Most of the week's largest deals came into a stronger market on Wednesday, as the U.S. municipal fixed income market was hitting on all cylinders.

Modest domestic economic growth, reasonable inflation, lackluster new-issue supply and sound fundamentals continue to drive investors into the tax-exempt bond market, according to Rob Amodeo, portfolio manager, at Western Asset.

"This performance further stems from new limitations on State and Local Tax Deductions (SALT), which increase the value of tax-exempt income. Also, tax-adjusted municipal yields also are attractive for maturities beyond 10 years," he said. "The muni market has distinct seasonal trends that can make investing timing important. Demand for tax-exempt income overwhelmed the usual selling in the secondary market during tax season, specifically in April, when flows into municipal bond funds and separately managed accounts surged."

He added that although the breath of the market feels thin, he expects municipals to continue performing relatively well.

"Under most conditions, demand tends to remain good during times of steady returns and low volatility," Amodeo said. "Demand tends to fade when investors confront negative returns and high volatility. Solid price returns, along with low market volatility, support further gains. If anything, munis might benefit from a flight-to-quality from riskier assets."

Western Asset is pursuing broad strategies, including sensitivity to rate risk, or duration, and is neutral to their respective benchmarks. For intermediate and long-duration portfolios, they said they continue to have a bias to the 10- to 20-year maturity range of the municipal curve.

"A steep ratio curve makes them look attractive versus other maturity ranges," he said. "We expect long ratios to be in a tight range during the intermediate future. In the short term, they may soften slightly before going lower."

Amodeo noted that on the short-end, maturities less than five years, the slope of the curve is extremely flat. That area of the curve is a little more vulnerable to modest steepening.

"Shorter maturities are also showing tight quality spreads and lower yield ratios," he said. "We see value in floating-rate bonds. They offer higher yields with less rate risk than most short-duration fixed coupon bonds. We also continue to see spreads tight to fair value in high yield, making that segment of the market more vulnerable to an outflow cycle."

As far as matters that may interrupt smooth sailing include elevated price volatility due to fiscal and monetary policy uncertainty, uneven U.S. and/or global growth, volatile inflation sentiment or geopolitical uncertainties.

"So far, steady tax receipts combined with reasonable spending are good signs for municipal budgets," Amodeo said. "Any near-term risks to valuations will likely come from less favorable balances between supply and demand."

Primary market

Goldman Sachs received the official award on the Port of Port Arthur Navigation District of Jefferson County, Texas’ (Aaa-VMIG1/NR/NR) $315 million of Series 2018 exempt facilities revenue bonds for Emerald Renewable Diesel as a remarketing. Susquehanna Group Advisors is the financial advisor; McCall Parkhurst & Horton is the bond counsel. The bonds, due June 1, 2049, are subject to a mandatory tender on Oct. 3.

Morgan Stanley priced the North Orange County Community College District of Orange and Los Angeles Counties, California's (Aa1/AA+/NR) $150 million of Election of 2014 Series B general obligation bonds on Wednesday.

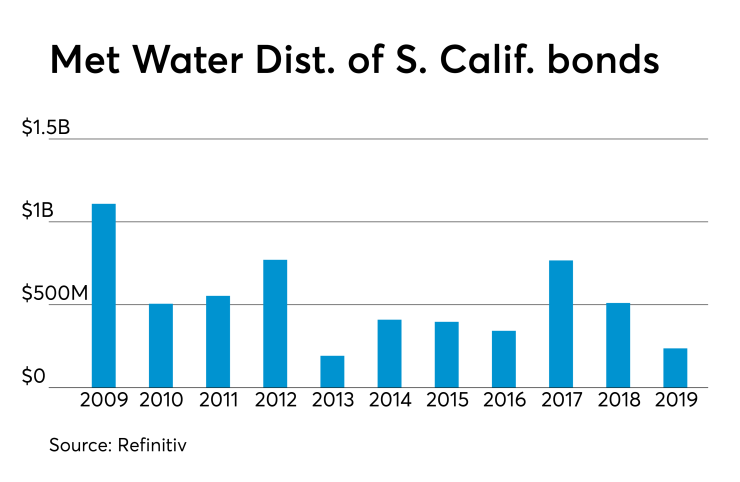

In the competitive arena, the Metropolitan Water District of Southern California (NR/AAA/AA+) sold $220.4 million of Series 2019A water revenue refunding bonds. JPMorgan Securities won the issue with a true interest cost of 2.7357%.

Proceeds will be used to current refund some outstanding debt. Public Resources Advisory Group is the financial advisor; Stradling Yocca and Alexis S.M. Chiu are the bond counsel.

Since 2009, the district has offered about $5.8 billion of bonds, with the most issuance occurring in 2009 when it sold $1.1 billion. It issued the least amount of bonds in 2013 when it sold $192 million.

Hillsborough County, Florida, sold $142.72 million of Series 2019 capital improvement non-ad valorem revenue bonds. Wells Fargo Securities won the issue with a TIC of 3.118%.

Proceeds will be used to finance and/or reimburse the costs of the acquisition, construction, reconstruction, expansion and equipping of various capital projects. Public Resources Advisory Group is the financial advisor; Bryant Miller and Llorente & Heckler are the bond counsel.

Wednesday's bond sales

Secondary market

Munis were mixed on the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GOs decreased two basis points to 1.69% while the yield on the 30-year muni fell four basis points to 2.37%.

The 10-year muni-to-Treasury ratio was calculated at 75.6% while the 30-year muni-to-Treasury ratio stood at 88.6%, according to MMD.

Treasuries were stronger as stocks fell. In late Treasury trading, the three-month was yielding 2.353%, the two-year was yielding 2.077%, the 10-year was yielding 2.239% and the 30-year was yielding 2.673%. The two-year hit its lowest point since Feb. 2018.

Previous session's activity

The MSRB reported 37,132 trades Tuesday on volume of $10.25 billion. The 30-day average trade summary showed on a par amount basis of $12.36 million that customers bought $6.09 million, customers sold $4.12 million and interdealer trades totaled $2.15 million.

California, Texas and New York were most traded, with the Golden State taking 13.227% of the market, the Lone Star State taking 13.099% of the market, and the Empire State taking 8.972%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. restructured A-1 revenue zeros of 2046, which traded 94 times on volume of $23.61 million.

ICI: Muni funds see $1.8B inflow

Long-term municipal bond funds and exchange-traded funds took in a combined inflow of $2.080 billion in the week ended May 22, the Investment Company Institute reported on Wednesday.

It was the 20th straight week of inflows and followed an inflow of $1.819 billion into the tax-exempt mutual funds in the previous week.

Long-term muni funds alone saw an inflow of $1.934 billion after an inflow of $1.764 billion in the previous week; ETF muni funds alone saw an inflow of $146 million after an inflow of $54 million in the prior week.

Taxable bond funds saw combined inflows of $2.485 billion in the latest reporting week after outflows of $138 million in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $7.835 billion after outflows of $11.423 billion in the prior week.

Morningstar set to acquire DBRS for $699M

Morningstar Inc. plans to acquire credit rating agency DBRS for $669 million, the firm said on Wednesday. The deal is expected to close early in the third quarter.

Morningstar intends to name a leader of the combined businesses by the time the deal closes.

New Jersey HESAA to sell $286M next week

The state of New Jersey’s Higher Education Student Assistance Authority is scheduled to issue $286.37 million in student-loan revenue bonds, to be backed by a pool of loans underwritten and serviced by the state’s post-secondary financial assistance body.

The Series 2019 revenue bonds will be issued through a 17-tranche capital structure transaction, with preliminary Aa1 ratings for all but a single subordinate tranche by Moody’s Investors Service.

The new series is rated below the Aaa rating Moody’s assigned HESAA’s previous issuance in 2018, due to lower levels of enhancement supporting the note structure, according to the agency.

The collateral will include $147.3 million in well-seasoned loans that were part of HESAA’s 2009 issuance, as well as up to $155 million in new loans that the trust will originate through an Oct. 31, 2020 prefunding and recycling period for the next academic calendar year.

Moody’s states the loans to be acquired during the prefunding/recycling period will be “high-quality collateral,” similar to loans already acquired by the trust with a weighted average FICO credit score of 742 at origination, with nearly 87% with co-signers or co-borrowers. The pool will have a very low exposure to for-profit schools of only 2.2%, minimizing exposure to the high default risks associated with those institutions, according to Moody’s.

The identified loans have an outstanding principal balance of $14,571, with a weighted average annual interest rate of 8.38%. The remaining terms are 132 months.

The deal's initial overcollateralization is 3.53%, lower than the 4.85% in investor protection afforded HESAA's 2018 triple-A rated issuance.

The pool will consist of undergraduate fixed-rate loans, graduate loans, refinanced loans and consolidation loans. The loans are underwritten to New Jersey College Loan to Assist State Students (NJCLASS) guidelines that must be met by borrowers or co-signers, such as minimum income levels, a minimum 670 FICO (with detailed credit history review).

About 20% of the 2009 loans have FICOs below 670 since they were issued before the HESAA tightened underwriting guidelines in 2012. But the 2009 loans being transferred to the trust are loans with approximately 80 payments of history, and “are past their peak default periods, which typically occur three to five years after the loan enters repayment,” according to Moody’s.

None of the existing loans in the pool are enrolled in New Jersey’s new Household Income Affordable Repayment Plan, which allows for borrowers to reduce maximum monthly payments to 15% of the household income beyond a 150% threshold over federal poverty guidelines. Under HIARP, repayment terms can be extended out to 25 years, with any remaining principal forgiven after that period.

Treasury auctions

The Treasury Department Wednesday auctioned $32 billion of seven-year notes, with a 2 1/8% coupon and a 2.144% high yield, a price of 99.877109.

The bid-to-cover ratio was 2.30.

Tenders at the high yield were allotted 69.05%. All competitive tenders at lower yields were accepted in full.

The median yield was 2.090%. The low yield was 2.000%.

Treasury also auctioned $18 billion of one-year 11-month floating rate notes with a high discount margin of 0.140%, at a 0.139% spread, a price of 99.997198.

The bid-to-cover ratio was 2.84.

Tenders at the high margin were allotted 94.23%.

The median discount margin was 0.130%. The low discount margin was 0.080%.

The index determination date is May 20 and the index determination rate is 2.335%.

Gary E. Siegel and Glen Fest contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.