A California healthcare company came to market with a multi-billion issue on Tuesday as municipal bonds weakened in secondary trading.

Primary market

Goldman Sachs issued indications of interest on the California Health Facilities Financing Authority’s $2.08 billion of Series 2017A revenue bonds for Kaiser Pemanente.

The $410 million of Subseries 2017A-1 green bonds were offered as 5s to yield about 50 basis points over the interpolated MMD security in 2027.

The $1.29 billion of Subseries 2017A-2 fixed-rate bonds were offered as 5s to yield about 50 basis points over the interpolated MMD security in 2027; as 4s to yield about 105 basis points over the interpolated MMD security in 2038; as 3 3/4s to yield about 105 basis points over the interpolated MMD security in 2044; as 5s to yield about 95 basis points over the interpolated MMD security in a second 2044 maturity; and as 4s to yield about 115 basis points over the interpolated MMD security in 2051.

The $380 million of Series 2017B mandatory put bonds were offered as 5s to yield about 40 basis points over the interpolated MMD security in 2032.

The deal is rated AA-minus by S&P Global Ratings and A-plus by Fitch Ratings.

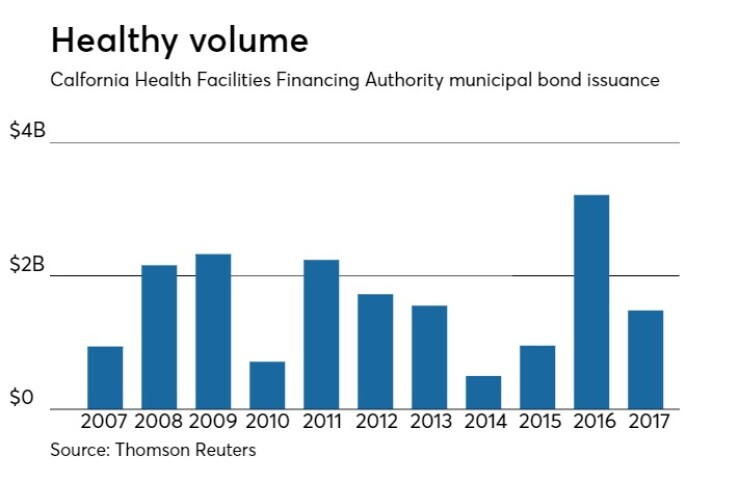

Since 2007, the California HFFA has sold more than $18 billion of securities with the largest issuance occurring last year when it came with a whopping $3.21 billion. The authority has only issued less than $1 billion four times, with the lowest year of issuance in the period in 2014.

Wells Fargo Securities priced the Port Authority of New York and New Jersey’s $694.74 million of tax-exempt consolidated bonds on Tuesday for retail investors ahead of the institutional pricing on Wednesday.

The $250 million of 200th Series bonds not subject to the alternative minimum tax were priced for retail as 5s to yield 2.38% in 2027, 2.50% in 2028, 2.70% in 2030 and to yield from 2.98% in 2034 to 3.11% in 2037, 3.23% in 2042, and 3.30% in 2047. No retail orders were taken in the 2057 maturity.

The $444.74 million of 202nd Series bonds subject to the AMT were priced for retail as 5s to yield 1.43% in 2020 to 3.43% in 2037. The 2017 and 2018 maturities were offered as sealed bids. No retail orders were taken in the 2024 maturity, or split halves of the 2029 and 2030 maturities, or in the 2031, 2032 maturities.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P and Fitch.

Siebert Cisneros Shank priced Atlanta’s $226.82 million of Series 2017A water and wastewater revenue refunding bonds on Tuesday.

The issue was priced to yield from 1.29% with a 5% coupon in 2020 to 1.99% with a 5% coupon in 2024 and from 2.58% with a 5% coupon in 2028 to 3.62% with a 3.50% coupon in 2039.

The deal is rated Aa2 by Moody’s, AA-minus by S&P and A-plus by Fitch.

In the competitive arena on Tuesday, Rhode Island sold $158.95 million of general obligation bonds.

Bank of America Merrill Lynch won the bonds with a true interest cost of 2.94%.

The $91 million of Series A consolidated capital development loan of 2017 bonds were priced to yield from 1% with a 5% coupon in 2018 to 3.31% with a 5% coupon in 2037.

The $67.95 million of Series B consolidated capital development loan of 2017 refunding bonds were priced as 5s to yield 1.93% in 2024 and from 2.27% in 2026 to 2.72% in 2031.

The deal is rated Aa2 by Moody’s and AA by S&P and Fitch.

The Hayward Unified School District, Calif., competitively sold $134 million of Series 2017 election of 2014 GOs.

BAML won the bonds with a TIC of 3.71%. The issue was priced to yield from 0.90% with a 3% coupon in 2018 to 3.43% with a 4% coupon in 2034; a 2037 maturity was priced as 3 1/2s to yield 3.66%, a 2039 maturity was priced as 4s to yield 3.66% and a 2042 maturity was priced as 4s to yield 3.70%.

The deal is rated A-plus by S&P and AAA by Fitch. The deal was insured by Assured Guaranty Municipal.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar increased $35.7 million to $14.69 billion on Tuesday. The total is comprised of $4.17 billion of competitive sales and $10.52 billion of negotiated deals.

Secondary market

The yield on the 10-year benchmark muni general obligation rose one to three basis points from 2.09% on Monday, while the 30-year GO yield gained two to four basis points from 2.95%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Tuesday. The yield on the two-year Treasury rose to 1.26% from 1.23% on Monday, while the 10-year Treasury yield gained to 2.31% from 2.27%, and the yield on the 30-year Treasury bond increased to 2.96% from 2.92%.

On Monday, the 10-year muni to Treasury ratio was calculated at 91.9%, compared with 92.0% on Friday, while the 30-year muni to Treasury ratio stood at 100.7%, versus 100.4%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,130 trades on Monday on volume of $8.64 billion.