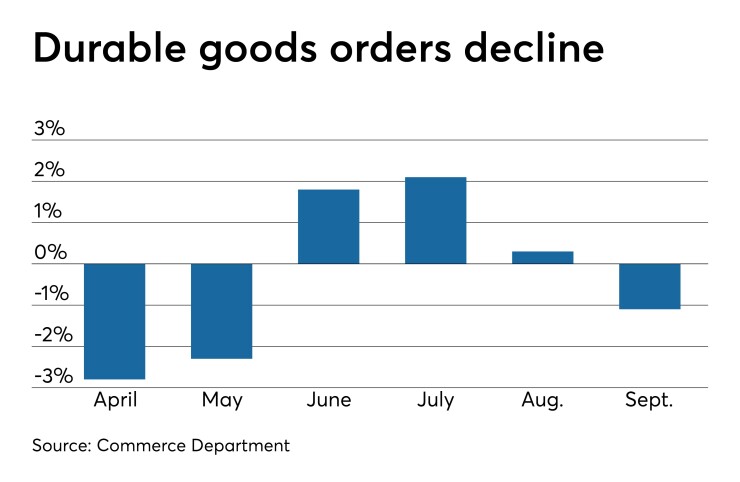

September durable goods orders fell more than expected, while orders for non-defense capital goods excluding aircraft and shipments also dropped, suggesting production won't rebound this year.

Durable goods orders fell 1.1% in the month, the Commerce Department reported. Economists polled by IFR Markets expected orders to fall 0.7%. Excluding transportation, orders were off 0.3%.

“Nondefense capital goods shipments — a proxy for business equipment investment in GDP — declined 0.1% month over month, and, after a massive 2.9% m/m decline in July, its Q3 average dropped by a sharp 9.2% quarter over quarter annualized after the precipitous 12.3% q/q annualized decline in Q2,” Berenberg Capital Markets U.S. Economist Roiana Reid wrote in a note.

“Conditions in the U.S. manufacturing durable goods sector softened in September, capping off another weak quarter for business fixed investment,” she said. “Declining core durable goods orders reflect soft manufacturing demand and declining shipments are due to the idiosyncratic factors facing the aircraft sector (Boeing), sluggish global growth that has reduced demand for U.S. manufactured goods, tariffs and trade-related uncertainties, and the slowdown in China’s economy.”

The General Motors strike and the continued trade strife with China contributed to the decline, she said. “A continued easing of U.S.-China trade tensions would lift global business sentiment, remove some uncertainties, and ease supply chain disruptions, but to date China’s slew of stimulus initiatives have yet to boost its domestic demand as reflected in its declining imports. Taken these two factors together, the eventual rebound in global and industrial production is unlikely to come before year-end and, when it does happen, it is likely to be modest.”

Separately, new home sales dropped 0.7% in September to a seasonally adjusted annual rate of 701,000 from a 706,000 pace in August, which was initially reported as a 713,000 rate, Commerce said.

Economists expected a 700,000 rate.

Sales gained 7.2% year-over-year.

"New home sales inched down in September, but the ongoing trend remains positive as builders increase their production," according to Greg Ugalde, chairman of the National Association of Home Builders.

The supply of new homes for sale slipped to 321,000 from 323,000 in August.

The median sales price in September was $299,400, down 8.8% from a year ago, and off from $325,200 in August, while the average price fell to $362,700 in September from $394,800 a month earlier.

Three of four home sold in September “were priced under $400,000 (the highest share since August 2016),” Reid said. “This is encouraging for young potential first-time buyers who have been stuck on the sidelines — home builders may be finally boosting construction at lower price points, where demand is now strongest. Construction of cheaper homes and low mortgage rates would help sustain the momentum in new home sales.”

While low mortgage rates have boosted the housing sector this year, “we expect rising real wages, favorable demographics, and low unemployment and continued job growth to support demand on a sustained basis in the intermediate term,” she said.

Initial jobless claims

Initial jobless claims fell to 212,000 in the week ended Oct. 19 from 218,000 the week before, the Labor Department said. Continued claims slid to 1.682 million in the week ended Oct. 12 from 1.683 million the week before.

Economists called for 215,000 initial and 1.675 million continued claims in the week.

Manufacturing

Manufacturing activity in the Kansas City region “eased slightly in October, and expectations for future activity inched lower but remained slightly positive,” the Federal Reserve Bank of Kansas City said. “The month-over-month price index for raw materials declined at a slower rate, while the price index for finished products expanded slightly. District firms expected prices to increase over the next 6 months.”

The composite index dipped to negative 3 in October from negative 2 in September, while the composite index for six months from now slid to positive 2 from positive 5.