Florida’s biggest city is coming through the pandemic with flying colors, according to two rating agencies, which said the city's finances are on the mend after taking a hit during the COVID-19 pandemic.

Last week, Moody's Investors Service raised the issuer rating on Jacksonville, Florida, to Aa2 from Aa3, citing “the ongoing expansion of the city's tax base and economy, which is notably more diverse than most of Florida and outperformed peers during the pandemic.”

Moody’s noted the rating also reflects the city's trend of strong finances and its willingness to tackle pension issues. “The city closed its three pension plans to new employees in 2017, which will reduce its unfunded liability in the long term,” Moody’s said.

Additionally, the rating agency upgraded the city's non-ad valorem bond rating and transportation bonds to Aa3 from A1.

The city has approximately $2 billion in outstanding debt.

“We are thrilled by this news,” Mayor Lenny Curry said in a statement emailed to The Bond Buyer. “These upgrades are a recognition of the incredible strength of the Jacksonville economy and the disciplined approach to fiscal governance we have exhibited since taking office.”

The mayor cited some of his administration’s major fiscal accomplishments, which included pension reform, cutting debt by more than $585 million, and adding more than $155 million to the city’s reserves.

“Moody’s specifically identified the closing of the three pension plans to new employees in 2017 as key,” the mayor said. “The groundbreaking reform put in place a plan to fully fund the pensions over time through the extension of a sales tax beginning in 2031.”

The plan also freed-up city resources in the short term to fund essential services and much-needed infrastructure improvements, Curry said.

“Since the reform was put in place, over $715 million has been used to grow the city economy and protect its citizens rather than be diverted to fund pension contributions,” he said.

The upgrade of the non-ad valorem rating moves it to one notch below the issuer rating because of the narrower revenues available, Moody's said. The upgrade of the transportation bonds reflects strong coverage due to a robust recovery from the impacts of coronavirus and adequate legal provisions.

Moody's also affirmed the A1 rating on the capital improvement bonds, which it said reflects healthy coverage from relatively narrow pledged revenues and strong legal provisions.

Additionally, Moody's affirmed the Aa3 rating on the Better Jacksonville Series 2012, 2012A, 2016, 2021 and 2022 sales tax bonds, which are secured by a voter-approved half-cent infrastructure sales surtax that will be collected through December 2030.

The city's share of the tax is fixed at 96.88% with the remaining 3.12% going to four smaller municipalities within Duval County. Legal provisions include a fully cash-funded net debt service reserve and 135% maximum net annual debt service additional bonds test.

Moody’s said the Better Jacksonville rating reflects healthy coverage due to a strong recovery from the impacts of coronavirus and a closed lien.

Moody’s outlook on the bonds is stable.

“The stable outlook on the issuer and non-ad valorem ratings reflects our expectation that the city will continue to grow reserves in line with budgetary growth,” Moody’s said. “The stable outlook on the various special tax ratings reflects that despite declines in revenues due to coronavirus, coverage will continue to improve and revenues will be relatively less volatile.”

Jacksonville has a population of about 925,000 and is located in the northeastern part of Florida; the state is rated triple-A by Moody’s, S&P Global Ratings and Fitch Ratings.

COVID-19 hit the city's economy hard, with its jobless rate surging into the double digits during the height of the pandemic. Since then, the jobless rate has fallen dramatically, dipping to 2.5% for the metropolitan statistical area in March from 2.9% in February and down sharply from 4.5% in March 2021.

In 1967, voters approved a referendum to merge the then-separate city and county governments into the consolidated city of Jacksonville, which created a 900-square-mile municipality in 1968, making it the largest city in the state.

In October, the city’s $1.1 billion fiscal 2021-2022

In February, the city sold $120.38 million of Series 2022A forward delivery special revenue refunding bonds. BofA Securities priced the deal with a top yield of 2.16% in 2032. Proceeds went to refund the city's Series 2021C special revenue refunding bonds and Series 2012 capital improvement revenue refunding bonds for debt service savings.

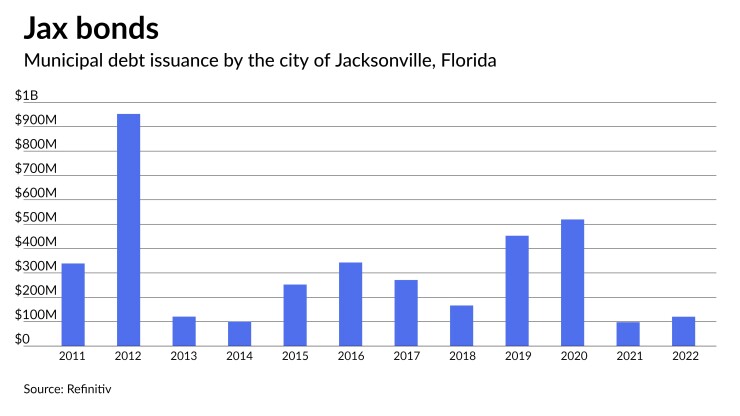

Since 2011, the city has sold about $3.8 billion of debt, with the most issuance occurring in 2012 when it offered $953 million. It sold the least amount of bonds last year when it issued almost $98 million of debt in 2021.

Last month, Fitch revised the city’s outlook to stable from negative and affirmed the AA rating on its capital improvement revenue bonds (CIRBs).

Fitch also affirmed the city’s transportation revenue bonds at AA-minus and the Better Jacksonville sales tax revenue bonds at A-plus.

The CIRBs are backed by a first lien on a 2% convention development tax (CDT) and a 2% professional sports facility tourist development tax (TDT).

The bonds are also backed by franchise fees, part of the local option communication service tax, a $2 million annual sales tax rebate from the state, which expires in 2024, and a cash-funded debt service reserve fund equal to maximum annual debt service.

Fitch said its affirmations reflected “the solid revenue performance of each dedicated tax structure and their respective resilience to historical revenue declines and the Fitch Analytical Stress Test (FAST) moderate recession scenario.”

The agency added the revision of the rating outlook on the CIRBs “reflects Fitch's view of the durability of the rebound in CDT and TDT revenue and strengthened debt service coverage.”

In the first six months of fiscal 2022, CIRB collections have improved to about 96% of fiscal 2019's pre-pandemic trend, although there was a large drop in February revenue due to surge of the Omicron variant.

In January, S&P affirmed the city’s AA issuer credit rating and kept a stable outlook on the Series 2022A bonds.

S&P said the rating reflected the city's “very strong economic characteristics, which continue to improve due to its broad and diverse economic base with a significant military presence."

Jacksonville is home to three U.S. naval facilities: the Naval Submarine Base Kings Bay, Naval Air Station Jacksonville and Naval Station Mayport. The Marine Corps has a Blount Island Command Base while the Florida Air National Guard is based at Jacksonville International Airport and the Coast Guard is based along the St. Johns River.