CHICAGO – A downgrade to speculative grade would raise the already high costs Illinois and its local governments pay to access the bond market.

That was the picture Nuveen Asset Management’s John Miller painted for lawmakers, describing consequences if the state's nearly two-year-old budget logjam remains unsolved by the spring session’s scheduled May 31 end.

Fitch Ratings, Moody’s Investors Service, and S&P Global Ratings have all warned a downgrade looms if progress in not made in balancing the state’s books.

“Another downgrade will negatively impact all of your constituents,” Miller, Nuveen's co-head of fixed income, said during a hearing on the state’s bond ratings held by the House Revenue and Finance Committee. “A below investment grade rating for Illinois will unquestionably restrict market access and drive up borrowing costs for municipal borrowers statewide.”

A one-notch downgrade would leave the state’s ratings at the lowest investment grade level of Baa3/BBB-minus, and without adoption of a fiscal 2018 budget that makes progress toward curing the state’s fiscal ills a negative outlook would likely remain.

That “would be telling investors, we’ve essentially arrived at below investment grade credit quality. Current credit spreads already reflect this is what investors expect,” said Miller, who joins other market participants and state officials sounding the alarms over the impact of any further rating erosion.

Illinois 10-year bonds are trading at a more than 200 basis point spread to the Municipal Market Data’s top-rated benchmark.

Illinois has preserved its investment grade status thanks to the sovereign powers states enjoy over spending and revenues and its sturdy general obligation repayment statute.

But political gridlock is blocking the state’s ability to match revenues and spending and a record $13 billion bill backlog has fueled worries that legal or political pressures to fund services could impede state GO repayment.

“Illinois’ rating and politically driven budget stalemate are already unprecedented. But we worry the implications of not solving this now may not be fully appreciated by the general public,” Miller told lawmakers.

The state is already the nation's lowest rated -- most of its peers are in the double-A category -- and no state has ever been rated speculative grade.

Such a fall would limit the state’s universe of buyers to high-yield purchasers, which would drive up borrowing costs long after solutions are reached.

“It’s likely many retail buyers would no longer be able to participate in the state’s future bond offerings and institutional investors will be more inclined simply sit on the sidelines for all Illinois investments,” Miller said. “The negative headlines and momentum that would follow another downgrade could take years to recover from.”

Miller told lawmakers he directly manages $20 billion of high-yield securities that are part of the firm’s $120 billion municipal bond portfolio. The firm holds $8.2 billion of debt on behalf of its clients that was sold by Illinois-based issuers.

The market has for some time referred to the “Illinois penalty” or “Illinois effect” imposed on credits throughout the state, even the highest grade and those with little or no exposure to state payment, aid, or tax risks.

For triple-A credits the penalty runs 25 to 30 basis points, compared to a slight penalty imposed on similar Texas borrowers and little to no penalty in California, Florida, and New York, according to charts comparing the five largest states Nuveen presented to the committee. For double-A credits, it’s about 50 basis points and for triple-B credits it exceeds 150 basis points.

Nuveen estimates the penalty costs local units of governments $930 million in added annual interest costs. “This translates directly into higher taxes and reduced services at all levels of government as debt service crowds out other spending,” Miller said.

The good news offered lawmakers was that a reversal of fortunes is within reach.

“Resolving the budget impasse will provide confidence to the bond market. Lowering borrowing costs will free up money for infrastructure, local projects and social services,” Miller said, citing other states, like California, which came back from fiscal distress and rebuilt credit quality.

The committee was also warned that the state could struggle to sell any short-term cash flow borrowing to pay down the bill backlog without a budget in place. The bipartisan Senate package still being negotiated authorizes $7 billion of issuance.

“Illinois can’t do it without a balanced budget for fiscal 2018,” Miller said adding he was unsure the market would even accept such a move.

If part of a budget agreement, the market and rating agencies might view it as beneficial because it would lower interest costs on the backlog, he added.

The committee’s chairman, State Rep. Michael Zalewski, D-Riverside, raised the specter of Puerto Rico. Miller highlighted the vast differences between the Puerto Rico and Illinois economies but warned comparisons still weigh on investor minds.

“Illinois has a substantially better economic base, larger population, much more diverse array of business, lower debt per capita ….. and a more stable economy,” but the Illinois name comes up as the market ponders “who’s next” and another downgrade would fuel such comparisons, Miller said.

Default risk was also raised during questioning and Miller stressed that his warnings are limited to risk premiums demanded of the state in the event of further credit deterioration. “Illinois’ ability to pay on its general obligation debt is sound” although it doesn’t tell the “complete story” of the state’s strains, he said.

Long before the impasse, the state stood out as an “outlier” due to the size of its long-term liabilities, underfunded pensions and reliance of payment deferrals. Those strains undercut economic strengths that would otherwise support a high-grade rating, Miller said.

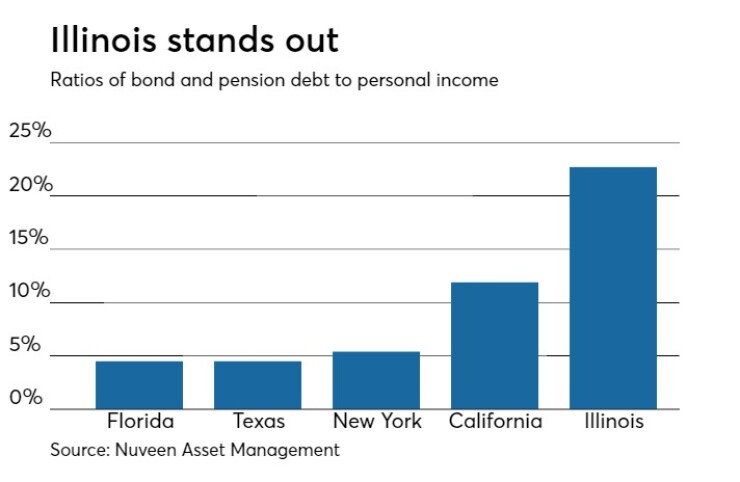

Illinois’ pension funded ratio of 40% is far below the other four big comparison states. Illinois’ net tax supported debt per capita of $2,511 is exceeded by New York at $3,070 but its net tax supported debt and pension liabilities to GDP ratio of 19.5% far exceeds the next highest – California – at 10.5%. Illinois’ debt and pension liabilities to personal income ratio of 22.7% also exceeds the other four with California next at 11.9%.

Pressure continues to mount for action as the session’s end nears.

On Monday, activists kicked off a Chicago-to-Springfield march to raise attention on the need to solve the budget crisis. A group of more 400 school district superintendents that are part of The Pass Illinois Budget coalition sent a petition to Rauner and legislative leaders demanding immediate passage of a budget, improvement in the state’s funding formulas and to get up to speed on all aid payments owed districts.

State treasurer Michael Frerichs, who last week warned during a news conference of the state’s credit risks, launched a petition drive demanding agreement on a state budget by May 31. “The time to act is overdue and we all need to play our part to demand action,” he said.

Senate President John Cullerton, D-Chicago, penned an op-ed Sunday in Springfield's State Journal-Register calling on Rauner to finalize his support for the “grand bargain.” Republicans are withholding their support on the bipartisan package Cullerton crafted with Republican Minority Leader Christine Radogno, R-Lemont, until further concessions are reached on worker’s compensation reforms and a local government property tax freeze.

“Under Governor Rauner, Illinois’ credit rating has taken a beating and now hovers on the verge of junk status, making it prohibitively expensive to borrow money for things like road and bridge projects,” Cullerton said. “I’ll keep negotiating, but at some point negotiating has to lead to a deal, and a deal has to result in votes to move forward.”

Rauner, in his own Tuesday State Journal-Register op-ed, countered Cullerton. He reiterated his position that the state’s current fiscal system is broken, needs change to achieve long term stability, and Democrats are to blame.

“Two years into our state budget impasse, it’s encouraging that some Democrats are finally willing to engage in serious negotiations to resolve our differences. But as we approach the end of the legislative session, many of them are buckling under enormous pressure from Speaker Michael Madigan, D-Chicago, powerful lobbyists and special interests who want to maintain the status quo,” Rauner wrote.

“But now is not the time to buckle. Now is the time to seal a good deal for taxpayers and put Illinois back on track,” Rauner said.