The latest rally in municipal bonds has spurred issuers to come to market, inflating the calendar for the week of June 15 to nearly $12 billion after weeks of low historical supply.

IHS Ipreo estimates total volume for the upcoming week at $11.6 billion, consisting of about $10.4 billion of negotiated deals and $1.2 billion of competitive sales. New York, Texas and Pennsylvania issues headline the new-issue slate.

The buyside took a breather Friday from the brisk activity seen earlier in the week when cash-flush investors wielded their buying power and devoured new deals. Muni yields on the AAA scales were little changed on Friday.

Primary market

There are 25 deals over $100 million on the upcoming calendar.

Goldman Sachs is set to price the New York State Urban Development Corp.’s $1. 3 billion of general purpose state personal income tax revenue bonds on Wednesday after a one-day retail order period on Tuesday. Goldman will also separately price the UDC’s $487 million of taxables on Wednesday.

Wells Fargo Securities is expected to price the Ford Foundation’s (Aaa/AAA/NR/NR) $1 billion of taxable corporate CUSIP social bonds on Thursday.

Citigroup is set to price the Texas Transportation Commission’s (Aaa/AAA//) $795 million of taxable general obligation highway improvement refunding bonds on Wednesday.

BofA Securities is expected to price the Geisinger Authority of Montour County, Pa.’s (A1/AA-//) $768 million of health system revenue bonds.

There is only one competitive issue over $100 million of the calendar.

Henrico County, Va., (Aaa/AAA/AAA//) is selling $118.456 million of general obligation bonds on Tuesday in two issues.

The deals consist of $103.68 million of tax-exempt Series 2020A general obligation public improvement bonds and $14.785 million of taxable Series 2020B GO refunding bonds.

PFM is the financial advisor and Hawkins Delafield is the bond counsel.

Proceeds from the tax-exempts will be used to finance school capital improvement projects, road improvements, fire station and facilities projects and recreation and parks facilities while proceeds from the taxables will be used to refund the outstanding Series 2011 GO public improvement bonds.

Lower rates have been helping spur issuance amid rising demand.

The Connecticut GO sale on Thursday was a food fest with $4 billion in orders for $400 million in bonds, said Peter Delahunt, managing director at Raymond James & Associates.

This week’s DASNY deal also fed the market’s voracious appetite for paper.

“Investors have a lot of cash and it showed up in heavily oversubscribed order flow on most all pricings today,” he said, adding that most deals were bumped to richer levels by a significant amount.

Part of the demand stems from the billions of dollars arriving into funds over the last five weeks, at a time when yields continue to drop in the midst of the supply-demand imbalance, Delahunt noted.

“A large-scale risk-off trade in global markets has led to a continued rally in U.S. Treasuries,” as municipals followed suit, and yields dropping by five to 10 basis points as demand continued to outstrip supply, he said.

Secondary market

Some noteable trades:

The very short end of the curve saw some weakness. Union County, New Jersey, 4 of 2021 traded at 0.35%. Forsyth County, North Carolina, 5s of 2022 traded at 0.26%. Virginia Beach 5s of 2022 traded at 0.30%. University of Texas revs, 5s of 2022, traded at 0.33%. Ohio waters, 5s of 2031, traded at 1.04% to 1.03%.

Out a bit longer, New York City TFAs, 4s of 2036 were at 1.98% to 1.97%.

More university debt was trading.

The University of Michigan 4s of 2038 were at 1.76% to 1.69% and University of Washington 5s of 2050 traded at 1.80%.

However, demand is there.

“What we learned this week was there is a lot of money coming into funds, and most of the week’s deals were oversubscribed — some of them 20 to 30 times,” a New York trader said Friday.

“There’s so much money around,” he said adding that he expects all of the upcoming week’s large offerings to be highly sought.

He said the market will have no trouble finding a home for the new bonds.

“Certainly with the flows — and reinvestment in June and July — the market can handle the supply,” he said.

At the same time, the market is in a Catch 22, again battling low rates, as cash-heavy investors are in the midst of summer reinvestment season, the trader noted.

“We’re in a fist fight between low rates again, the same low rates that caused people not to want to put money to work back in February, and now we’re back here,” he said.

“The market is tightening up a little bit, but not as much as Treasuries,” the trader added.

He said investors will need to find a comfort level with the levels, as the Federal Reserve Board has indicated the need to keep rates low in the near future.

“I believe we will stay in this trading range and I don’t see us breaking out of it,” the trader predicted.

However, in the backdrop of the week’s strength, there are many cross-currents that could potentially impact the market, according to the trader.

He listed the re-emergence of COVID-19, unemployment, and the status of states and municipalities reopening for business or reimposing restrictions as among of the “thousands of possibilities” impacting the market’s behavior going forward.

For now, he said, the status quo remains positive, according to the trader.

“The market is day-to-day, and the theme is the Fed is keeping interest rates low, there’s no inflation, and no reason to go to higher rates, so week by week we will see what the economy does emerging out of COVID,” he said.

“It’s not off the table,” especially with talk of a potential vaccine available by August, he noted.

“All sorts of things are going on right now, but short-term we are going to handle the supply, rates are probably going to stay low, and there’s a lot of money flowing in and being spent on new issues,” he said.

On MMD’s AAA benchmark scale, short yields moved higher, with the 2021 maturing up two basis points to 0.22%, the 2022 up two basis points to 0.24% and the 2023 riding one basis point to 0.25%. The yield on the 10-year GO muni was unchanged at 0.85% while the 30-year was flat at 1.61%.

The 10-year muni-to-Treasury ratio was calculated at 122.0% while the 30-year muni-to-Treasury ratio stood at 111.3%, according to MMD.

“High-yield munis are slightly stronger again today while investment-grade munis are little changed in quiet Friday trading,” ICE Data Service said. “Puerto Rico bonds are generally unchanged.”

The ICE AAA municipal yield curve showed short yields rising slightly, with the 2021 to 2023 maturities up one basis point to 0.190%, 0.217% and 0.258%, respectively. Out longer, the 10- and 30-year maturities were unchanged at 0.820% and 1.616%, respectively.

ICE reported the 10-year muni-to-Treasury ratio stood at 120% while the 30-year ratio was at 110%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.19%, the 2022 maturity at 0.24% and the 2023 maturity at 0.25% while the 10-year muni was at 0.84% and the 30-year stood at 1.61%.

The BVAL curve showed the 2021 maturity 0.14% up one basis point and the 2022 unchanged at 0.19%. BVAL calculated the 10-year muni was unchanged at 0.80% while the 30-year remained at 1.63%.

Munis were mixed on the MBIS benchmark scale.

Treasuries were weaker as stocks traded higher.

The three-month Treasury note was yielding 0.178%, the 10-year Treasury was yielding 0.695% and the 30-year Treasury was yielding 1.444%.

The Dow rose 0.80%, the S&P 500 increased 0.38% and the Nasdaq gained 0.14%.

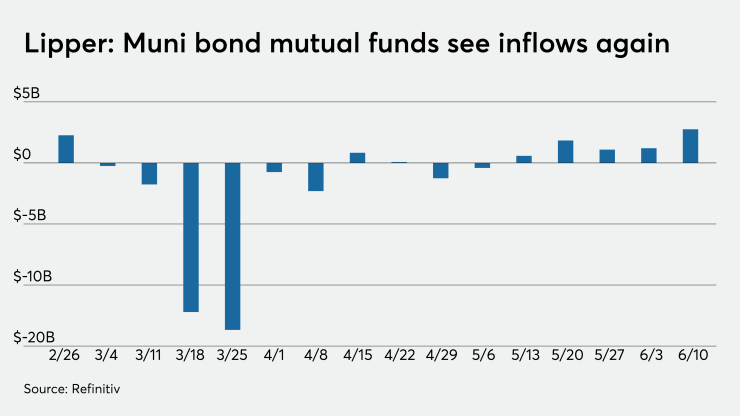

Lipper reports $2.8B inflow

Investors remained bullish on municipal bonds and continued to put cash into bond funds in the latest reporting week. It was the fifth straight week funds saw inflows and the fourth week in a row that those inflows topped $1 billion.

In the week ended June 10, weekly reporting tax-exempt mutual funds saw $2.759 billion of inflows, after inflows of $1.206 billion in the previous week, according to data released by Refinitiv Lipper Thursday.

Exchange-traded muni funds reported inflows of $528.605 million, after inflows of $517.983 million in the previous week. Ex-ETFs, muni funds saw inflows of $2.230 billion after inflows of $688.360 million in the prior week.

The four-week moving average remained positive at $1.724 billion, after being in the green at $1.180 billion in the previous week.

Long-term muni bond funds had inflows of $1.555 billion in the latest week after inflows of $349.431 million in the previous week. Intermediate-term funds had inflows of $307.069 million after inflows of $124.738 million in the prior week.

National funds had inflows of $2.560 billion after inflows of $1.653 billion while high-yield muni funds reported inflows of $593.509 million in the latest week, after inflows of $195.145 million the previous week.

Bond Buyer indexes mixed

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 3.69% from 3.71% from the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields rose to 2.19% from 2.16% in the previous week.

The 11-bond GO Index of higher-grade 11-year GOs increased to 1.72% from 1.69%.

The Bond Buyer's Revenue Bond Index was up to 2.61% from 2.58% from the previous week.

The yield on the U.S. Treasury's 10-year note dropped to 0.66% from 0.82% the week before, while the yield on the 30-year Treasury decreased to 1.41% from 1.61%.