CHICAGO — Illinois will shed its only floating-rate paper and cancel associated interest rate swaps with proceeds from a $920 million general obligation refunding deal.

The preliminary offering statement is expected to post midweek and pricing is expected as soon as next week, according to state documents. The deal will offer two series, one for $650 million, and a second for $270 million.

The deal is expected to be priced favorably to an April sale because Moody's Investors Service eased its outlook for Illinois when the state passed its first on-time budget in several years.

The issue will refund $600 million of floating-rate 2003 bonds and cover swap termination fees — negatively valued at $83 million in April — used to synthetically fix the debt. The structure had given the state headaches as its ratings deteriorated, threatening termination events and higher interest costs.

“The financing plan will de-risk the state's debt portfolio by refinancing into fixed-rate bonds its $600 million in variable-rate demand obligations,” S&P Global Ratings wrote.

The deal will also refund other GO debt for savings. Ahead of the sale, the three major rating agencies affirmed their ratings with two at the lowest investment grade level and the third at two notches above junk.

“It’s impossible to call interest rates so it’s good policy any time you can extinguish interest rate risk,” said Brian Battle, director of trading at Chicago-based Performance Trust Capital Partners.

The buyside should also look more favorably on the state’s paper than it did with its last sale in April based on secondary market trading levels that narrowed after passage of a fiscal 2019 budget at the end of May and Moody’s July 19 outlook revision to stable from negative on its Baa3 rating.

The state’s April GO issue came amid increasing market concerns about whether Republican Gov. Bruce Rauner and the General Assembly’s Democratic majorities would return to budget gridlock ahead of the looming November state elections.

The state went two years without a budget until lawmakers overrode Rauner's veto in July 2017 to pass the fiscal 2018 spending plan. It raised income taxes by about $4.5 billion and provided $6 billion in borrowing authority to pay down the state's $16 billion unpaid bill backlog.

The $38.5 billion fiscal 2019 budget was the first Rauner signed since taking office in 2015.

“They are coming at a time when there’s not a lot of supply and a lot of demand with reinvestment dollars available and they will definitely benefit from the outlook change,” Battle said. “They will be happy the state has gone to stable.”

The state’s 10-year GO paper is currently trading at about 160 basis points to the Municipal Market Data’s AAA benchmark with spreads at 142 basis points on the longer end.

The 10-year yield in its April 25 sale landed at 4.55%, a 205 basis point spread to the AAA early in the trading day and a 121 bp spread to the BBB. The long 25-year maturity in the April sale landed at 4.88%, a 185 bp spread to the AAA early in the trading day and a 102 spread to the BBB.

Spread tightening followed passage of a budget in late May — narrowing to about 165 bp — and they further narrowed late last month to a range of 150 bp to 153 bp after Moody’s outlook revision.

Spreads in April increased from the state's previous GO deal in November, when the 10-year landed at about 170 bp.

The true interest cost on the state’s November sale was 4.29%. Rising rates and state penalties boosted the TIC to 4.72% on the April sale.

The state’s spreads have fluctuated widely over the last three years, with the 10-year peaking at more than 335 bp in June 2017, finishing 2017 at 177 bp. Spreads again topped 200 bp this spring before the state passed a budget.

FLOATERS/SWAPS

The fiscal 2019 budget package paved the way for the swap payoff by providing the needed authority to finance the termination payments.

Rauner’s finance team remarketed the paper in direct placements in 2016 with a mandatory tender coming up on Nov. 17, and also renegotiated the swap rating triggers.

The 2016 terms on its five swaps with four counterparties included the novation of two to lower the ratings thresholds for triggering termination events.

Terminations were to have been triggered on the derivative contracts with Barclays, JPMorgan, and Bank of America if the state’s rating from Moody’s Investors Service or S&P Global Ratings fell to junk.

The state already had more breathing room on the largest swap, with Deutsche Bank, which was set at a lower threshold.

The counterparties lowered the rating thresholds again last year so that a state downgrade to BB/Ba2 would trigger termination events.

Illinois is rated at Baa3 with a stable outlook by Moody’s, BBB-minus with a stable outlook by S&P, and BBB with a negative outlook by Fitch Ratings.

Barclays is counterparty to two swaps each for $54 million, Bank of America is on one for $54 million, JPMorgan Chase is on one for $54 million, and Deutsche Bank is on $384 million.

The swaps were negatively valued at $153 million in 2016 and $107 million last year, compared to $83 million as of April, according to state disclosure documents.

In 2016, the state also remarketed the floating-rate paper that was supported by letters of credit from six banks set to expire in November 2016 putting it in direct placements with four banks. The bonds bear either a LIBOR or SIFMA-based interest rate that rises if the state is downgraded.

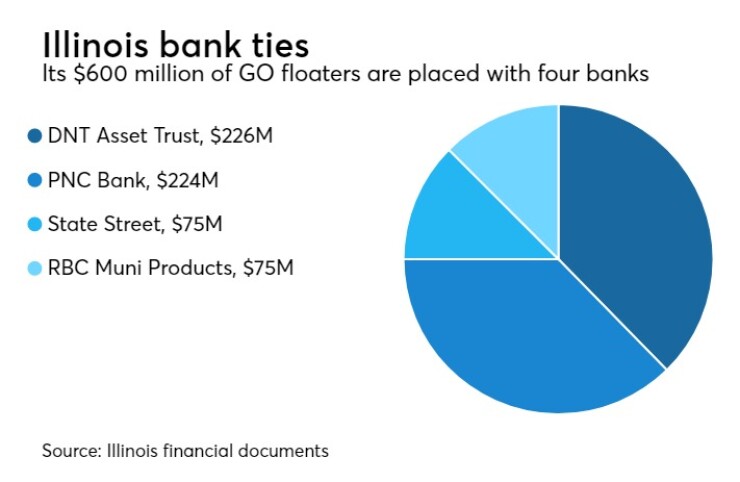

DNT Asset Trust accounts for $226 million, PNC Bank NA accounts for $224 million, State Street Public Lending Corp. accounts for $75 million and RBC Municipal Products LLC accounts for $75 million.

The state’s spread previously rose to 3.45% from 2.95% based on downgrades in 2017, with further increases that would have been triggered by a downgrade to junk.

RATINGS

Rating analysts warn that the state’s deep fiscal stains will demand action after the November election. Rauner running for re-election against Democrat J.B. Pritzker, and all state House seats and one-third of Senate seats are up. Democrats hold a supermajority in the Senate and are just shy of a supermajority in the House.

The BBB-minus rating “reflects our view of the state's lack of budget reserve and generally weakened financial condition, lingering structural budget imbalance, backlog of unpaid bills, and distressed pension funding levels, offset by its well-established record of treating transfers for GO debt service as priority payments, deep economic base, and above-average per capita personal incomes," said S&P analyst Gabriel Petek.

Illinois is saddled with a $129 billion unfunded pension tab and is overdue on $6.8 billion of bills as of Tuesday. Another material risk is the state’s poor preparation for the next recession.

“Although our forecast anticipates continued economic growth, Illinois' finances are stretched and retain minimal cushion to weather the additional fiscal pressures that would accompany an economic downturn,” S&P said.

Fitch said its negative outlook reflects that “fiscal pressures may accelerate in the near term as the fiscal 2019 budget entails significant implementation risk and uncertainties remain regarding ongoing fiscal management and decision making, particularly given the contentious political environment."

Adoption of a budget is a plus, but all three rating agencies say implementation risks diminish the positives. It relies on $300 million from the long-stalled sale of the state’s downtown Chicago headquarters, $400 million from uncertain savings from pension reforms including buyouts and it doesn’t account for about $400 million in overdue raises.