Long-term yields on top-rated municipal bonds continued their record breaking decline, according to Municipal Market Data on Wednesday, as the 30-year general obligation fell to another new low.

In the primary, the Bank of America Merrill Lynch won the state of Maryland's $1 billion of top-quality general obligation bonds on a day that saw a large wave of new issues flood into the market and the waiting hands of eager buyers.

Secondary Market

The yield on 30-year munis dropped two basis points to 2.34% from Tuesday's previous record low of 2.36%, according to the final read of MMD's triple-A benchmark scale. Tuesday's prior low on the 30-year was 2.39%, set on May 17.

The yield on 10-year benchmark muni dropped one basis point to 1.60% on Wednesday from 1.61% on Tuesday, according to MMD. It stands 13 basis points above its all-time low of 1.47% set in 2012.

MMD's Senior Market Strategist Daniel Berger said the muni market has been encouraged by Federal Reserve Board Chair Janet Yellen's Monday comments, which it interpreted as possibly pushing off rate hikes until later in the year.

U.S. Treasuries were narrowly mixed on Wednesday. The yield on the two-year Treasury was unchanged from 0.78% on Tuesday, while the 10-year Treasury yield slipped to 0.70% from 1.71% and the yield on the 30-year Treasury bond decreased to 2.51% from 2.53%.

The 10-year muni to Treasury ratio was calculated at 94.0% on Wednesday compared to 94.0% on Tuesday, while the 30-year muni to Treasury ratio stood at 93.2% versus 93.1%, according to MMD.

Primary Market

BAML won Maryland's $1.04 billion of GO State and Local Facilities Loan of 2016, First Series bonds with a true interest cost of 2.17%.

The issue was priced to yield from 0.82% with a 5% coupon in 2019 to 2.69% with a 3% coupon in 2031.

Traders said the deal met with a warm reception from buyers.

"Since it was a competitive deal, technically you don't get an oversubscription, but it was bid 'aggressively' in the sense that it was through the MMD scale in a few maturities," said one New York trader. "However, that's not surprising because while rates are at historical lows, the ratios still look attractive."

The deal is rated triple-A by Moody's Investors Service, S&P Global Ratings and Fitch Ratings.

Seattle, Wash., sold $164.95 million of Series 2016 drainage and wastewater system improvement and refunding revenue bonds. Morgan Stanley won the bonds with a TIC of 2.92%. The issue was priced to yield from 0.40% with a 5% coupon in 2016 to 2.63% with a 4% coupon in 2039; a 2041 maturity was priced as 4s to yield 2.65% and a 2046 maturity was priced as 4s to yield 2.70% the deal is rated Aa1 by Moody's and AA-plus by S&P.

Clark County, Nev., competitively sold $107.35 million of Series 2016 highway revenue motor vehicle fuel tax refunding bonds. Raymond James won the bonds with a TIC of 1.38%. The issue was priced as 5s to yield from 0.82% in 2018 to 1.60% in 2024. The deal is rated Aa3 by Moody's and AA-minus by S&P.

The Fayetteville Public Work Commission, N.C., sold $114.41 million of Series 2016 revenue bonds. Wells Fargo Securities won the bonds with a TIC of 2.49%. The issue was priced to yield from 0.63% with a 5% coupon in 2017 to approximately 3.072% with a 3% coupon in 2041. The deal is rated Aa2 by Moody's and AA by S&P and Fitch.

Nassau County, N.Y., sold $141.45 million of Series 2016C general improvement bonds. Citigroup won the issue with a TIC of 3.38%. The issue was priced as 5s to yield from 0.82% in 2018 to 2.83% in 2043. The deal is rated A2 by Moody's, A-plus by S&P and A by Fitch.

In the negotiated note sector, Nassau County sold $159.9 million of bond and revenue anticipation notes. Morgan Stanley priced the $5.17 million of Series 2016B BANs as 3s to yield 0.85% in 2017; the $35.13 million of Series 2016C taxable BANs at par to yield 1.10% in 2016; and the $119.60 million of Series 2016A RANs as 2s to yield 0.70% in 2016. The notes are rated SP1-plus by S&P and F1 by Fitch.

In the negotiated sector on Wednesday, Piper Jaffray priced the Pennsylvania Turnpike Commission's $408.11 million of Series 2016 A1 and A2 turnpike revenue bonds.

The $267.33 million of Series A1 bonds were priced to yield from 1.29% with a 3% coupon in 2020 to 2.86% with a 5% coupon in 2036; a 2041 maturity was priced as 5s to yield 2.98% and a 2046 term bond was priced as 5s to yield 3.03%. The $140.78 million of Series A2 variable-rates were priced at par in 2017 and 2018 to yield about 50 and 60 basis points, respectively, over the one-month LIBOR. The deal is rated A1 by Moody's and A-plus by S&P.

Citigroup priced the San Diego County Water Authority's $296.51 million of Series 2016A and B water revenue refunding bonds.

The $98.91 million of Series 2016A tax-exempt green bonds were priced as 5s to yield from 2% in 2030 to 2.12% in 2033. The $197.6 million of Series 2016A tax-exempt bonds were priced as 5s to yield 1.63% in 2026 and 1.76% in 2027 and to yield from 2.17% in 2034 to 2.33% in 2038. The bonds are rated Aa2 by Moody's, triple-A by S&P and AA-plus by Fitch.

Not only was this the first time the SDCWA hit the market with a AAA rating, it was also the authority's first green bond sale.

"The sale went very, very well, in particular the green bond portion," said Lisa Marie Harris, finance director, SDCWA. "We had over $650 million in orders, so we were way oversubscribed and we were able to achieve 18.5% of present value savings or $63.2 million."

Harris cited the syndicate team at Citi, the new triple-A rating and the timing of the sale, as the market saw yet another 30-year record low on the MMD scale, as reasons for the successful sale.

"We did well and even got a strong retail showing from mom and pop investors, including new investors who did not have our paper prior to today," she said. "Obviously the AAA rating shows we are a very a strong credit but there are still challenges that we have to face."

Though the water authority, along with other California issuers, is still challenged by the drought, Harris said the sale demonstrates the improvement of the authority's debt portfolio and shows it is able to take advantage of opportunities for savings.

On Tuesday, Morgan Stanley priced the SDCWA's $87.69 million of Series 2016S-1 subordinate lien water revenue refunding bonds. The deal was priced as 3s and 5s to yield 1.07% in a split 2021 maturity. That deal was rated Aa3 by Moody's, AA-plus by S&P and AA by Fitch.

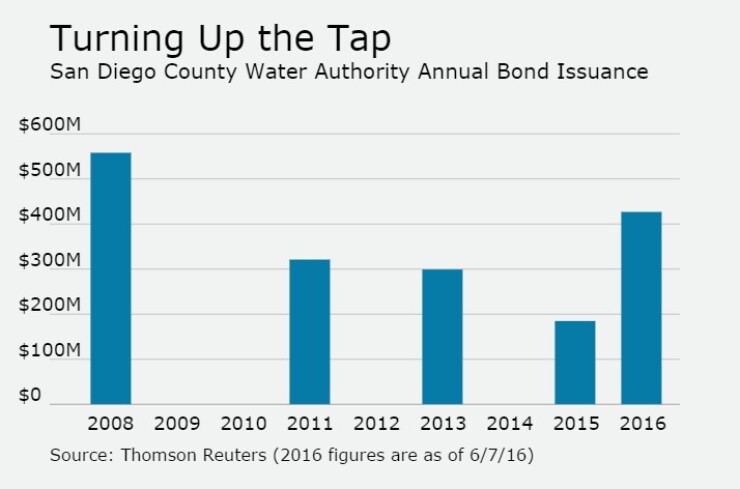

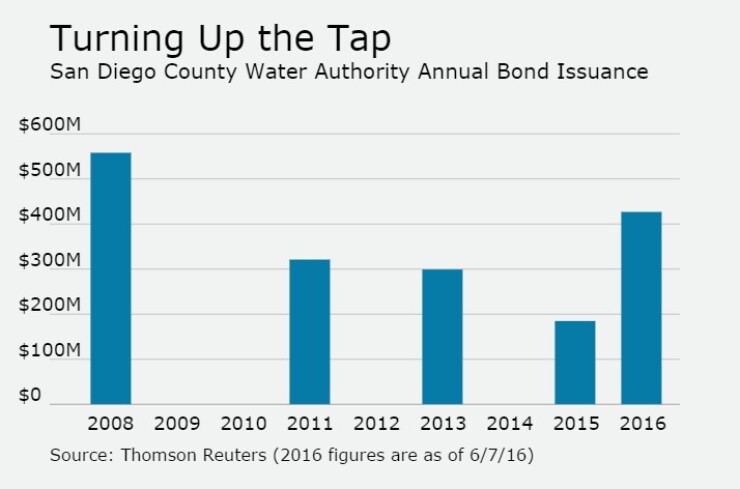

Since 2008, the SDCWA has sold about $1.79 billion of debt, with the most issuance occurring in 2008 when it issued $558 million. The SDCWA saw a low year of issuance in 2015, when it came to market with $185 million. The authority did not sell bonds in 2009, 2010, 2012 or 2014.

Goldman Sachs priced the Massachusetts Development Finance Agency's $233.20 million of Series 2016N revenue bonds for the Dana-Farber Cancer Institute. The issue was priced as 5s to yield from 2.35% in 2029 to 2.68% in 2036 and to yield 2.76% in 2041 and 2.81% in 2046. The deal is rated A1 by Moody's and A by S&P.

BAML priced the California Statewide Communities Development Authority's $219.91 million of Series 2016 revenue bonds for John Muir Health.

The issue was priced as 5s to yield 1.77% in 2025, as 5s to yield 2.04% in 2027, as 3s to yield 3.03% in 2035 and 3.05% in 2036, as 5s to yield 2.68% and as 4s to yield 3.07% in a split 2041 maturity, as 5s to yield 2.71% and as 4s to yield 3.11% in a split 2046 maturity and as 5s to yield 2.81% and as 4s to yield 3.24% in a split 2051 maturity. The deal is rated A1 by Moody's and A-plus by S&P.

Citi priced the Board of Regents of the University of Texas System's $213.19 million of Series 2016D revenue financing system bonds.

The issue was priced to yield from 0.65% with a 2% coupon in 2017 to 1.75% with a 5% coupon in 2026. The deal is rated triple-A by Moody's, S&P and Fitch.

Barclays Capital priced the Lower Colorado River Authority, Texas' $188.39 million of Series 2016 transmission contract refunding revenue bonds for the LCRA Transmission Service Corp. Project.

The issue was priced to yield from 0.67% with a 3% coupon in 2017 to 2.91% with a 4% coupon in 2035; a 2038 maturity was priced as 3s to yield 3.125%, a 2042 maturity was priced as 4s to yield 3.06% and a 2046 maturity was priced as 5s to yield 2.77%. The deal is rated A by S&P and A-plus Fitch.

Goldman Sachs priced the California Educational Facilities Authority's $170.35 million of Series U7 revenue bonds for Stanford University. The issue was priced as 5s to yield 2.71% in 2046. The deal is rated triple-A by Moody's, S&P and Fitch.

JPMorgan Securities priced the McAllister Academic Village LLC's $119.4 million of Series 2016 revenue refunding bonds for the Arizona State University's Hassayampa Academic Village project. The issue was priced as 5s to yield from 1.21% in 2020 to 2.75% in 2039. The deal is rated A1 by Moody's and AA-minus by S&P.

On the short-term negotiated calendar, Wells Fargo priced Los Angeles County, Calif.'s $800 million of 2016-17 tax and revenue anticipation notes. The TRANs were priced as 3s to yield 0.67% in 2017. The notes are rated MIG1 by Moody's, SP1-plus by S&P and F1-plus by Fitch.

Piper Jaffray priced the state of Idaho's $500 million of Series 2016 tax anticipation notes. The TANs were priced as 2s to yield 0.72% in 2017. The deal is rated MIG1 by Moody's, SP1-plus by S&P and F1-plus by Fitch.