University Of Pittsburgh’s (Aa1/AA+/NR/NR) $400 million of Series 2019A taxable university bonds and $160 million of Series 2017C taxable as a remarketing.

Morgan Stanley priced the New Jersey Health Care Facilities Financing Authority’s (NR/A/A+/NR) $356.41 million of Series 2019 revenue bonds for the Valley Health System Obligated Group.

BofA Securities priced the Troy Capital Resource Corp., N.Y.’s (A3/BBB+/NR/NR) $261.165 million of forward delivery revenue refunding bonds for Rensselaer Polytechnic Institute.

Wells Fargo Securities priced the University of Cincinnati’s (Aa3/AA-/NR/NR) $234.36 million of Series 2019B taxable general receipts bonds and $86.675 million of Series 2019 tax-exempt general receipts bonds.

Citigroup priced the Forsyth County Water and Sewerage Authority, Ga.’s (Aaa/AAA/AAA/NR) $137.55 million of Series 2019 refunding and improvement revenue bonds.

RBC Capital Markets priced the Maricopa County Industrial Development Authority, Ariz.’s (NR:Ba2/AA-:NR/NR/NR) $143.415 million of education revenue bonds for legacy traditional schools projects, consisting of Series 2019A credit enhanced bonds, Series 2019B bonds and Series 2019C taxable bonds.

RBC also priced the Coast Community College District of Orange County, Calif.’s (Aa1/AA+/NR/NR) $167.996 million of Series 2019F Election of 2012 GOs. And RBC priced Colorado’s (Aa2/AA-/NR/NR) $166.1 million of Series 2019O Building Excellent Schools Today (BEST) tax-exempt certificates of participation.

JPMorgan Securities priced the North Carolina Turnpike Authority’s (NR:Aa1/BBB:AA+/BBB:AA+/NR:NR) $400 million of Series 2019 Triangle Expressway System senior lien turnpike revenue bonds and $115.979 million of Series 2019 Triangle Expressway system appropriation revenue capital appreciation bonds. The senior lien maturities of 2042, 2049 and 2055 totaling $159.35 million were insured by Assured Guaranty Municipal and rated AA by S&P Global Ratings.

Raymond James & Associates received the written award on the California Health Facilities Financing Authority’s (Aa3/AA-/AA-/NAF) $500 million of Series 2019 taxable senior revenue social bonds for the “No Place Like Home Program.”

Secondary market

Market participants watched as equities fell off recent highs as investors grew cautious about the pace of Sino-U.S. trade negotiations.

Geo-political issues have grabbed investors’ attention this year, with some participants going so far as to say they have been driving sentiment more than market technicals and economic data.

The market was also cautious ahead of the afternoon release of the minutes for the previous Federal Open Market Committee’s meeting in October.

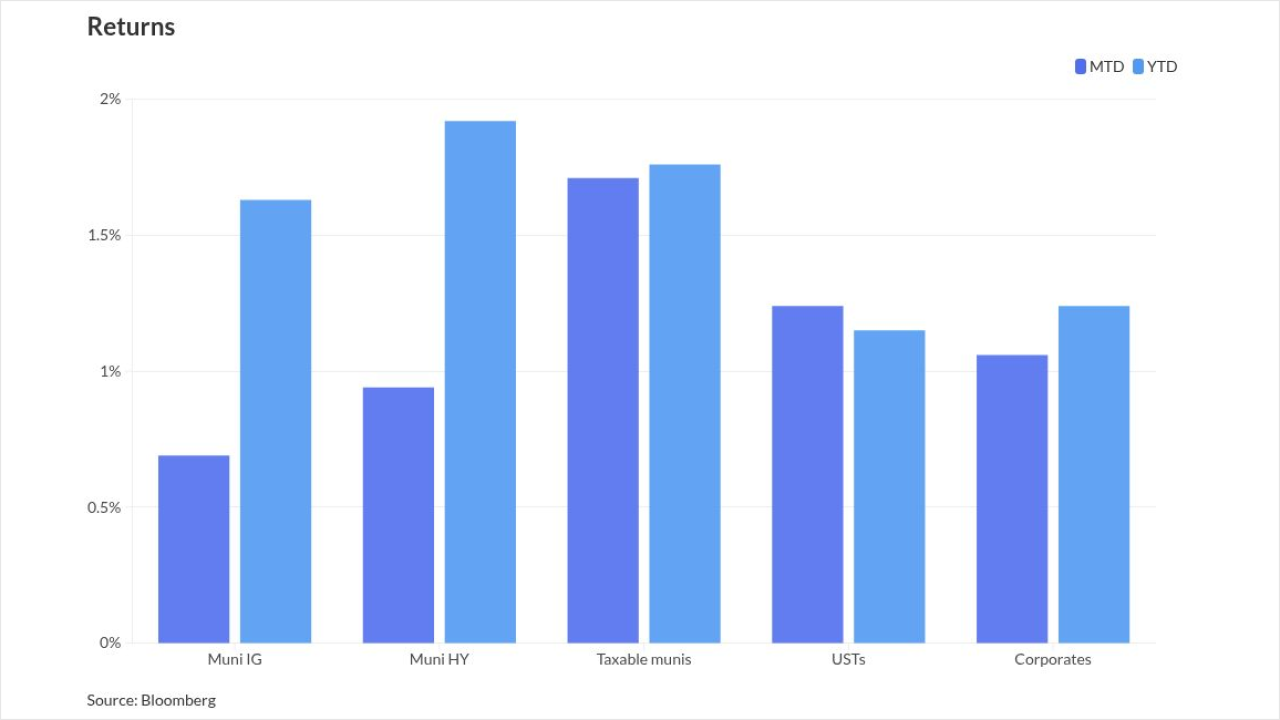

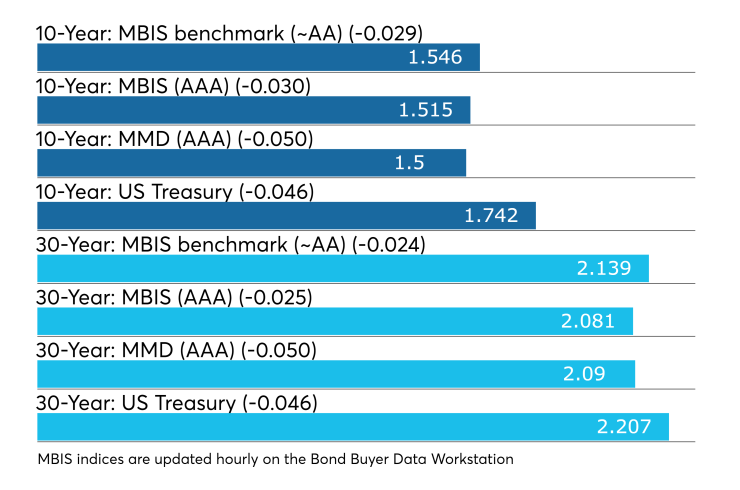

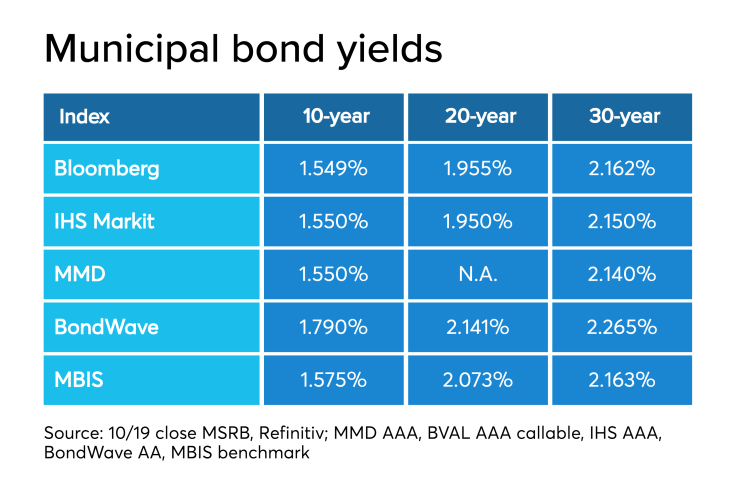

Munis were stronger on the MBIS benchmark scale, with yields falling by two basis points in the 10- and 30-year maturities. High-grades were also stronger, with yields on MBIS AAA scale falling by three basis points in the 10-year maturity and by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO fell five basis points to 1.50% while the 30-year dropped five basis points to 2.09%.

The 10-year muni-to-Treasury ratio was calculated at 86.4% while the 30-year muni-to-Treasury ratio stood at 94.9%, according to MMD.

Stocks were trading lower as Treasuries strengthened. U.S. equities neared all-time highs as the latest earnings reports and economic data lifted spirits. The Dow Jones Industrial Average was down about 0.6% in late trading as the S&P 500 Index fell around 0.5% while the Nasdaq lost almost 0.7%.

The Treasury three-month was yielding 1.574%, the two-year was yielding 1.570%, the five-year was yielding 1.582%, the 10-year was yielding 1.742% and the 30-year was yielding 2.207%.

Previous session's activity

The MSRB reported 35,060 trades Tuesday on volume of $9.25 billion. The 30-day average trade summary showed on a par amount basis of $10.38 million that customers bought $5.81 million, customers sold $2.71 million and interdealer trades totaled $1.86 million.

California, New York and Texas were most traded, with the Golden State taking 13.822% of the market, the Empire State taking 11.016% and the Lone Star State taking 10.97%.

The most actively traded security was the Clark County, Nev., airport Series 2017E revenue refunding 5s of 2027, which traded seven times on volume of $23.97 million.

ICI: Muni funds see $1.8B inflow

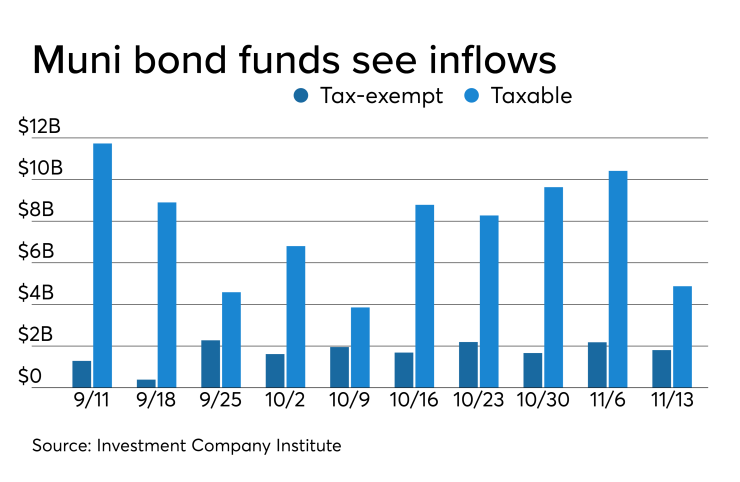

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.806 billion in the week ended Nov. 13, the Investment Company Institute reported on Wednesday.

It was the 46th straight week of inflows into the tax-exempt mutual funds and followed an inflow of $2.182 billion in the previous week.

Long-term muni funds alone saw an inflow of $1.611 billion after an inflow of $1.792 billion in the previous week; ETF muni funds alone saw an inflow of $322 million after a revised inflow of $279 million in the prior week.

Taxable bond funds saw combined inflows of $4.875 billion in the latest reporting week after revised inflows of $10.417 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $6.970 billion after revised inflows of $7.609 billion in the prior week.

Treasury sells CMBs

The Treasury Department Wednesday sold $15 billion of 16-day cash management bills, dated Nov. 26 and due Dec. 12, at a 1.540% high tender rate. The bid to cover ratio was 3.63.

The coupon equivalent was 1.567%. The price was 99.931556. The low bid was 1.450%. The median bid was 1.515%. Tenders at the high were allotted 52.15%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.