SAN FRANCISCO — The effort to build a commuter rail line through the two counties north of California’s Golden Gate has been a story of ups and downs mimicking the rolling countryside of Marin and Sonoma counties.

But the effort cleared a major hurdle this week when the Sonoma Marin Rail Transit District priced $174.1 million of long-term fixed-rate bonds to finance the backbone of what is envisioned as a 70-mile system.

The main thoroughfare through the two counties, U.S. 101, often looks more like a parking lot than a highway.

The general manager of the SMART district, said the rail line is expected to cut commuters’ travel time in half during periods of heavy traffic.

“I have what I call my two best friends in Sonoma and Marin counties, that is Highway 101,” Mansourian said. “When we have finished, we will get you there in 59 minutes from Sonoma county while you have Wifi, read your emails and have a latte.”

However, when trains start running in 2016, riders will be limited to a shorter ride than first anticipated, thanks to the economic buffeting of the recession.

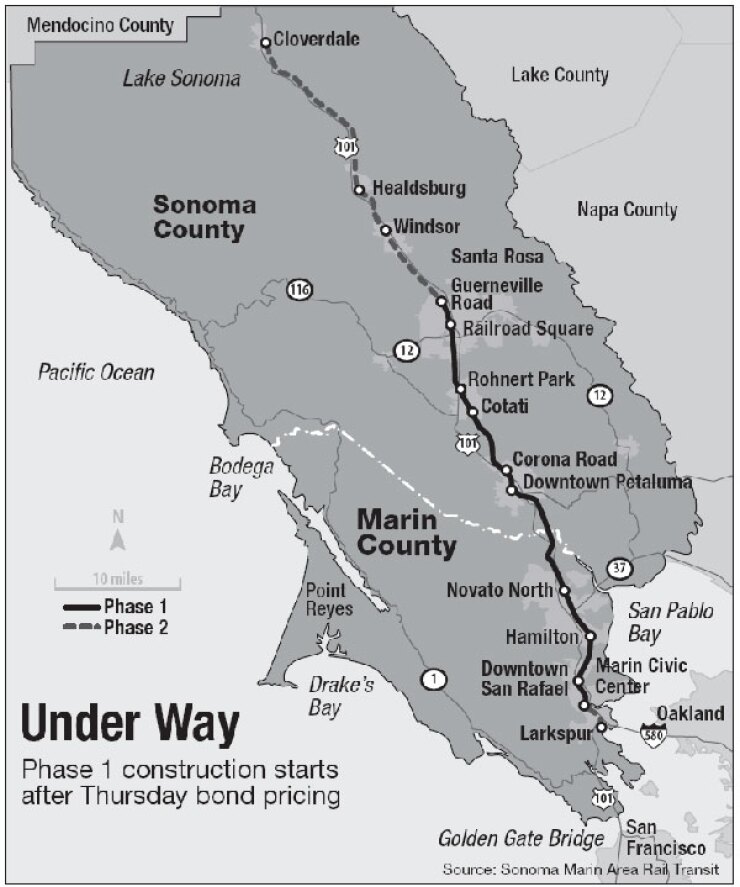

The original plan by SMART was created by the state Legislature in 2003. It called for a 70-mile route between Larkspur, which sits on the San Francisco Bay in Marin County, through the Sonoma County seat of Santa Rosa and north to Cloverdale, along with a parallel bicycle and pedestrian path.

However, the recession led to a revision of sales tax estimates the district would collect and forced SMART to reconsider break the project into two phases.

The district’s board amended the plan to focus on the first segment, running about 36 miles between the two county seats of San Rafael and Santa Rosa at a cost of $366 million, half of which will come from a bond sale.

The district will get much of the other funding from $101 million of sales tax revenues and $30 million from the Bay Area Toll Authority. The money will be used for passenger rail cars, construction and rehabilitation of about 40 miles of tracks, along with bike and walking paths.

Major bridges and tunnels along with way will also have to be fixed or replaced.

The district recently awarded a $103 million contract to start construction on the first part of the rail line, which is expected to begin running in 2016.

The plan is a result of a 2008 ballot item, Measure Q, passed by voters in both Sonoma and Marin counties, that increased sales taxes by a quarter-cent for 20 years to fund the building and operation of a passenger line along an unused north-south freight train track bisecting the two counties.

The referendum required a two-thirds supermajority to pass, and followed a similar 2006 measure that narrowly missed the two-thirds threshold.

Most demand is expected to come from commuters that normally use Highway 101, according to a ridership study.

District officials originally planned to sell the bonds earlier in the year but faced uncertainty after local gadflies announced an effort to repeal the Measure Q sales tax.

“The repeal process created uncertainty for potential bondholders and the market was jittery,” Mansourian said.

That created a waiting game to see if the critics would collect enough signatures to put a repeal measure on the ballot. They ultimately failed, but not before adding a degree of difficulty to the district’s financing plan.

With the ballot measure still a threat in late 2011, SMART went ahead with a bond issue that took into account the uncertainty created by the threatened tax repeal.

In December, the district issued $190 million of variable-rate multi-modal bonds, putting the proceeds in escrow until the outcome of the threatened repeal became clear.

In February, the SMART board certified the failure of the repeal effort, clearing the way to finalize the bond financing by remarketing the debt in long-term fixed-rate mode. Thursday’s pricing brought yields ranging from 1.03% for the 2016 maturity to 3.42% for 2029, the longest maturity, according to Thomson Reuters. The bonds are callable in 2022.

Barclays Capital managed the original bond issuance and served as remarketing agent. Public Financial Management is financial advisor. Orrick, Herrington & Sutcliffe LLP is bond counsel and Fulbright & Jaworski LLP is disclosure counsel.

Marin and Sonoma are some of the wealthiest counties in California.

Fitch Ratings rated the bonds A and Standard & Poor’s assigned a AA rating.

“We weren’t sure what the ratings agencies would say about SMART’s creditworthiness, but none of us expected AA ratings,” district vice chairwoman and Marin County supervisor Judy Arnold said in a statement this month after the ratings were announced.

“I am very proud of our organization for getting such a rating,” Mansourian said.

In its report earlier this month on the deal, Fitch said the bonds are backed by a strong tax base and sound debt-service coverage.

Fitch analysts said the district estimates sales tax revenue for fiscal 2012 will rise nearly 9% to $28 million from a year earlier. However, the rating agency said project revenues coverage of SMART’s debt service and operations costs will be somewhat weak when trains are expected to begin running in 2016.

“These concerns are mitigated somewhat by issuer plans to fund a six-month operating reserve, which provides some offset to short-term sales tax volatility,” the report said.

Fitch noted that the startup rail line does not score high for essentiality.

“While ridership may ease congestion somewhat, essentiality is viewed as weaker than other transit systems, though this may change over time,” the agency said in its report.

The planned second phase of the project would extend the line south to a ferry terminal in Larkspur and north to Cloverdale, which is north of Santa Rosa. No funding has yet been identified for the second segment.

Even though it has no standing plans to issue any further debt, SMART’s board could do so in the future if the economy improves and sales tax revenues grow, according to Mansourian.

“For this phase, we don’t see another bond sale,” the general manager said. “But if the economy improves board the always has the option.”