SAN FRANCISCO — Moody’s Investors Service downgraded California Housing Finance Agency home mortgage revenue bonds for the second time this year, affecting $5 billion of debt amid the frail state housing market.

Moody’s cut the long-term underlying rating on CalHFA’s home mortgage revenue bonds one notch to Baa2 and in a separate report dropped its issuer rating also one notch to A3. The outlook for both is negative.

The downgrade of the home mortgage revenue bonds affects $5.1 billion of debt while the lowered senior unsecured rating hit $1.1 billion of outstanding bonds.

“The downgrade reflects the ongoing impact of losses due to mortgage delinquencies and foreclosures, and the diminished protection against those losses provided by mortgage insurance,” Moody’s analyst William Fitzpatrick said in a report on the mortgage revenue bonds released late Monday.

Fitzpatrick said the negative outlooks are a result of the uncertainty surrounding mortgage losses because of ongoing high delinquencies and foreclosure rates in California’s housing market and weak economy.

California’s foreclosure rate was the second highest in the country in August, according to RealtyTrac. The Golden State’s unemployment rate stood at around 12%.

“In light of the decline in real estate value in California and continued high unemployment in our state, these actions are not unexpected,” according to Ken Giebel, a spokesman for the Housing Finance Agency.

Giebel said the downgrades will have no impact on agreements with banks or prompt any requirements to post additional collateral.

In June, Moody’s downgraded the long-term underlying rating on CalHFA’s home mortgage revenue bonds to Baa1 from A3 and left the rating on review for downgrade pending a review of an insurer of the program, Genworth Mortgage Insurance Corp.

At the same time, it put CalHFA’s issuer rating on watch for a downgrade.

Moody’s said the ratins drop on the mortgage revenue bonds is partially a result of the downgrade to Ba1 in May of Genworth Mortgage Insurance Corp., which has reinsured around 40% of CalHFA’s single-family mortgage loans that are pledged as repayment for the revenue bonds.

CalHFA’s revenue bonds are also expected to come under pressure from the potential expiration of the federal government’s Temporary Credit and Liquidity Program at the end of the year, Moody’s said.

If it expires without it being replaced or with the associated debt refinanced, the debt would become bank bonds.

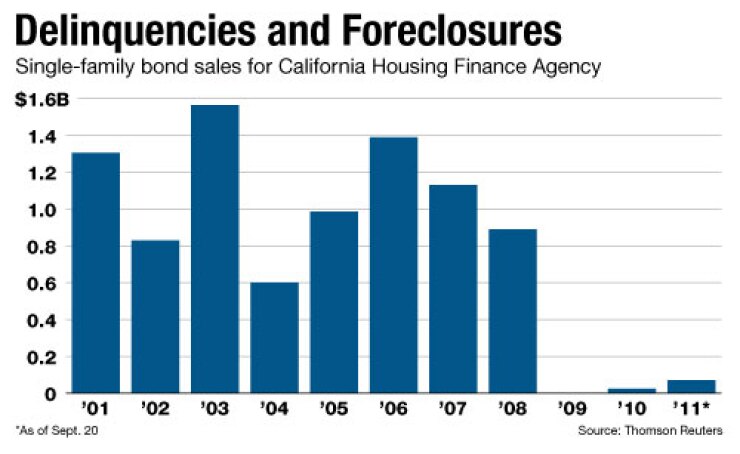

Moody’s said the key source of the housing agency’s losses over the past three years has come from its single-family mortgage portfolio.

The multifamily program remains relatively strong.

CalHFA also has a large amount of interest rate swaps that expose it to counterparty risk and cash-flow problems because it must post collateral, according to the rating agency.

A majority of the mortgage revenue bonds are variable rate, which according to Moody’s adds interest-rate risk as swaps are terminated and rising amounts of debt become unhedged.

Although the revenue bonds are not a general obligation of CalHFA, the housing agency is obligated to make payments on interest rate swaps tied to the revenue bonds.

Moody’s has enhanced ratings of Aaa and VMIG 1 on variable-rate demand obligations tied to the revenue bonds that are based on support from Fannie Mae and Freddie Mac and are unaffected by the downgrade.

Standard & Poor’s rates CalHFA’s home mortgage revenue bonds BBB and the issuer A-minus.

Triple-B rated California HFA mortgage revenue bonds with a 4.40% coupon maturing in 2017 sold on Sept. 15 in an interdealer trade for 99.28 to yield 4.54%, according to trade date provided by the Municipal Securities Rulemaking Board.