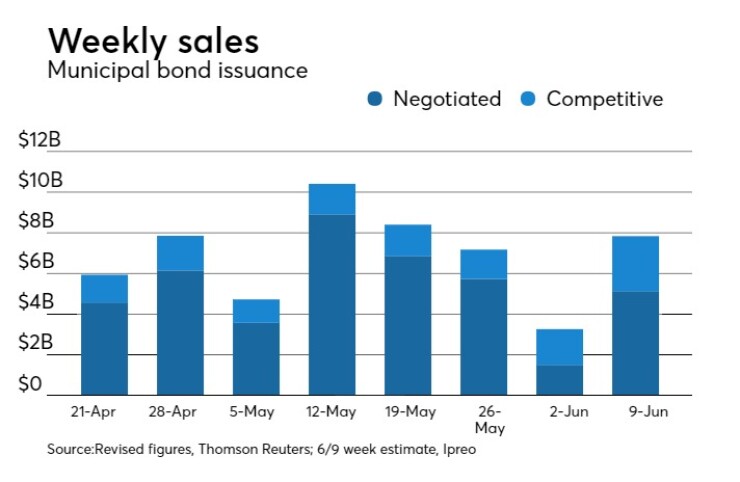

The municipal market figures to get back to a more normal issuance level this week, giving participants an array of choices.

Ipreo estimates volume will climb to $7.83 billion, after a revised total of $3.25 billion sold in the past holiday shortened week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $5.13 billion of negotiated deals and $2.70 billion of competitive sales.

There are 19 transactions scheduled that are larger than $100 million, with two of them – including the largest one - being note deals.

“The market has not changed in a while,” said Jim Grabovac, senior portfolio manager at McDonnell Investment Management. “We have had such consistent behavior, with low volatility and spread compression. I would call it a supply challenged environment.”

On the flip side, he said, muni performance has been strong compared with Treasuries.

“We are getting back to rate and ratio levels that we had in 2015 and 2016, which were big years in refunding volume,” he said. “I am wondering if it could spark some refunding issuance. Seven out of the 10 largest deals this week are refundings, so maybe there is reason for some optimism.”

Citi is expected to price the County of Los Angeles’ $800 million of 2018-2018 tax and revenue anticipation notes on Tuesday. The deal is rated MIG 1 by Moody’s Investors Service, and SP-1-plus by S&P Global Ratings and F-1-plus Fitch Ratings.

The city of Chicago plans two deals totaling $599.265 million. The windy city will first come with $399.705 million of second lien wastewater transmission revenue bonds, featuring a project series and a refunding series on Tuesday, with Siebert Cisneros Shank & Co. running the books. This deal is rated A by S&P, AA-minus by Fitch and Kroll Bond Rating Agency.

On Wednesday, the city will be back with $199.56 million of second lien water revenue refunding bonds, with Cabrera Capital Markets as lead manager. This deal is rated A by S&P, AA-minus by Fitch and AA by Kroll.

The competitive market will be busy with five deals larger than $100 million. On Thursday, Clark County, Nevada, is scheduled to sell two deals totaling $624.25 million. It will be broken down to $562.685 million of general obligation limited tax building and refunding bonds and $61.565 million of GO limited tax refunding bonds with additionally secured by pledge revenue. Both deals are rated AA-minus by S&P.

RBC Capital Markets is slated to price the Metropolitan Washington Airports Authority’s $533.79 million of system revenue refunding alternative minimum tax bonds on Tuesday. The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Secondary Market

Top shelf municipal bonds ended stronger on Friday after the release of a mixed report on the employment situation in the United States last month.

The Labor Department said non-farm payrolls rose 138,000 in May, less that the 185,000 gain expected by economists polled by IFR Markets. However, the unemployment rate dropped to 4.3% last month from 4.4% in April, its lowest level since May 2001. Economists surveyed by IFR Markets had expected the jobless rate to remain steady.

Market participants had been awaiting Friday's report for indications of economic performance ahead of the Federal Open Market Committee's monetary policy meeting on June 13-14.

The yield on the 10-year benchmark muni general obligation fell four basis points to 1.86% from 1.90% on Thursday, while the 30-year GO yield dropped six basis points to 2.69% from 2.75%, according to the final read of Municipal Market Data's triple-A scale.

Since the start of the year, the yield on the 10-year muni has dropped over 45 basis points while the yield on the 30-year muni is off more than 35 basis points.

U.S. Treasuries were stronger on Friday. The yield on the two-year Treasury dipped to 1.28% from 1.29% on Thursday as the 10-year Treasury yield dropped to 2.16% from 2.21% while the yield on the 30-year Treasury bond decreased to 2.81% from 2.87%.

On Friday, the 10-year muni to Treasury ratio was calculated at 86.2%, compared with 85.8% on Thursday, while the 30-year muni to Treasury ratio stood at 95.7% versus 95.8%, according to MMD.

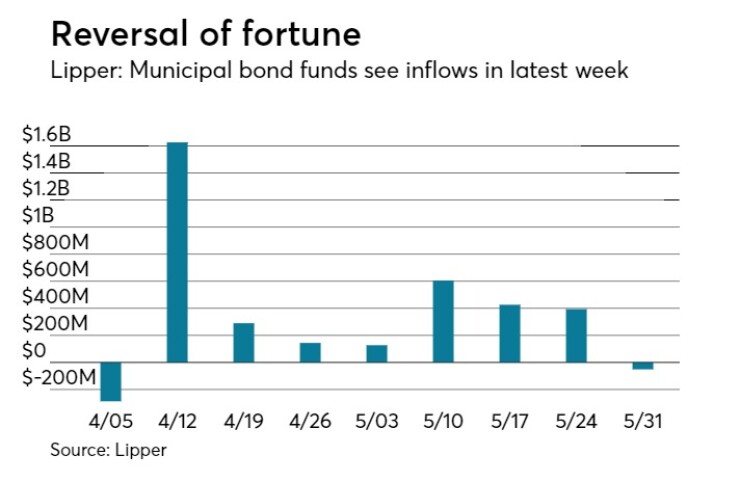

Lipper: Muni bond funds see outflows

Investors in municipal bond funds changed course and took their cash out of the funds in the latest week, according to Lipper data released late on Thursday.

The weekly reporters saw $50.837 million of outflows in the week ended May 31, after inflows of $394.498 million in the previous week.

The four-week moving average was positive $344.028 million, slipping from positive $388.683 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also reported outflows, losing $106.029 million after gaining $238.275 million in the previous week. Intermediate-term funds had outflows of $96.676 million following inflows of $8.640 million.

National funds had inflows of $77.134 million after inflows of $447.135 million in the previous week. High-yield muni funds reported outflows of $7.485 million, after inflows of $171.583 million the previous week.

Exchange traded funds reported inflows of $64.657 million, on top of inflows of $50.978 million in the previous week.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended June 2 were from Iowa, Maryland and Illinois issuers, according to

In the GO bond sector, the Coralville, Iowa, 4s of 2037 were traded 20 times. In the revenue bond sector, the Baltimore, Md., Convention Center 5s of 2046 were traded 46 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 41 times.

Week's actively quoted issues

Illinois, New York and California names were among the most actively quoted bonds in the week ended June 2, according to Markit.

On the bid side, the Illinois taxable 5.1s of 2033 were quoted by 52 unique dealers. On the ask side, the New York Hudson Yards Infrastructure Corp. revenue 4s of 2036 were quoted by 226 unique dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 22 unique dealers.