Municipals were thrust into the spotlight on Wednesday, rallying hand in hand with treasuries as the equity market's 2014 gain evaporated and investors ran for the safety of fixed income.

The U.S. treasury market firmed further, after yields plunged on Tuesday. Most notably, yields on the 10-year fell beneath 2% during the day, before floating back to 2.11% by the end of the day, a 10 basis point drop from Tuesday's market close. The two-year strengthened seven basis points to 0.32% from Tuesday, while the 30-year stayed under 3%, falling seven points as well to 2.88%.

The strength bled into the primary market where muni issuers picked up even cheaper borrowing costs, successfully placing the new deals. The Dormitory Authority of the State of New York - often referred to as simply DASNY - placed a little over $1 billion in state sales tax revenue bonds,in a two-pronged deal that featured both taxable and tax-exempt debt, according to Ipreo.

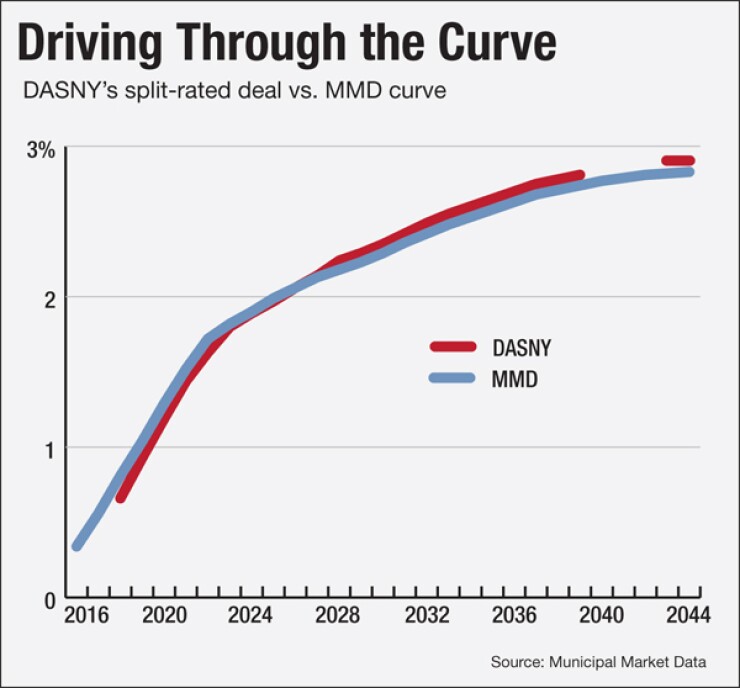

Pricing was through the Municipal Market Data triple-A 5% scale, with yields on the $1.04 billion Series 2014A tax-exempt tranche ranging from 0.10% on a 3% coupon in 2016 through 2.87% on a 5% coupon in 2044, according to Ipreo. The $15.31 million Series 2014B taxable tranche carried a single maturity in 2016 that was priced at par with a 0.33% coupon.

The pricing through the scale was especially notable because the DASNY deal carried a split rating: Aa1 from Moody's Investors Services and triple-A from Standard & Poor's.

"Everyone knew the scale was going to get hugely bumped, that's why it priced through the MMD curve," said a New York based trader. "Most days are static, so you can price off yesterday's MMD scale, but today was volatile -- you needed to price accordingly."

Rather than pricing off of Tuesday's yield curve, as the case with most primary issuances, the deal was priced in anticipation of Wednesday's tightened curve. By market close, yield on bonds maturing between 2022 through 2044 had fallen between eight and 10 basis points, while yields on bonds maturing in 2020 and 2021 feel six and seven basis points, respectively, according to the MMD triple-A 5% curve. Yields on bonds maturing between 2015 through 2018 strengthened up to three basis points.

Compared to Tuesday's curve, however, DASNY priced at a discount to MMD up to 2026, as low as 15 basis points beneath the yield curve in 2018. The long end of the deal priced above the curve, at spreads ranging from one to 13 basis points.

The deal also picked up strength from the New York Sales Tax Asset Receivables Corporation deal issued in late September, which the trader referred to as "liquid gold." Thanks to the unique issuers and ultra-secure revenue stream, investors piled into the deal, which ended up gaining $8 billion in orders for the $2 billion of available bonds.

Wednesday DASNY deal wasn't tied to a specific university, hospital or housing project and was securitized by state sales tax collections, making the bonds similarly attractive, the trader said.

"We heard it was very, very oversubscribed," said the trader. "Every account said that they were putting in as many orders as they could for all of the maturities."

New York's strength in the primary carried over to the secondary, where the Port Authority of New York and New Jersey emerged as one of the day's market movers, according to data collected by Markit. The Port Authority's 4.75s of 2037 strengthened 10 basis points to 2.65% in round lot trading.