HARTFORD, Conn. -- As lawmakers scrambled frantically in Connecticut's state capitol to get a long-overdue budget in place, bankruptcy candidate Hartford received another steep downgrade.

Hartford is where a wobbly city and a shaky state intersect.

S&P Global Ratings plunged the capital city further into junk Thursday, lowering its general obligation rating four notches to B-minus from BB.

Two days earlier, Moody's Investors Service lowered the city's GOs to Caa1, seven levels below investment grade under its system.

S&P also put the city on credit watch with negative implications and dropped its rating on the lease revenue bonds of the Hartford Stadium Authority, which owns and operates minor league baseball Dunkin' Donuts Park, by three notches to B-minus from BB-minus.

As groggy lawmakers prepared to reconvene around noon Friday -- Hartford Mayor Luke Bronin has asked for an additional $40 million to help the city avoid a Chapter 9 filing -- Bronin focused on the much clearer message from S&P.

"S&P's action reflects the reality that we've been emphasizing for many months -- which is that a truly long-term, sustainable solution is going to require the participation of all stakeholders," said Bronin, who threw down a marker earlier this month with a threat to file under Chapter 9 within 60 days.

"One of Hartford's fiscal challenges is our debt burden in years ahead, and that's why we will continue to look to engage bondholders in discussions about a responsible, long-term debt restructuring."

Debt-service payments of $3.8 million and $26.9 million are due this month and late October, respectively.

Bronin has scheduled a conference call with bondholders for Sept. 25.

“My assumption from a distance is that they’ll be taking the temperature of bondholders at the meeting and before long, we’ll know more,” said Thomas Schuette, a partner and co-head of investment research and strategy at Gurtin Municipal Bond Management. “The city’s back is up against the wall and even if the mayor is using this as a nudge to the state, any help from the state would just buy them a little bit of time.”

Bronin would need Gov. Dannel Malloy's approval to file for bankruptcy. The mayor also faces headwinds from some City Council members.

Detroit's bankruptcy showed that municipal bonds are no longer a risk-free investment, according to Hernando Montero-Salazar, director of credit analysis at Stoever Glass & Co. In Detroit, federal Judge William Rhodes essentially ruled that a municipality's full faith and credit pledge does not guarantee full bondholder recovery.

"One of the main takeaways from Detroit is that all municipal investors are facing uncertainty with distressed credits," said Montero-Salazar. "The sanctity of general obligation bonds have been put into question. There is a need for clearly understood credit risk."

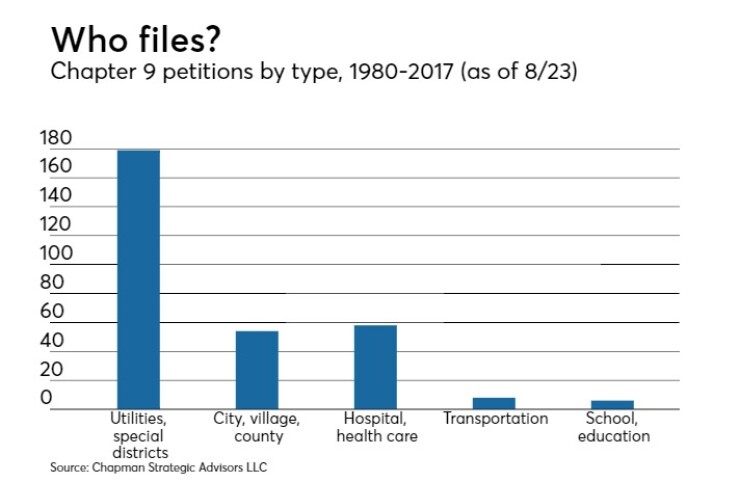

Hartford's numbers look ugly. Restructuring expert James Spiotto, a managing director with Chapman Strategic Advisors LLC, calls the situation a "perfect storm."

The city faces a deficit of up to $65 million for fiscal 2018 and projects an $83 million hole within five years. Thanks to refundings pushed out by Bronin predecessor Pedro Segarra, debt service is expected to rise to $57 million in FY2019.

Between 2006 and 2015, the city's fund balance reserve plummeted 34% while debt per capita spiked 78%. Population and business are in sharp decline. Iconic insurer Aetna Inc. is bolting its Farmington Avenue headquarters for New York.

Half the capital city's property is tax-free, thus stunting revenue.

Thanks to the plethora of state buildings, hospitals, colleges, Metropolitan District Commission facilities and not-for-profits, Hartford -- geographically tiny to begin with at only 18 square miles -- has 35% less taxable property than prosperous neighbor West Hartford, and barely more taxable property than small, affluent suburbs Farmington and Glastonbury.

"We are a city with the tax base of a suburb," said Bronin, Malloy's former chief counsel. Hartford's mill rate, 74.29, is already the state's highest.

In addition, labor concessions to date have been inadequate.

“I think the mayor is being a realist about this. He understands how bad these contracts are with the service providers in the city of Hartford," said state Sen. Scott Frantz, R-Greenwich.

"Until he can undo these legacy costs which have now been extended for them as well, on ridiculous terms, I might add, it’s an impossible situation to deal with," Frantz added.

"He needs to get that undone or he needs additional funding," Frantz said. "He’s trying on both ends. Good for him for trying. He’s smarter than anyone else up here in charge of the system up here when it comes for doing the best thing for the city of Hartford.”

Just how much aid Connecticut can provide Bronin has been in question over the past two years. The state's own credit is wobbly and Its projected deficit for the next biennial spending plan is estimated at roughly $3.5 billion.

Municipal Market Analytics questions whether Hartford could satisfy the standard criteria for proving itself insolvent. According to MMA, the city has "vastly better and less expensive options."

Malloy over the summer signed a law that enables Connecticut cities to push out refunding debt to 30 years from 20 while providing a statutory lien for bondholders. Lawmakers forwarded the measure -- essentially for Hartford and New Britain -- during the dark of the night in early June as part of an omnibus bill that covered everything from tax preparers to mental health savings accounts.

Even without the lien, said MMA, the city could also refinance, at a minimum, the roughly 80% of its outstanding GO debt covered by bond insurance policies, primarily through Assured Guaranty Municipal Corp. and Build America Mutual.

More "scoop and toss" debt, however, raises red flags in the capital markets.

"Municipal issuers should stay away from that and municipal investors should stay away from that," said Schuette.

Spiotto warned against overreliance on debt.

"It’s what they call a ‘dangerous opportunity,’" said Spiotto, a managing director with Chapman Strategic Advisors LLC. “A bridge can’t be used as a crutch.”

Malloy's proposed municipal oversight board would approve restructurings and deficit financing backed by the state’s capital reserve fund, function as an arbitration panel for labor disputes, approve budget assumptions and appoint a financial manager.

"Historically, Connecticut has an ad hoc approach to municipal financial distress with state receivers," said Spiotto in reference to Bridgeport, Waterbury and West Haven.

Bridgeport filed for bankruptcy in 1991, but a federal judge ruled the city could pay its bills.

While Bronin has called for a "regional solution," and has even pitched Hartford's case to key suburbs, such a dynamic is lacking in Connecticut, which traditionally has favored leafy suburbs over cities and could be paying the price for that as a back-to-cities trend takes hold nationally.

“In Connecticut, you have a highly fragmented set of jurisdictions and a handful have become very troubled," said Aaron Renn, a senior fellow with the Manhattan Institute for Policy Research. "You have a lot of poor and minority people walled into individual communities. What is the answer to that?

“Connecticut’s struggling because its cities aren’t big enough. That’s true of New England in general. People don’t think of themselves as committed to an urban region. In New England, that creates challenges."

Connecticut has taken some body blows on the business front of late. The latest blow came Tuesday, when Alexion Pharmaceuticals Inc. said it would leave New Haven for Boston, leaving state officials to demand repayment of $26 million in loans and grants.

Alexion had moved down the road to New Haven from Cheshire 18 months earlier.

Aetna announced its exit plans in June and last year, General Electric Co. moved to Boston from Fairfield, Conn.

“They are working on stabilizing their client base after losing at least the headquarters piece of Aetna,” said Alan Schankel, a managing director at Janney Capital Market, said of Hartford. “Their taxes are extremely high.”

State officials Thursday confirmed the loss of 3,900 jobs in August.

Spiotto said Hartford can help itself through smart economic development, including the establishment of a foreign trade zone in parts of the city that have lost manufacturing.

“Debt burden is really symptomatic of a bigger problem,” said Spiotto. “They have been depopulated and debusinessed, and revenue is not sufficient to keep it going. A number of states are trying to figure out how to deal with it.”

Examples of turnaround attempts, he said, include the recrafting of Pittsburgh into an “eds and meds” city focused on education and health care, and the Upside Chicago initiative, aimed at building industrial parks in Chicago’s South Side and adjacent suburbs.

Now, said Spiotto, is the time for the states and the business communities to try to figure out what mechanics will work.

“We’re in a changing economy,” he said. “Certain aspects of business that applied 50 years ago won’t be around 10 years from now.”

Gurtin’s Schuette said Hartford, first and foremost, should get its own house in order.

“As a credit analyst, I’m not impressed by some shiny, new economic development program," he said. "Economic development is now a 50-state battle zone, a race to the bottom.”

Hartford’s lone stabilizing presence, he said, is its status as a capital city. “They’re not going to lose the state capitol to Massachusetts because of some economic development incentives,” he said.

Malloy won't seek a third term next year, which could prompt him to try to avoid a capital city bankruptcy on his legacy.

Fearing such a tarnish -- and possible contagion -- in their own state, Pennsylvania lawmakers late in 2011 passed a law restricting capital Harrisburg from filing Chapter 9. Its City Council did so anyway, over the objections of then-Mayor Linda Thompson -- but a federal judge negated the filing six weeks later.