CHICAGO – The Midwest lagged behind the national uptick in municipal bond issuance last year as issuers there held back on new money borrowing.

Overall, Midwestern borrowers sold $70.5 billion of municipal bond debt in 4,331 transactions last year, up 10% from the $64 billion of volume in 3,684 deals a year earlier, according to data from Thomson Reuters. Issuance levels were strongest in the second quarter when $19.5 billion was sold.

The increase fell short of the 19% national gain, but it marked a second year in which the region's issuance picked up steam. Midwest volume increased 6.9% in 2014 after sinking in 2013 by 18%.

Refundings totaling $29.4 billion outpaced new money debt of $28.8 billion as issuers took advantage of low interest rates. Combined deals totaled another $12.3 billion. New money was off 2.9% while refunding jumped 28.2%.

New money tapered off only in the Midwest and Far West regions in 2015.

"While the Midwest didn't break any issuance records, the region took a forward bounce for bond supply during the course of the year," said Richard Ciccarone, president of Merritt Research Services LLC.

"As a productive force in building infrastructure, the news wasn't so good. Most of the increase was attributable to refundings, especially education, issued by school districts," he said.

"There is still plenty of pent up demand for infrastructure rebuilding however state and local governments remain cautious about taking on tax supported debt due to slow economic growth in the region and a culture that is more resistant to debt," Ciccarone said.

Even North Dakota, which increased its debt issuance over the previous year at the second fastest rate in the region, is more than likely going to scale back its borrowing in line with the slowdown in the oil production that has driven its economy, Ciccarone said.

North Dakota issuance was up 60% to reach $1.2 billion.

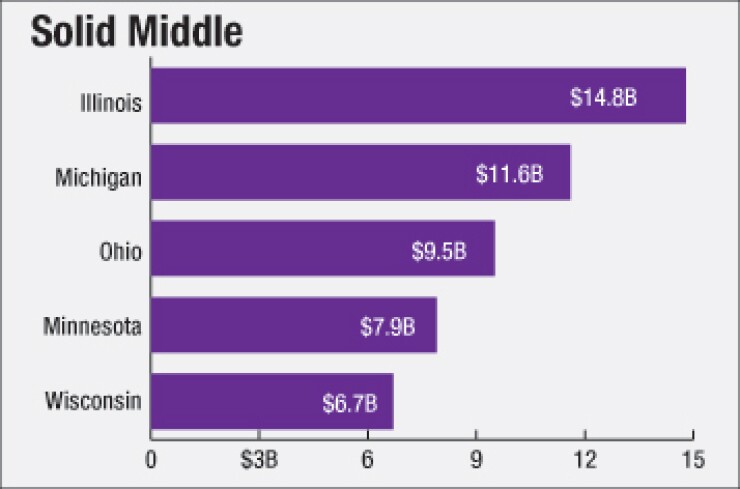

Deals from Illinois accounted for $14.8 billion of overall volume, up 13.6% from 2014, followed by Michigan where $11.6 billion was borrowed, up 27.3%. Ohio's $9.5 billion of debt marked a 14.1% drop from 2014. Minnesota followed with $7.9 billion of debt, up 11.8%. Borrowing also slowed in Missouri, Nebraska, and South Dakota, while increasing in Indiana, Iowa, and Wisconsin.

Education-related transactions topped sector based borrowing and saw a big 35.9% leap to $24.3 billion. General purpose bonding followed with $12.4 billion, up 14% with healthcare issuance at $9.3 billion, a 22.4% increase. Electric power and housing issuance also posted increases while development, environmental facilities, transportation, and utility bonding declined.

Refundings drove the healthcare jump, said HFA Partners. Its database put national issuance by acute care hospitals at about $18 billion, up more than 50% from 2014, excluding private placements and floating-rate and tax-supported issues.

"The higher issuance volumes are attributed in large part to a spike in refundings as rates continue to hover near record lows and more existing bond issues become currently callable," HFA said in a recent report.

The firm believes that the hike in the federal funds rate could spur some hospitals to act on issuing new money debt for capital projects over concerns that rates could be on the rise. Other market participants suggested that could be the case in other sectors also.

The Michigan Finance Authority was one of the most active borrowers, floating hospital deals for the Sparrow Group, Beaumont, McLaren and other major Michigan providers. Health care issuance represented one of the most active areas for MFA debt sales, state officials said.

The use of private placements continued to grow, rising 13.5% to account for $6 billion of Midwestern borrowing last year. Debt Thomson Reuters categorized as being backed by revenues accounted for $40.3 billion of volume while general obligation bonds represented the remaining $30.1 billion.

Chicago's $1.95 billion sale of O'Hare International Airport bonds in October topped the list of largest Midwest offerings of 2015. The issue mostly refunded outstanding debt with about $300 million of new money raised. The city promoted the airport's recent growth spurt, improved credit, and conservative debt portfolio, and segregation from the city's more troubled corporate fund as it headed into the market with a deal led by JPMorgan and Loop Capital Markets.

The region's second-biggest deal, Chicago's $1.1 billion July GO deal, was billed by the city finance team as a "cleanup" issue primarily for near term budget relief at the expense of its long-term debt load. Morgan Stanley ran the books. The largest Midwest deal outside Illinois came from the state of Minnesota's largest-ever deal in August, when it issued $1.1 billion of new money and refunding GOs.

The Michigan State Building Authority followed with its $990 million sale led by JPMorgan. The revenue-backed deal also marked the building authority's largest deal to date. Moody's upgraded the bonds to Aa2 from Aa3, linked off Michigan's GO rating.

Ahead of the sale, Moody's upgraded the state's GOs one notch to Aa1. Moody's and Standard & Poor's downgraded Michigan from triple-A in 2003 and Gov. Rick Snyder has repeatedly said one of his goals is to regain the top ratings the state enjoyed before its downward spiral began. Snyder did not propose a new deposit of funds into the state's rainy day account in fiscal 2017, which could stall any further positive credit momentum.

The Illinois State Toll Highway Authority was one of the big new money borrowers selling $800 million in two deals.

Several big issuers are expected to keep up their pace of borrowing in 2016. New money should continue to flow from the Illinois toll authority as a $12 billion capital program continues.

Chicago has already sold a $500 million GO refunding with plans for another $3.6 billion of new money, refunding, and restructuring GO and revenue-backed borrowing in its 2016 pipeline. That number could grow with a possible O'Hare sale now that its airlines have signed off on the next phase of the airport's $8 billion O'Hare Modernization Program runway configuration and expansion plan .

Illinois, once a top issuer as it borrowed heavily to fund a now expiring $31 billion capital program, has lagged. That's not expected to change this year as the state's ongoing fiscal 2016 budget impasse has pushed work on a new capital program to the backburner.

Bank of America Merrill Lynch and JPMorgan ran away with the lead spots among senior managers with B of A Merrill taking the top spot with $4.4 billion of bonds and JPMorgan following as senior manager of $4.1 billion.

Regional based firms fared better than last year as Piper Jaffray finished third, credited with leading deals valued at $2.6 billion, followed by Stifel Nicolaus with $2.4 billion, Robert W. Baird and Co. with $2.3 billion, and RBC Capital Markets with $2.2 billion. Citi, the top finisher last year in the region, ranked 7th with $1.8 billion.

Public Financial Management easily topped the league table of Midwest financial advisors, credited with $6.1 billion of business. Second-place Stauder Barch advised on $1.8 billion of deals, Ehlers & Associates followed with $1.4 billion, Baird with nearly $1.4 billion, and Acacia Financial Group with $1.2 billion.

Chapman and Cutler LLP easily recaptured the top spot among bond counsel credited with $3.4 billion of deals, followed by Gilmore & Bell PC with $2.5 billion, and Ice Miller with $2.2 billion. Quarles & Brady LLP and Miller Canfield Plc rounded out the top five.