Municipal buyers will see a rather small new issue calendar next week with the biggest offerings coming from the city of Los Angeles, which will competitively sell almost $1.9 billion of notes and bonds.

Ipreo estimates weekly bond volume at $5.33 billion, down from a revised total of $6.42 billion this week, according to updated data from Thomson Reuters. Next week’s calendar is composed of $3.99 billion of negotiated deals and $1.34 billion of competitive sales.

Primary market

On Tuesday, Los Angeles is selling $1.54 billion of 2018 tax and revenue anticipation notes.

The notes are due June 27, 2019. Financial advisor is Montague DeRose & Associates; bond counsel is Squire Patton.

The TRANs are rated MIG1 by Moody’s Investors Service and SP1-plus by S&P Global Ratings.

On Wednesday, the City of Angels will sell $321.81 million of general obligation bonds, consisting of $276.24 million of Series 2018A taxable social bonds; $34.995 million of tax-exempt Series 2018B GO refunding bonds; and $10.57 million of taxable Series 2018C GO refunding bonds.

Financial advisors are Public Resources Advisory Group and Omnicap Group; bond counsel is Nixon Peabody.

The bonds are rated AA by S&P.

In the negotiated sector, the Dormitory Authority of the State of New York is coming to market with a $342.68 million deal. Raymond James & Associates is set to price DASNY’s Series 2018-1 municipal health facilities improvement program lease revenue bonds, New York City issue, on Wednesday after a one-day retail order period.

Proceeds from the sale will be used to refund certain outstanding bonds in the program and pay costs of issuance.

"The bonds will be secured by rental payments from the city," according to a release from the city. "In the event the city does not make a rental payment when due, the state comptroller is required to pay DASNY the unpaid rentals out of state Medicaid payments otherwise due to the city or to be paid to providers on behalf of the city. Both city and state payments are subject to annual appropriation."

The deal is rated Aa2 by Moody’s and AA-minus by S&P.

Barclays Capital is expected to price the Connecticut Health and Educational Facilities Authority’s $300 million of revenue bonds for Yale University on Tuesday.

The deal is rated triple-A by Moody’s and S&P.

After a constructive week where new issues were devoured by hungry investors, a New York trader said the market is eager for more supply next week to fulfill upcoming redemptions.

“The Big Cal tobacco deal did awesome and was way over subscribed,” he said, noting the deal was trading up on Friday morning. “That July 1 reinvestment date is huge, so new issues are doing well,” he added.

He said, however, investors are still camping on the short end as the Federal Reserve is still focused on raising rates.

“People are just afraid so they are staying short,” he said. “There’s no supply pressure at all; it was a constructive week.”

Bond Buyer 30-day visible supply at $6.61B

The Bond Buyer's 30-day visible supply calendar increased $2.57 billion to $6.61 billion on Friday. The total is comprised of $1.86 billion of competitive sales and $4.76 billion of negotiated deals.

Secondary market

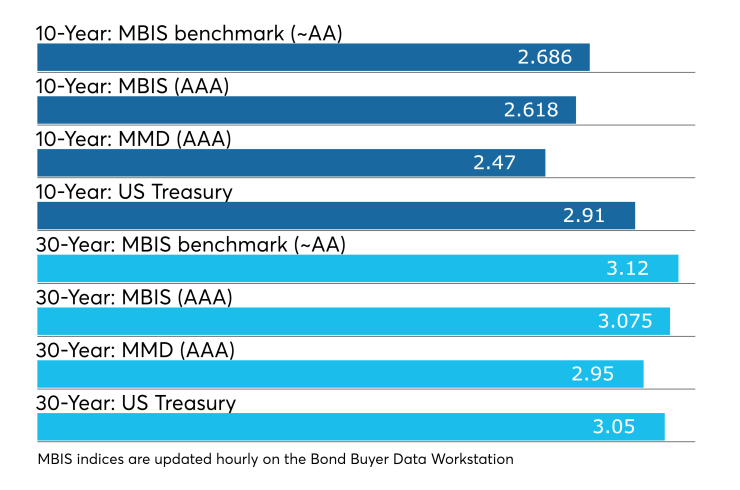

Municipal bonds were stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the three- to 30-year maturities and rose less than a basis point in the one- and two-year maturities.

High-grade munis were mixed but little changed, with yields calculated on MBIS’ AAA scale falling less than one basis points in the eight- and nine-year, 13-year and 23- to 30-year maturities, rising less than a basis point in the one- to six-year and 16- to 22-year maturities, and remaining unchanged in the seven-, 10- to 12-year, 14- and 15-year and 23- and 24-year maturities.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed yields rising as much as one basis point in both the 10-year muni general obligation and the 30-year muni maturity.

Treasury bonds were stronger as stock prices were mixed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 85.3% while the 30-year muni-to-Treasury ratio stood at 97.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 38,802 trades on Thursday on volume of $16.26 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 22.331% of the market, the Empire State taking 9.768% and the Lone Star State taking 9.032%.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended June 22 were from Illinois, California and Puerto Rico issuers, according to

In the GO bond sector, the Adams County School District No. 172, Ill., 3.75s of 2038 traded 19 times. In the revenue bond sector, the Golden State Tobacco Securitization Corp., Calif., 5s of 2047 traded 137 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp.6s of 2038 traded 12 times

Week's actively quoted issues

Puerto Rico, Texas and Illinois names were among the most actively quoted bonds in the week ended June 22, according to Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp.’s taxable 6.05s of 2036 were quoted by 60 unique dealers. On the ask side, the Grapevine-Colleyville Independent School District, Texas, GO 5s of 2026 were quoted by 102 dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 18 dealers.

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds continued to show confidence and again put cash into the funds in the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $646.014 million of inflows in the week ended June 20, after inflows of $449.614 million in the previous week.

Exchange traded funds reported inflows of $410.136 million, after inflows of $172.711 million in the previous week. Ex-ETFs, muni funds saw $235.878 million of inflows, after inflows of $276.903 million in the previous week.

The four-week moving average remained positive at $340.591 million, after being in the green at $237.288 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $606.057 million in the latest week after inflows of $394.458 million in the previous week. Intermediate-term funds had inflows of $105.799 million after inflows of $208.625 million in the prior week.

National funds had inflows of $684.818 million after inflows of $420.991 million in the previous week. High-yield muni funds reported inflows of $268.850 million in the latest week, after inflows of $322.355 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.