Minnesota will sell its annual new money bond deal this summer with some positive fiscal momentum after adopting pension system changes that for the time being bolster the system’s health.

The

“This bipartisan legislation stabilizes pension benefits for 511,000 workers, retirees, and their families,” Gov. Mark Dayton said in a statement after signing the Omnibus Pension and Retirement Bill on May 31.

The package carried the endorsement of pension fund boards, retiree associations, and local government organizations, and no one has publicly threatened a legal challenge to the benefit cuts.

The benefit, funding, and actuarial changes enacted in

The overhaul is designed to put the state on path to fully fund its pensions within 30 years. The

“We believe these changes will result in improved funding levels, which we view as a credit positive,” S&P Global Ratings analyst Cora Bruemmer wrote June 7. "We expect plan funded levels to improve based on Governmental Accounting Standards Board standards due to benefit reforms along with increased employer and employee contributions.”

S&P does not believe local employers will be strained by the increased funding levels because the state will help locals out and state coffers are flush.

But the state remains at risk that gains could be reversed and unfunded liabilities will rise because contributions will continue to be tied to a statutory formula instead of an actuarial funding formula. Also, plan actuarial assumptions are more conservative than they once were, but many plans in other states are even more so, Bruemmer said.

“We think it likely that the legislature will need to make additional adjustments to the plans to keep from lagging behind actuarial requirements,” the report said.

S&P said it can’t predict how soon action might be needed and questioned whether there will “be the political willingness to do so at that time.”

Political gridlock has long wreaked havoc on Minnesota budgeting, in some cases driving government shutdowns. An inability to agree on fixes to erase past red ink led to the use of one-shots that drove up the state’s structural deficits and contributed to the state’s loss of its triple-A ratings.

Dayton – of the state’s Democrat-Farmer-Labor Party – pushed through an income tax hike on top earners in 2013 when he enjoyed a legislative majority. He is not seeking re-election in November.

The state has since enjoyed healthy surpluses and has rebuilt its reserves that currently hold about $2 billion. Republicans now control the legislature and the most recent sessions have been contentious.

PENSION CHANGES

The package covers all statewide cost-sharing, multiple-employer pension plans. Members include teachers, firefighters, judges, pilots, and other state and local government employees, and the changes impact 173,000 retirees and 511,000 beneficiaries. It evolved over the last three years from the work of the Legislative Commission on Pensions and Retirement with input from pension funds and other stakeholders.

Most local government and state employees are members of the Minnesota State Retirement System, the Public Employees Retirement Association of Minnesota, which primarily covers local government general and public safety employees, and the Minnesota Teachers Retirement Association.

Contributions have fallen short of actuarially determined contributions despite changes made to the system every few years to try to rein in costs, and funding levels took a hit in 2016 due to poor returns and new reporting standards that impacted how discount rates and other assumptions were counted. Overall, the systems combined dropped to just a 53% funded ratio but most gained ground in 2017.

Dayton convened a pension blue ribbon panel to address growing concerns in 2016 and the drop in funded ratios helped drive the political support for action.

Dayton opposed a 2016 package and a 2017 package because one included measures that would have limited local government power on various work rules and the other lacked higher contributions.

Dayton wrote to House Speaker Kurt Daudt, R-Crown, in April about the urgency of passing the plan already adopted by the Senate. “Setting our pension plans on a course to continued stability will be viewed favorably by rating agencies, improve our state's finances, and keep our promises to hundreds of thousands of workers and retirees, who are depending on us to solve this problem,” Dayton wrote.

The package phases out some early retirement benefits, reduces some cost-of-living adjustments, and eliminates the COLA trigger which increased COLAs to 2.5% per year if a 90% funded ratio was achieved. The new COLA falls between 1% and 1.5%, depending on the plan.

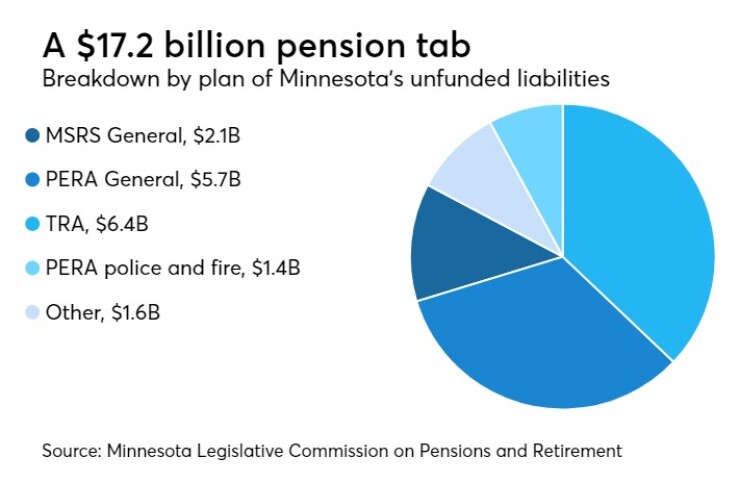

The Minnesota Legislative Commission on Pensions and Retirement projects the cuts will reduce unfunded liabilities by $3.4 billion across all of the plans while additional savings of $2.7 billion are expected over a 30-year amortization period.

Increased contributions being phased in for most of the plans are modest and designed so that most of the plans reach a 100% funded ratio within 30 years on an actuarial basis. The increased contributions should help improve near-term funded ratios but contribution levels remain fixed in statute based on a percentage of payroll leaving the state open to future underfunding, S&P stressed.

The package cuts the assumed rate of investment returns to 7.5%. The plans have been using either an 8% or 8.5% rate. While any reduction is viewed positively by the market and analysts, some have warned 7.5% is too high.

Pew’s April review of states’ 2016 figures put the median return assumption at 7.5%, but said state pension plans had generated just 6% returns over the past decade and various projections suggest the average will land around 6.5% over the next decade. If states had used the 6.5% rate, net pension liabilities of $1.4 trillion would have jumped by another $382 billion.

The Minnesota package also altered assumptions tied to payroll growth, salary increases, and mortality scales.

The state will provide $9.5 million annually in 2019 and 2020 and $14 million annually beginning in 2021 to subsidize the higher local government funding demands. State aid to districts will rise to help offset their higher contributions.

The total costs to the state for higher contributions and aid is $27 million in fiscal 2019 and then $114 million in the next biennial budget. S&P views the costs as affordable given a February revenue forecast that projected a $329 million surplus in the current biennium that runs through June 30, 2019 and a $251 million in the next biennium.

SESSION

Dayton this year signed a $1.5 billion capital budget known as the “bonding bill” despite his anger over the funding mechanism and spending levels he warned fall short of what’s needed for higher education, public lands, and environmental work.

He had proposed a $1.5 billion plan but he wanted to fund most of the infrastructure projects with borrowing. The approved legislation uses about $800 million of borrowing while dipping into non-general funds for the remainder.

“I am signing this bill, despite my objections, because areas throughout Minnesota need the projects and the jobs which it will provide,” Dayton wrote in a letter to legislative leaders.

The state returns to the market in August with its annual general obligation sale that will provide financing for the new bonding bill and past ones. “We are still determining the size, but it will all be new money, no refundings,” said Minnesota Management Budget spokesman Keith Hovis.

The state opened the biennium with a $3.3 billion balance and has nearly $2 billion in reserves.

Minnesota got back its AAA rating from Fitch Ratings in July 2016. Moody's Investors Service and S&P rate the state Aa1 and AA-plus.

A Nuveen Asset Management report earlier this year highlighted the market’s strong regard for the state's paper but had warned that pensions were a sore spot. State GOs consistently trade within 10 basis points of national AAA benchmark yields. “We expect Minnesota municipal debt will continue to see strong demand due to favorable credit perceptions and relatively high state income tax rates,” the report said.