Municipal bond traders will be walking into a holiday-shortened week with what little issuance there is on the calendar jammed into two days ahead of the July 4 holiday on Thursday and an early close on Wednesday.

There are fewer than $1 billion of bonds and notes up for sale in the upcoming week.

As long as municipal supply remains constrained, the market should keep rolling along, says Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management.

"Unless we get disappointment by the Federal Reserve, I don't think the inflows will change," he said. "The environment, whether it's taxes or interest rates, will continue until we get stronger global growth, and until that happens, the muni environment will stay positive."

He added that the inflows into munis have been very impressive — as muni bond inflows keep outpacing equity inflows.

"Will it maintain its current pace? Probably not. But nonetheless munis still provide relative value, outside the short end of the curve."

Now, halfway through the year, bond volume totals $165.26 billion in 4,763 deals — nearly matching the $165.68 billion in 4,812 issues halfway through 2018. Even though total volume is close, there is a stark difference between the first and second quarters of each of the past two years.

Although volume in 2019 is currently running on pretty much the same pace as last year, Heckman said that the biggest difference between the two years is the inflows.

"Even if you go back to 2017 when flows were a bit better than 2018 — inflows have outsized relative to what we have seen in the past," Heckman said. "July is historically not a big issuance month and come July 1, we will get a bunch of redemptions and all that money has to be put to work. So it will be interesting to see how people react when they come back after the holiday."

Primary market

There is only one deal on the slate above $100 million with the two biggest deals being remarketings.

The Metropolitan Water District of Southern California (NR/NR/AA+) is coming to market with two deals worth $271.255 million on Tuesday. JPMorgan Securities is set to remarket $175.63 million of Series 2017C subordinate water revenue bonds and Series 2017D subordinate water revenue refunding bonds in SIFMA Index mode. BofA Securities is set to remarket $95.625 million of Series 2017E subordinate water revenue bonds in SIFMA Index mode.

In the competitive arena, Salt Lake County, Utah, is selling $70 million of Series 2019 tax and revenue anticipation notes on Tuesday.

Zions Public Finance is the financial advisor; Chapman and Cutler is the bond counsel.

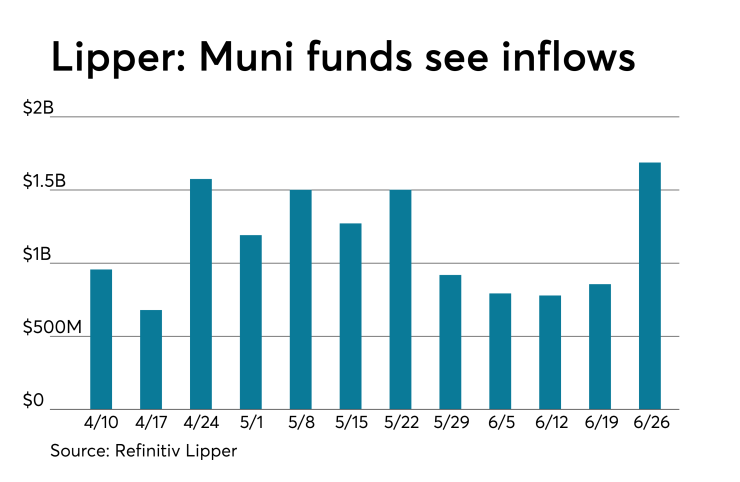

Lipper: More inflows into muni funds

For the 25th straight week, investors remained bullish on municipal bond funds, according to data from Refinitiv Lipper.

Those tax-exempt mutual funds, which report flows weekly, saw $1.688 billion of inflows in the week ended June 26 after inflows of $856.009 million in the previous week.

Exchange-traded muni funds reported inflows of $232.389 million after inflows of $129.732 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.456 billion after inflows of $726.277 million in the previous week.

The four-week moving average remained positive at $1.029 billion, after being in the green at $836.540 million in the previous week.

Long-term muni bond funds had inflows of $1.492 billion in the latest week after inflows of $738.878 million in the previous week. Intermediate-term funds had inflows of $166.746 million after inflows of $41.303 million in the prior week.

National funds had inflows of $1.499 billion after inflows of $706.719 million in the previous week. High-yield muni funds reported inflows of $394.955 million in the latest week, after inflows of $273.121 million the previous week.

On Wednesday, the Investment Company Institute reported long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.590 billion in the week ended June 19, while long-term muni funds alone saw an inflow of $1.414 billion and ETF muni funds saw an inflow of $176 million.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended June 28 were from New York, California and Puerto Rico issuers, according to

In the GO bond sector, the Nassau County, N.Y., 5s of 2020 traded 28 times. In the revenue bond sector, the Los Angeles 5s of 2020 traded 73 times. In the taxable bond sector, the Puerto Rico GDB Debt Recovery Authority 7.5s of 2040 traded 23 times.

Week's actively quoted issues

Puerto Rico, New York and New Jersey, and Pennsylvania names were among the most actively quoted bonds in the week ended June 28, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5s of 2058 were quoted by 51 unique dealers. On the ask side, the Pennsylvania Turnpike Commission revenue 4s of 2049 were quoted by 120 dealers. Among two-sided quotes, the Port Authority of N.Y. and N.J. taxable 5.647s of 2040 were quoted by 16 dealers.

Secondary market

Munis were little changed in late trade on the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GO remained unchanged at 1.63% and 2.31%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 80.8% while the 30-year muni-to-Treasury ratio stood at 90.9%, according to MMD.

Treasuries were a bit stronger as stocks were a little higher. The Treasury three-month was yielding 2.120%, the two-year was yielding 1.737%, the five-year was yielding 1.758%, the 10-year was yielding 2.004% and the 30-year was yielding 2.530%.

“The ICE Muni Yield Curve is maintaining its levels from the previous trading session,” ICE Data Services said in a Friday market comment. “Tobacco and high-yield are quiet and stable as well. The taxable sector is also enjoying the stability with yields hovering around one basis point of [Thursday’s] session."

Previous session's activity

The MSRB reported 39,728 trades Thursday on volume of $14.46 billion. The 30-day average trade summary showed on a par amount basis of $12.78 million that customers bought $6.55 million, customers sold $4.14 million and interdealer trades totaled $2.09 million.

California, Texas and New York were most traded, with the Golden State taking 14.341% of the market, the Empire State taking 13.109% and the Lone Star State taking 10.428%.

The most actively traded security was the Los Angeles 2019 TRANs 5s of 2020, which traded 116 times on volume of $131.13 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.