BRADENTON, Fla. — Facing a potential $1.5 billion shortfall over the next two years, Kentucky Gov. Steve Beshear Tuesday night recommended an $18.4 billion biennial budget to lawmakers that calls for a total of $1.53 billion of new debt.

Beshear said his budget plan for fiscal 2011 and 2012 is balanced, and does not include tax hikes or across-the-board layoffs.

However, the budget imposes 2% cuts on most state agencies over the next biennium and relies on revenue from expanded gambling at racetracks, which has not yet been considered by the Legislature.

Lawmakers have not agreed on gambling proposals in the past and some predicted that Beshear’s reliance on extra gambling revenue will face an uphill battle during the session, which began Jan. 5.

The governor’s budget assumes $780 million in revenue from video lottery terminals at racetracks over the next two years while funding such important priorities as education, job creation, health care, and public safety.

Without gambling revenue, Beshear said agency budgets would see cuts of more than 12% in the first year of the biennium, and 34% in the second year. Agencies have already experienced cuts of 20% to 25% because of declining revenue.

“[Additional] cuts of this magnitude would undoubtedly lead to mass layoffs and would inflict devastating damage on literally hundreds of critical services to communities and individuals around the commonwealth, such as prenatal care, water permits, air quality inspections, social workers and fire inspections of public facilities like day-care centers and schools,” Beshear warned.

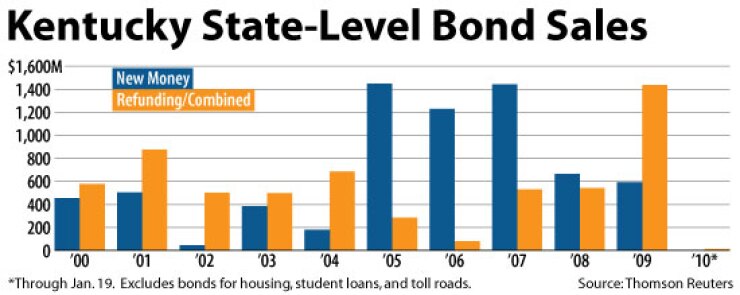

The proposed budget provides for selling $627.12 million of new bonds in fiscal 2011 and $904.5 million in fiscal 2012. The debt spending includes $60 million in loan and grant funds for job creation and retention, $150 million in borrowing for building and renovating schools, and $300 million for road projects. Other debt spending is for agency budget and state projects, and universities.

Lawmakers face difficult decisions during their session, which runs through mid-April. And failure to stabilize the state’s financial operations could result in a downgrade, Fitch Ratings analyst Karen Krop warned in a Dec. 29 report.

Since Kentucky has drawn down large balances and depleted its budget reserve, Krop said it must enact a structurally balanced budget and a plan to restore the rainy-day fund, which would help avoid a downgrade.

Fitch and Moody’s Investors Service have negative rating outlooks on the state’s primary credit — the Kentucky State Property and Buildings Commission, which they rate AA-minus and Aa3, respectively. Standard & Poor’s rates the debt A-plus with a stable outlook.

The commission had $3.18 billion of outstanding principal debt through 2029, according to the state’s financial report as of last June.