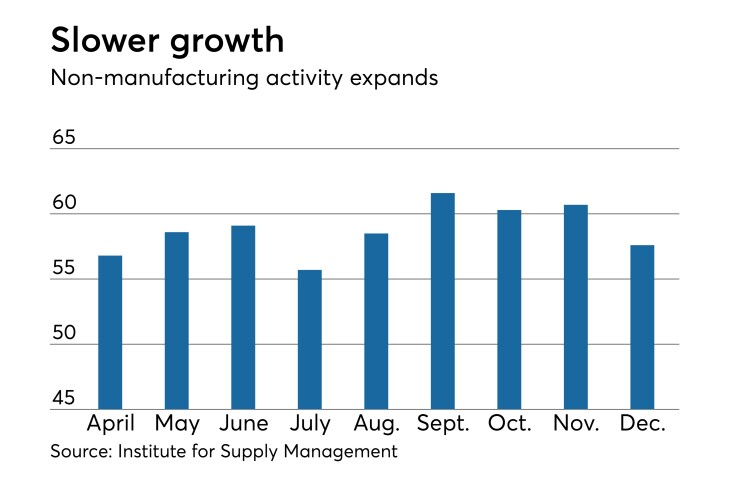

The U.S. services sector expanded at a slower pace in December as the non-manufacturing index dropped to 57.6 from 60.7 in November, on a seasonally adjusted basis, the Institute for Supply Management reported Monday.

An index reading below 50 signals a slowing economy, while a level above 50 suggests expansion.

Economists polled by IFR Markets had expected a 59.0 level.

The prices paid index slid to 57.6 from 64.3, the 34th consecutive month prices were growing, the ISM said. The employment index fell to 56.3 from 58.4.

The business activity/production index fell to 59.9 from 65.2, the new orders index was at 62.7, up from 62.5; backlog of orders decreased to 50.5 from 55.5; new export orders grew to 59.5 from 57.5; inventories declined to 51.5 from 57.5; inventory sentiment dipped to 59.0 from 60.0; the supplier deliveries index fell to 51.5 from 56.5; and imports dipped to 53.5 from 54.5.

Members' general comments on business in the month included:

- “New residential home sales have slowed significantly. Tariff delay has slowed material cost increases, but all indications are that January will bring price increases.” (Construction)

- “Economy still chugging along, despite the rise in interest rates and relentless political claptrap. Mid-winter [activity] appears to be helping a variety of sectors, including agriculture and construction.” (Finance & Insurance)

- “Overall, our year-end outlook is positive. We are already receiving converted RFPs to orders for 2019. Based on the uncertainty of the tariffs, we have advised our clients to make purchases early in first quarter 2019, if possible, to save money. There is concern in our industry regarding the full year due to tariffs, unless a deal can be reconciled with China. We expect lower profit margins and reduced sales for 2019 until our suppliers can source product from other countries, which may not be until late [in the year].” (Management of Companies & Support Services)

- “Business is still on an uptrend. Receiving more inquiries for training going into new year.” (Professional, Scientific & Technical Services)

- “Steady demand and supply. Finding qualified employees is a challenge.” (Public Administration)

- “Business is exceeding expectations. 2019 should equate or exceed 2018.” (Real Estate, Rental & Leasing)

- “Business is very good. Strong demand and pipeline.” (Retail Trade)

- “The end of the year continues to be busy, with high load factor.” (Transportation & Warehousing)

- “Overall, the industry looks to have a pullback year in demand for 2019. Several factors are contributing to this: stock market retraction, tariffs, trade dispute with China, higher mortgage rates, higher home prices, stagnant wage growth, labor shortages and higher material costs.” (Wholesale Trade)