-

A preliminary pricing wire gives Tuesday's Three World Trade Center Tower Project deal wide spreads for investors able to participate.

By Kate SmithOctober 28 -

The municipal market's attention will be driven to the New York City skyline, as Goldman, Sachs & Co. prices the mammoth $1.63 billion unrated Three World Trade Center Tower Project deal.

By Kate SmithOctober 28 -

After an impressive municipal rally investors wonder whether a correction is imminent and are closely watching appetite for this weeks primary deals.

By Kate SmithOctober 27 -

The municipal market opened slowly on Monday morning as traders saved their energy for the week's larger deals, scheduled for pricing later this week.

By Kate SmithOctober 27 -

The commonwealth of Puerto Rico's general obligation rally this week most likely stemmed from the flood of high yield paper in the primary market this week, traders agreed.

By Kate SmithOctober 24 -

Friday morning's market was slow, capping a particularly active week in both the primary and secondary.

By Kate SmithOctober 24 -

Pricing for Detroit's Convention Facility Authority bond Thursday indicated that the market is still cautious with credits associated with the bankrupt Michigan city.

By Kate SmithOctober 23 -

Long-dated maturities on Wednesday's San Joaquin deal regained some strength in Thursday morning trading.

By Kate SmithOctober 23 -

Thursday's Metropolitan Transportation Authority deal may provide traders with much needed yield thanks to its frequency in the market.

By Kate SmithOctober 23 -

Long-end interest dominated this week's secondary trading as the equity market's sell-off prompted a wave of interest in municipals, pushing yields down.

By Kate SmithOctober 17 -

Friday proved to be another active day in the primary as repricings were announced with even tighter spreads.

By Kate SmithOctober 17 -

Yields in municipals have begun to retrace some of their early week gains on the long end.

By Kate SmithOctober 16 -

As the equities market remains volatile, issuers will benefits with cheap borrowing costs in Thursday's primary as investor flock to the traditionally safe asset class.

By Kate SmithOctober 16 -

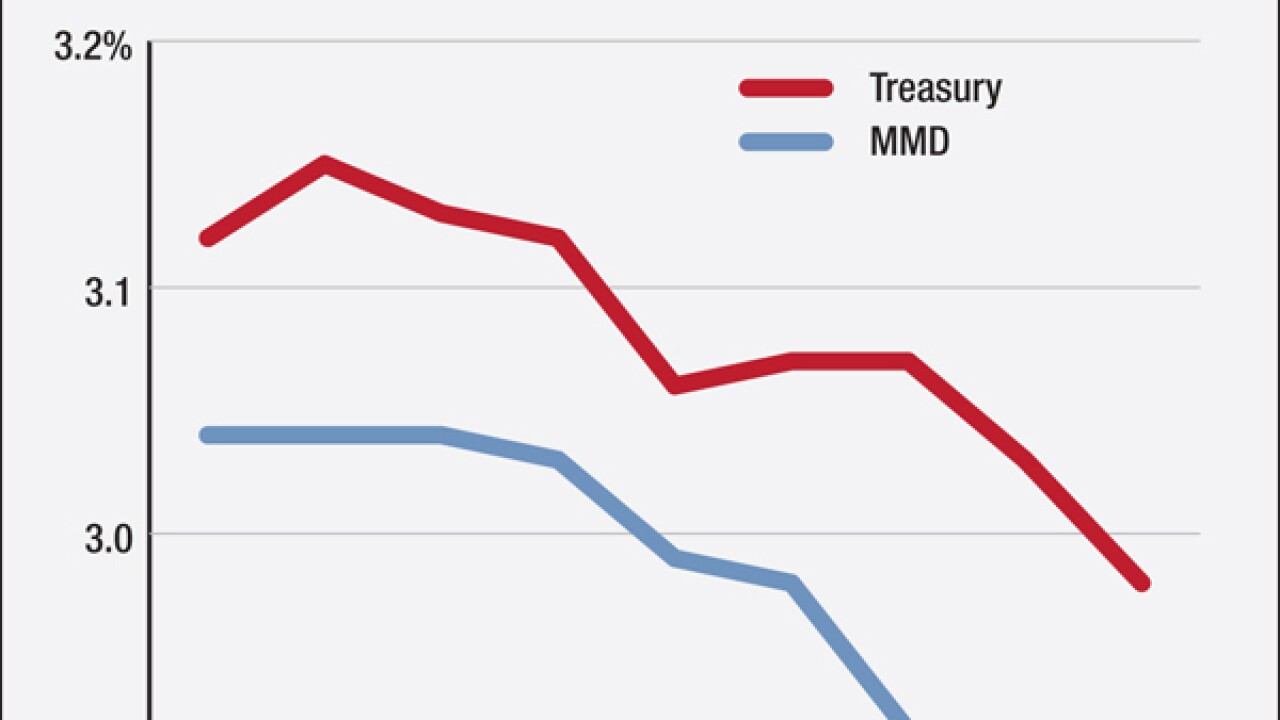

All eyes were on municipals on Wednesday, as the asset class picked up strength from the rallying Treasury market. The firmness stemmed from a red-filled day in the U.S. equities market.

By Kate SmithOctober 15 -

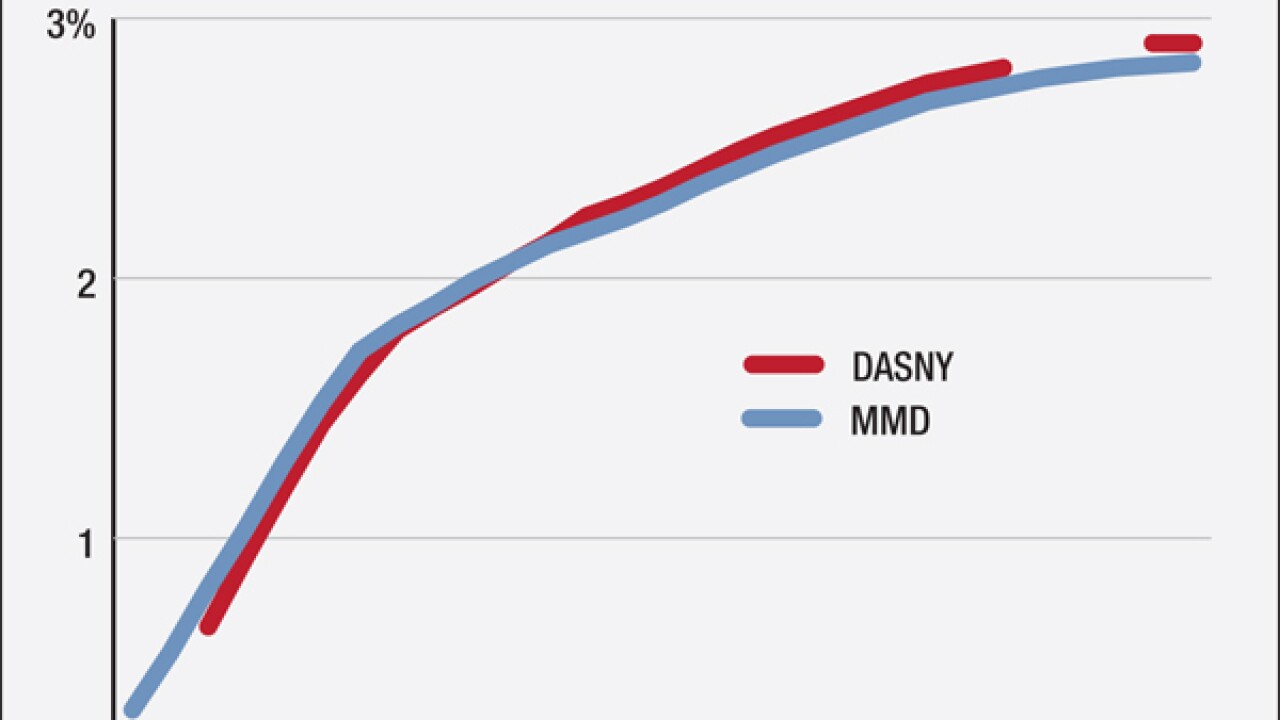

The state of Washington priced right along Municipal Market Data's triple-A 5% curve during its pricing on Wednesday, despite a double-A rating. The deal picked up strength from the intensely firming Treasury market.

By Kate SmithOctober 15 -

As Treasury yields plummet to 2014 lows, issuers coming to market on Wednesday will benefit, likely to catch cheap borrowing costs.

By Kate SmithOctober 15 -

Tuesday's tightening municipal market indicated to traders that investors had "given up hope" of any yield in the near-term future.

By Kate SmithOctober 14 -

Municipal scales tightened significantly on Tuesday morning as traders gave up hope that higher yields may be on the horizon.

By Kate SmithOctober 14 -

Taxable issuance will dominate the day's primary market, giving borrowers flexibility with proceeds, but pushing away more traditional municipal bond buyers.

By Kate SmithOctober 7 -

A modified barbell strategy is expected to drive duration interest in this week's primary market, based on data from last week's secondary trading activity.

By Kate SmithOctober 6