DALLAS – The impact of two major hurricanes in one month will be felt nationwide and should play a role in Congressional debates over immigration, infrastructure and other policy areas, according to a former federal official who specializes in housing and disaster recovery.

“The storms may have an unforeseen impact on policy,” said Orlando J. Cabrera, a partner at the Washington law firm Arnall Golden Gregory.

Cabrera was assistant secretary for Public and Indian Housing at the Department of Housing and Urban Development during the George W. Bush administration, from 2005-2008.

Cabrera’s experience in the area of disaster recovery includes working through more than a dozen natural disasters with the Federal Emergency Management Agency and various state disaster recovery agencies during his time at HUD. Prior to that, he was chief executive of the Florida Housing Finance Corporation, the nation’s fourth largest housing finance agency. He specializes in private activity bonds and affordable housing credits, among other areas.

During his tenure in Florida, Cabrera faced five hurricanes in a 12-month period: Jeanne, Frances, Ivan, Charlie and Dennis.

“I can safely say that no one has ever gone through an Irma-like event – one that, in the span of two days affected approximately 80% of the land mass of the country’s fourth most populous state,” Cabrera said.

As of Wednesday, more than 4.7 million electricity customers in Florida were without power, according to Gov. Rick Scott. State officials were also clearing a path for fuel deliveries to heavily damaged areas of the state. Jacksonville in northeast Florida faced heavy flooding from the St. John’s River, an unanticipated consequence of Irma’s path through the state.

Statewide, more than 6 million people in Florida were evacuated from their homes ahead of Irma’s landing on the mainland on Sunday. The number of homes that are habitable is unknown.

Bond issuers in the states most directly affected by Irma – Florida, Alabama, Georgia, South Carolina and Tennessee – face no immediate worries about their credit ratings, according to Moody’s analyst Robert Weber. All of the affected states are rated triple-A, except for Aa1-rated Alabama.

“Damage is still being assessed, but the most impacted local governments' near-term liquidity will likely be pressured by unbudgeted public-safety and clean-up costs,” Weber said. “Still, in general, U.S. municipalities have a strong record of managing through and recovering from serious storms, especially in Florida and elsewhere in the Southeast where hurricanes are relatively routine.”

Property taxes are a large component of revenues for local governments in all states in the path of the storm, Moody’s said.

“Reassessment timelines vary, but severe damage could reduce tax bases,” Weber said. “Expenditures for debris removal, public safety and damage to public facilities will in some cases pressure liquidity in the near term.”

Florida can exempt damaged municipalities from some assessment limits, which would offset at least a portion of property tax losses. Sales taxes in areas significantly affected by Irma's storm path may decline if residents are displaced and businesses remain closed for a lengthy period of time, although rebuilding typically provides a medium-term boost to these revenues, Weber said.

Many cities and counties in Georgia rely on Special Purpose Local Option Sales Tax (SPLOST) revenues to cover at least a portion of debt service. Debt is backed by a general obligation pledge. If SPLOST revenues fall short of debt service needs, municipalities can use other revenues to pay debt service, Weber pointed out.

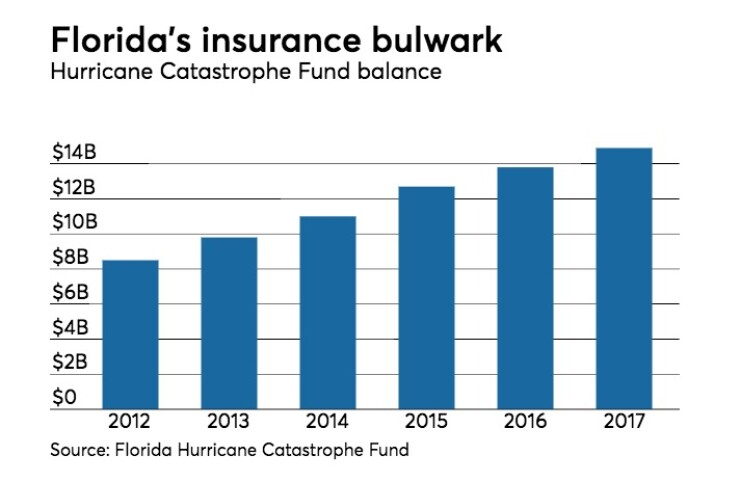

After 1992's devastating Hurricane Andrew, the withdrawal of private insurers from Florida led the state to set up two bond funded entities to ensure continued windstorm coverage: the Citizens Property Insurance Corp., which covers people directly, and reinsurer the Florida Hurricane Catastrophe Fund.

They should withstand the storm well, the firm Miller Tabak Asset Management said in a

"While Irma has left behind significant property damage, Florida Citizens and the FHCF are well-positioned to meet claims while continuing to provide strong bondholder protections," the comment said. "Both entities have accumulated exceptional levels of liquidity over the course of 12 years with minimal hurricane activity."

Despite Florida’s long experience with hurricanes and successful development of catastrophe bonds to provide reinsurance for storm damages, the state will face the need for adjustments, Cabrera said.

“Recent politics in Florida notwithstanding, folks at the state level might be revisiting the decision to essentially abandon state involvement given that the storms will at some point impact the state’s finances and general fund,” Cabrera said.

“On the federal level, there is an important conversation to have about the acceptance of risk by the private sector versus the socialization of risk through flood insurance,” he added. “Flood insurance is indispensable but the way we finance it is not viable over time. It is certainly not the time to be cutting the National Flood Insurance Program, as the administration proposed, or cutting efforts regarding resiliency, as was done just before Harvey hit. The administration has apparently and thankfully reversed itself on that decision.”

The Harvey and Irma storms could serve as a wake-up call for taxpayers who have previously questioned the role of government in their lives, Cabrera said.

“As taxpayers, we need to accept that there will be costs we cannot and should not avoid that will help the economy in the long run,” he said. “An expenditure (for example buried power line where viable) that creates a sound infrastructure is worthwhile to consider because the near term expense might be justified by the long term economic savings of allowing the economy to recover more quickly. Is that a hard conversation? Sure. It is important to have when rebuilding? Absolutely.”

State and local issuers can expect to face higher prices for labor and materials needed for recovery, Cabrera said.

"The question I have pondered is whether the storms will cause Congress to visit -- or rather revisit -- labor economics and immigration policy,” he said. Texas and states in the Southeast seaboard, particularly Florida, are also highly dependent on immigrant farmworkers.

“Those people are desperately needed now,” he said.

“I am curious to see how Congress will react if at all – especially those in Texas and the Southwest – where the policy of curtailing immigration has been a constant drumbeat for some time. It would seem to me that allowing the undocumented to remain might alleviate construction cost wage inflation and that there could be calls for Congress to consider doing something on that basis,” Cabrera said.

“After each major catastrophe, the stress on construction materials and skilled and unskilled labor is inevitable,” he said. “Harvey was going to impact construction costs significantly over the next two to three years. Irma will as well on a much wider scale as it essentially impacted the entire Florida peninsula. Unlike Harvey though, the bulk of the damage repair in Florida is going to be on repairing structures and not necessarily reconstructing.”

In its initial report on Irma, S&P Global Ratings noted the state’s strong financial position and readiness to reinsure policies for property owners, as well as the strength of its bond funded insurers.

“A lack of severe storm activity since 2005 has translated into increased reserves and enhanced liquidity for Citizens Property Insurance Corp.,” wrote analyst Sussan Corson. “There is about $13.3 billion in resources available from surplus, reinsurance, Florida Hurricane Catastrophe Fund (FCHF) reimbursement, and pre-event bonds. In addition, Citizens has the ability to levy emergency assessments on a direct written premium assessment base that has steadily increased to almost $44 billion in 2016.”

Economist Ray Perryman, founder of the Perryman Group, estimated the net impact of Hurricane Irma at $76.2 billion in real gross domestic, $50.5 billion in real personal income, and about 553.7 thousand person-years of employment.

"For Florida, we estimate Hurricane Irma will result in losses of $58.6 billion in real gross state product, $38.7 billion in real personal income, and 409.9 thousand job years when multiplier effects are considered,” Perryman said.