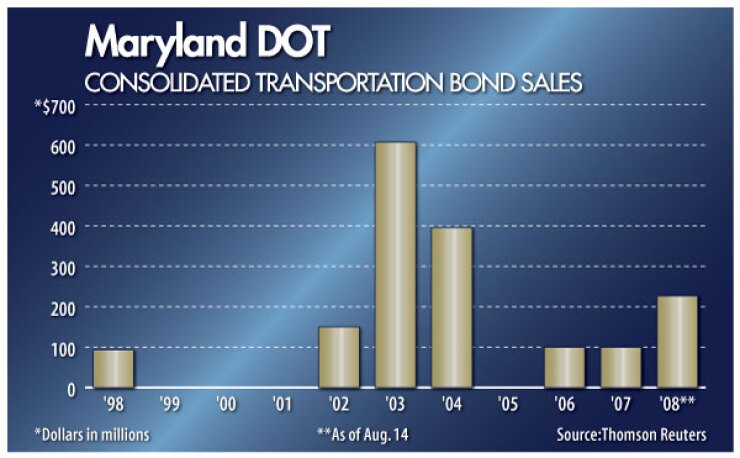

WASHINGTON - The Maryland Department of Transportation will bring $280 million of consolidated transportation bonds to market on Wednesday. The competitive sale is the second of the department's 2008 series. Proceeds from the revenue-backed bonds will go toward an amalgam of capital projects.

The bonds have maturities ranging from 2011 to 2023.

Public Financial Management Inc. is financial adviser on the deal. Bond counsel is Kutak Rock LLP.

Merrill Lynch & Co. was the winning bidder in January for $250 million of DOT bonds sold at a true interest cost of 3.77%. Other bidders on that sale were: JPMorgan, Prager, Sealy & Co., Goldman, Sachs & Co., Banc of America Securities, Citi, Lehman Brothers, Morgan Stanley, and UBS Securities LLC, according to a department spokesperson. The bonds were rated AAA by Standard & Poor's, Aa2 by Moody's Investors Service, and AA by Fitch Ratings.

"We expect the same ratings" for Wednesday's issue, said Erin Henson of the Transportation Department.

Fitch gave its AA rating again to the department's upcoming deal, affirming its AA rating on about $1.3 billion of outstanding consolidated transportation bonds and about $57 million of county transportation revenue bonds. Fitch assigned a stable outlook.

Standard & Poor's and Moody's had not released ratings for the new issue as of Friday.

The consolidated transportation bonds will go toward the Maryland transportation trust fund, and will provide a portion of the capital funds for projects in the department's transportation program, including highway projects. The department encompasses the Maryland Aviation Administration, the Maryland Port Administration, the Maryland Transit Administration, the Motor Vehicle Administration, and the State Highway Administration.

Maryland DOT capital projects also are paid for with federal grants and conduit financings and certificates of participation.

Some allocations in the current consolidated transportation program are $3.55 billion in department funds for highway capital projects; $1.5 billion in department resources for state transit projects; $389 million for passenger rail; and $187 million for airport planning and preservation.

Fitch said the Maryland DOT's issue is secured by a broad base of revenue sources and that pledged taxes available to the bonds "are forecast to grow beginning July 1, 2008, due to the inclusion of 5.3% of the state's sales and use tax collections, as well as increases in corporate and titling tax rates under recent tax law changes."

The transportation trust fund is furnished with bond and note proceeds along with a host of other revenue sources, such as motor vehicle titling and fuel taxes, motor vehicle registration fees, bus and rail fares, port fees and airport revenues, and some of the state's sales and corporate income taxes.

But record-high fuel costs and a faltering economy have put stress on transportation revenues in Maryland, as well as nationally.

"Pledged taxes in aggregate are subject to economic cyclicality and collection factors," Fitch said in its rating report. "Although average growth between fiscal 2001 and 2007 was 2.6% per year, more recent economic slowing and the impact of rising energy prices are weighing on collections. Pledged taxes fell 2.1% in fiscal 2007 and 4.6% in fiscal 2008. Rising gasoline prices, slowing vehicle sales and a changing mix of motor vehicles is leading to the declines in motor fuel taxes, titling taxes, and registration fees, while broad economic slowing is leading to a decline in corporate tax."

Nevertheless, the department has maintained a solid coverage of maximum annual debt service in pledged taxes and department net revenues. Its coverage is forecast to stay solid despite revenue changes because of gains from tax rate increases that have been enacted, the ratings agency said.

The department's current five-year capital plan of $10.6 billion is expected to decline somewhat, reflecting the slowdown in revenue growth, Fitch said. The current plan focuses on system preservation, with most funding directed to highways and mass transit.